Sell your expiring term insurance for cash, if you qualify.

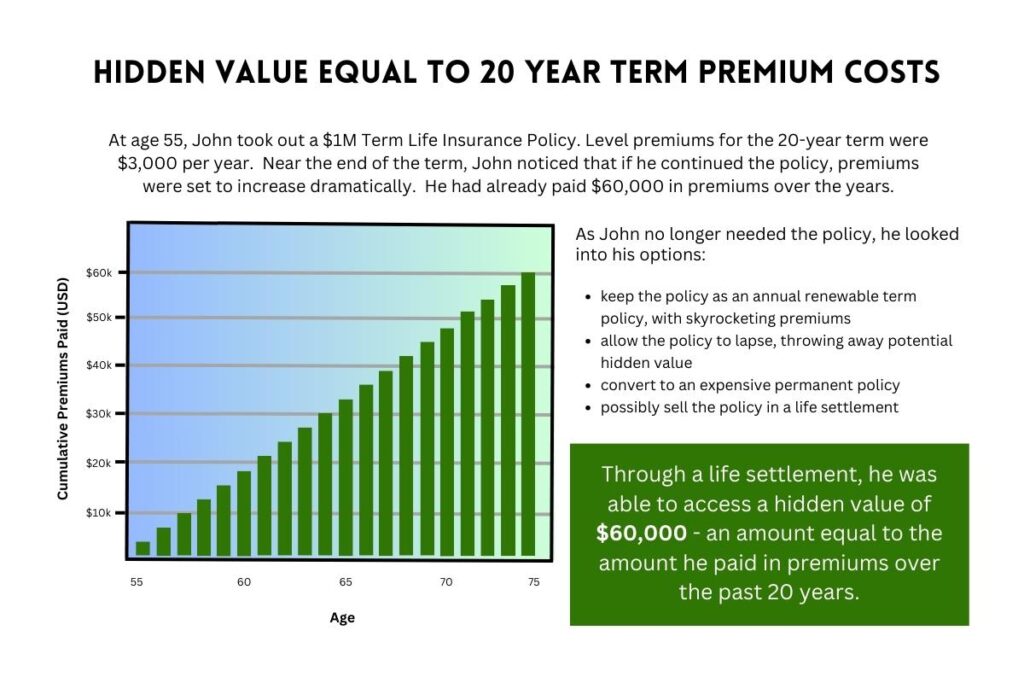

Most people still have no idea that if you qualify, you might be able to sell your expiring term insurance for cash, today. It usually only takes a 5-minute call to learn if you’re likely to qualify or not. Even healthy people, if they have the right policy and are the right age, could qualify to sell an unneeded term insurance policy and possibly even get the equivalent of all the money they paid for the insurance coverage over the years.

Insurance companies rely on an astronomical lapse rate when they issue term insurance policies. You’re never supposed to be able to build up a cash value, so you are just paying the cost of the insurance while you need it. In spite of this, your policy may have built up a tremendous hidden value.

How is it possible to get cash out of a term insurance policy?

When insurance companies issue term policies, they know that the vast majority, well over 90%, are going to lapse typically, and they adjust costs of insurance accordingly. A 35 year old male only has to pay an average of about $33 per month for a million dollars of coverage that would last 20 years. A 55-year-old male would have to pay an average of about $216 monthly to get the same 20 years’ worth of coverage. At the end of that 20 year period, typically the coverage expires, needs renewed or has to be converted.

That’s why it’s called term insurance. It’s for a specific term as opposed to permanent insurance such as whole life or universal life. After the original term, you’re faced with a decision. Usually, you either have to start paying dramatically higher annual renewable rates for your term insurance or convert it to whole life insurance or universal life insurance.

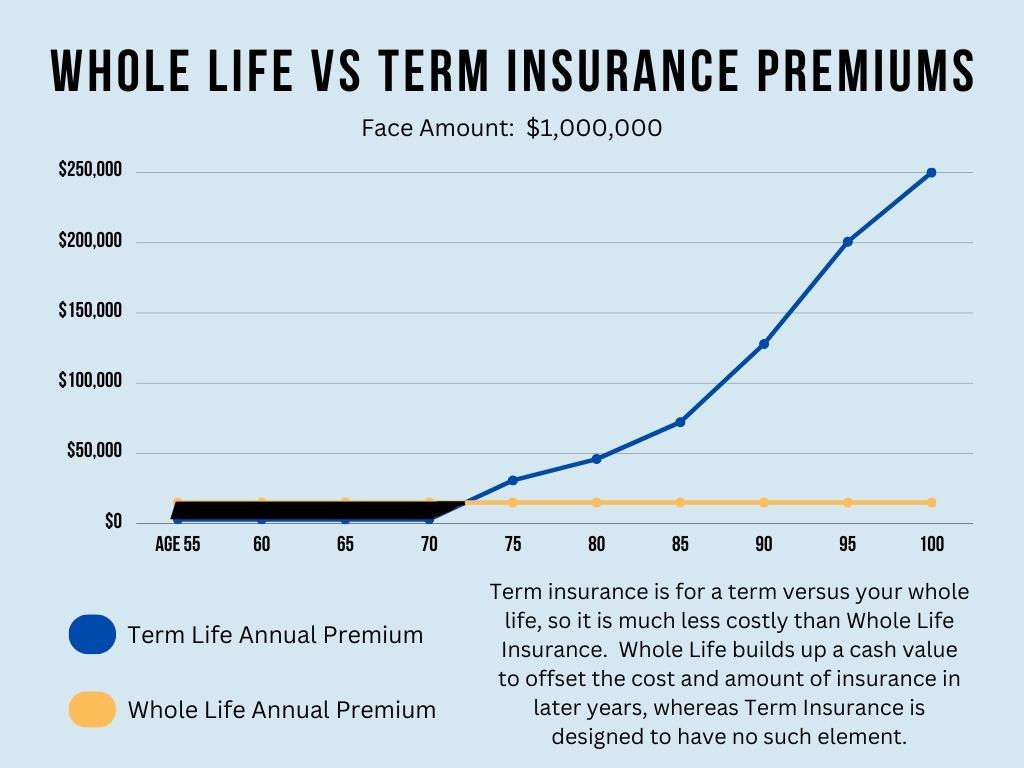

Term Insurance versus Whole Life

If you’re converting your term insurance to permanent life insurance, your premiums are going to be 5 to 10 times higher depending upon your age. A universal life policy has a cash value element to it and a term insurance policy doesn’t. A universal life or a whole life policy is supposed to make sure that you have coverage for your entire life. That’s why those types of policies are usually used for financial planning where the insurance has to stay in place forever to pay estate taxes for example.

Depending upon the policy that your term insurance can be converted into or if your term insurance policy is even convertible at all is usually what’s going to determine if your policy qualifies to be sold in the secondary market.

Once you hit about age 70, you should always have any of your life insurance appraised before you cancel it. Anybody 65 and over should absolutely have their term life insurance reviewed before they cancel it.

Buyers of Term Life Insurance Policies

A buyer of term life insurance policies will take your term policy and convert it into the best permanent life insurance policy that will last the rest of your life. They’re able to figure out how much money they have to pay in for the rest of your life plus what they give you over your life expectancy to get a market return on their investment.

Your life expectancy is a major, if not the largest variable when it comes to determining the value of your term life insurance policy. Viatical.org appraises and finds direct buyers for many healthy people that are over the age of 70, but if you’re unhealthy you may very well have value in your term life insurance even if you’re in your 40s or 50s.

The difference in life expectancy between two people to an insurance company is what makes it more likely that they’ll pay a claim if somebody’s in poor health. Often insurance companies rate someone’s premiums at a higher level than someone who would be in better health at the same age. If you have preferred rates on your term policy, but your health has slipped since you purchased it, you might have a hidden value.

Underwriting a Life Settlement

When it comes to underwriting a life settlement, it’s completely different and almost completely the reverse. Generally, the sicker you are and the older you are, the more likely you are to qualify and get a higher offer on your life insurance policy, assuming it qualifies. It makes sense because whatever fund buys your policy is going to have to pay the premiums for the length of your life. If you’re a 70-year-old in great health with a 20-year life expectancy, there is often little to no value, but it certainly warrants an appraisal before you cancel it.

Selling Your Term Insurance Policy

When you’re selling your term insurance policy, you’ll only have to pay taxes on what you receive in excess of the premiums you paid over the years. Whatever you have paid into your policy is considered the tax basis, even if you have no cash value at all. We help accountants and advisors every day when it comes to valuing clients’ insurance policies and have uncovered staggering amounts of hidden value that can resurrect or reinvigorate a financial plan.

Sell Life Insurance Policy? Here’s What You Need to Know

Understanding the Option to Sell Your Term Life Insurance Policy

Life insurance policies are designed to provide financial security for your loved ones in the event of your untimely death. However, life can be unpredictable, and sometimes circumstances change, leaving you wondering what to do with your policy. If you find yourself in a position where you no longer need or can no longer afford your life insurance policy, you may be considering selling it. But can you sell your term life insurance policy, and what are the implications of doing so? Let’s explore your options.

Can You Sell Your Term Life Insurance Policy?

The short answer is yes, you can sell your term life insurance policy if you qualify and it is the right type of policy. This is known as a life settlement, and it involves selling your policy to a third party fund that buys policies in exchange for a lump sum of cash. However, it’s important to note that not all term life insurance policies will qualify for a life settlement. In general, the policy must have a death benefit of at least $100,000 and the policyholder must be at least 65 years old or have a serious illness or medical condition. Additionally, the policy must be in force and have been in place for a certain period of time, usually at least two years. Unless you are very sick, your policy usually needs to be convertible to a permanent policy to qualify.

Understanding the Pros and Cons of Selling Your Term Life Insurance Policy

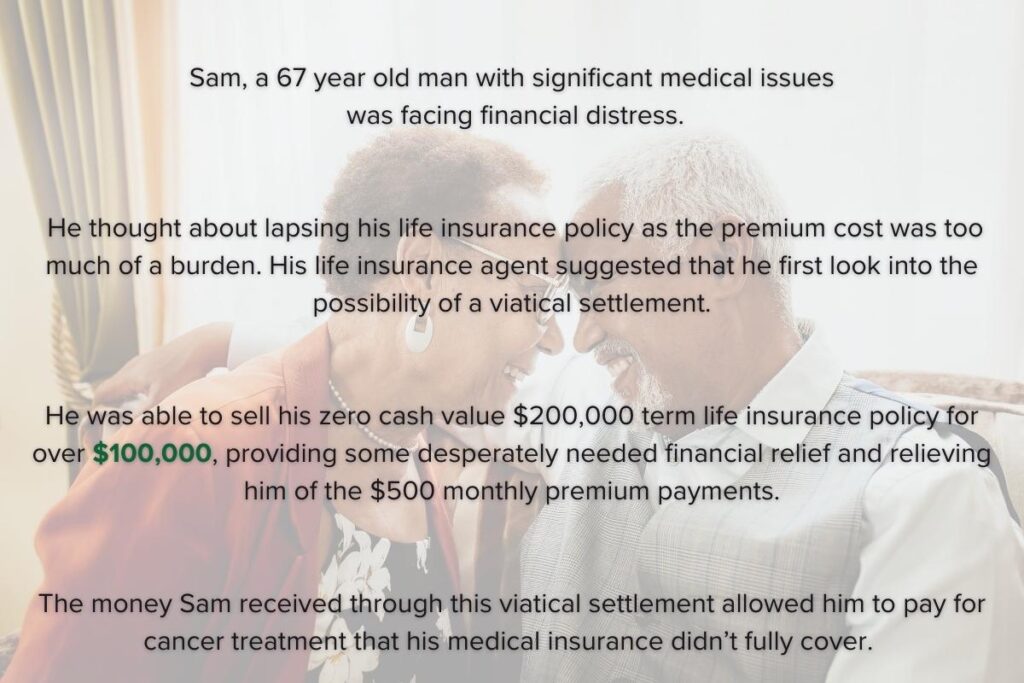

The primary benefit of selling your term life insurance policy is the immediate cash infusion. This can be especially useful if you’re facing financial hardship, such as mounting medical bills or unexpected expenses. Additionally, you’ll no longer be responsible for paying the premiums on your policy, which can free up more money in your budget.

However, it’s important to carefully consider the potential downsides of selling your term life insurance policy. For one, you’ll receive less money than the death benefit of your policy. Additionally, you’ll lose the death benefit of your policy, which means that your beneficiaries will not receive a payout when you pass away. The fund that purchases your life insurance policy and pays all future premiums will collect the death benefit upon your passing.

How to Sell Your Term Life Insurance Policy

If you’re interested in selling your term life insurance policy, the first step is to have your policy appraised for value in the secondary market for life insurance. You may choose to work with a life settlement broker, they typically charge around a 30% fee of your payout. A life settlement provider company usually purchases for certain funds and the publicly traded providers profess that they also charge around 30% on average.

Viatical.org’s automated platform allows you to get your policy in front of actual funds that purchase life insurance policies, with no middleman and a compliant closing by a licensed Life Settlement Provider in your state, usually for a flat fee. Our direct approach can yield a much higher net offer in many cases.

If value is found once your policy is appraised and you decide you want to sell, buyers will make offers on your policy. Once you’ve agreed to a sale, the buyer will take over the premiums on your policy and you’ll receive a lump sum of cash. Depending on your tax situation, you may owe taxes on the proceeds of the sale, but usually only on the amount that exceeds the premiums you paid into your policy, which is your policy’s cost basis. Always be sure to consult with your tax professional to understand the implications of selling your policy.

How much do you get when you sell your life insurance policy?

The amount of money you can receive when you sell your life insurance policy can vary widely depending on a number of factors but mainly the type of policy you have, your policy’s face value, your age and health. In general, the older and less healthy you are, the higher the percentage of your face value you can expect to receive.

Is it a good idea to sell my life insurance policy?

Every case is different. If you no longer need or can no longer afford your insurance, selling your term life insurance policy can provide you with financial flexibility and peace of mind. It’s important to note that not all policies are eligible for a life settlement, and there may be tax implications involved. To ensure you’re making the best decision for your unique situation, consult with a financial advisor and a reputable life settlement company. Don’t wait until it’s too late – start researching your options today to get the most value out of your life insurance policy.

How Much Can You Get for Selling a Term Life Insurance Policy?

The amount you can get for selling a term life insurance policy will depend on several factors, including your age, health, and the value of the policy. Typically, the older you are and the larger the policy, the more money you can get for it.

If you’re considering selling your life insurance policy, it’s important to get more than one bid to get the best possible offer for your policy.

Selling your term life insurance policy can provide you with a lump sum of cash that you can use for whatever you need, whether it’s paying off debt, covering medical expenses, or funding your retirement. It’s a great way to unlock the value of your policy and get the money you need when you need it most.

In the example above, John sold his policy while he was in good health. Generally, those that have experienced a slippage in health will receive more when selling a policy. Here is an example:

What Happens When You Sell a Term Life Insurance Policy?

Selling your term life insurance policy through a life settlement can be a smart financial move, but what happens next? When you sell your policy, you receive a lump sum of cash that you can use however you wish. This money can help cover expenses such as medical bills or pay off debt.

Once the policy is sold, the buyer becomes the new owner of the policy and takes overpaying the premiums. This means you no longer have to worry about making payments, and you have access to cash that you can use right away.

Who Buys Life Insurance Policies?

The Role of Life Settlement Brokers and Companies That Buy Life Insurance Policies

Life settlement companies are typically the best option for selling a life insurance policy, as they can provide a lump sum payment that is typically more than the surrender value of the policy. The exact amount you receive will depend on factors such as your age, health, and the terms of the policy. The best company to sell your life insurance policy to will depend on your individual needs and circumstances.

When it comes to selling life insurance policies, Viatical.org can help you navigate the process. Our platform can help you understand your options and connect you with potential institutional buyers directly.

Selling your life insurance policy can provide you with much-needed funds when you need them the most. Whether you’re facing financial hardship, no longer need the policy, or have other reasons for selling, life settlement companies can help you explore your options and make the most of your policy. With the help of the right company, you can sell your life insurance policy with confidence and ease.

Who Usually Buys Life Insurance?

When it comes to buying life insurance, individuals and families are the primary purchasers. However, when it comes to buying life insurance policies from policyholders, it is usually life settlement companies that buy them. Our platform can help you navigate the process of selling your life insurance policy and connect you with top potential funds that purchase term policies. Not all companies purchase term life insurance.

What is the Difference Between a Life Settlement Broker and a Life Settlement Provider?

A life settlement broker and a life settlement provider are two different entities involved in the life settlement process.

A life settlement broker is a licensed professional who represents the policyholder and works on their behalf to find a buyer for their life insurance policy. The broker typically helps the policyholder navigate the life settlement process, including gathering and presenting the necessary information to potential buyers, negotiating offers, and ensuring that the transaction is completed in a timely and fair manner. Brokers earn a commission or fee for their services, it averages around 30% of your sales proceeds.

On the other hand, a life settlement provider is a company that represents life settlement investors. Life settlement provider companies do not typically purchase policies with their own capital, but instead act as intermediaries as well between policy owners and the institutional investors who provide the funding to purchase the policies. The provider company processes the closing documents and facilitates the transaction between the policy owner and the investor, while sometimes also managing the policy until maturity or sale. A publicly traded Provider indicates that they also make 30% of the gross proceeds.

In summary, a life settlement broker represents the policyholder and helps them find a buyer for their policy and usually charges 30%, while a life settlement provider represents an investor.

Viatical.org will make sure that your policy is reviewed by the actual fund that purchases life insurance policies, to be closed by a licensed closing provider in your state. The process is efficient and does not have multiple layers of middlemen.

How much money do life settlement brokers make?

The compensation for life settlement brokers can vary depending on a number of factors, such as the complexity of the case, the amount of time and resources required, and the specific terms of the agreement between the broker and the client.

In general, life settlement brokers typically receive a commission or fee for their services, which is usually a percentage of the settlement amount. The percentage can exceed 30% or more, depending on the broker and the circumstances of the case.

It’s worth noting that some states may have regulations or restrictions on the fees that life settlement brokers can charge, so it’s important to consult with a licensed broker or financial professional in your area to get a more accurate estimate of the costs involved.

Do I need to use a life settlement broker?

While it’s not legally required to use a life settlement broker, many policyholders find it helpful to work with a broker who can offer guidance and support throughout the life settlement process. A broker can help you navigate the complex and often confusing world of life settlements and can help you find the best buyer for your policy.

That being said, you are not obligated to use a broker if you don’t want to pay their commission. In some cases, you may be able to negotiate directly with a life settlement provider or sell your policy through the direct-to-consumer platform at Viatical.org.

What are alternatives to using a life settlement broker?

If you’re looking to sell your expiring term insurance for cash and are interested in working with direct life settlement buyers, who are institutional or fund-level investors that purchase policies directly from policyholders. Viatical.org is a platform that connects policyholders with direct buyers, offering an alternative to the high fees charged by traditional life settlement brokers.

Using Viatical.org’s platform is simple. Viatical.org will match you with a direct buyer who is interested in purchasing policies like yours. This buyer will be an actual institutional or fund-level investor who can appraise your policy and make an offer based on its value.

If you’re interested in the offer, you can review it and decide whether to accept or reject it. If you accept, the transaction will be completed via a life settlement provider company licensed in your state.

By using Viatical.org’s platform, you can potentially get a higher payout for your policy by selling directly to an institutional or fund-level investor. This can be a good option if you want to avoid paying high fees to a broker and get the best possible outcome for your policy.

If you are trying to sell your expiring term insurance for cash, it’s important to work with a reputable company that you can trust. Viatical.org’s innovative platform connects policyholders with direct life settlement buyers, helping you navigate the complex process of selling your policy with ease.

Explain the Direct Model for Life Settlements

Viatical.org’s founder introduced the direct to consumer platform at the Life Insurance Settlement Association conference in 2016. The direct model for life settlement involves policyholders selling their life insurance policies directly to institutional or fund-level investors, rather than going through a life settlement broker or provider. This model has become increasingly popular in recent years, as more institutional investors have entered the life settlement market and as policyholders have become more aware of their options.

Under the direct model, policyholders work with a platform, such as Viatical.org, to connect with potential buyers. The platform will typically require the policyholder to provide some basic information about their policy, such as the type of policy, the face value, and the current premiums.

What is the process?

The platform gathers medical records and actuarial reports, to help determine the policy’s value. If interested, investors make offers to the policyholder based on the policy’s value. The policyholder can then review the offer and decide whether to accept or reject it.

If the offer is accepted, the investor and policy owner will work with a licensed Provider to complete the transaction. This involves escrowing money, transferring ownership of the policy to the investor and paying the policyholder a cash settlement. Once the transaction is complete, the investor will become the new owner of the policy and will be responsible for paying any future premiums.

What are the benefits?

The direct model for life settlement can offer a number of benefits to policyholders. Because they are selling directly to institutional or fund-level investors, policyholders should be able to get a higher payout for their policy than they would if they went through a broker or provider.

Additionally, the direct model can be more transparent and straightforward than the traditional model once policy sellers have a better sense of the market value of their term policy.

At the end of the term of a term life insurance policy, the policy typically expires, and coverage ends. If the policyholder passes away during the term of the policy, the death benefit will be paid out to the beneficiaries named in the policy. However, if the policyholder outlives the term of the policy, there is typically no payout, and the policy simply expires.

It’s important to note that some term life insurance policies may offer the option to renew the policy at the end of the term, but this usually comes with an increase in premiums. Additionally, some policies may include a conversion option, which allows the policyholder to convert the policy to a permanent life insurance policy without undergoing additional underwriting.

If you have a term life insurance policy that is approaching the end of its term, it’s important to carefully consider your life insurance needs and goals and decide if you want to renew the policy, convert it to a permanent policy, let it expire or try to sell it for cash if you qualify.

If you’re interested in keeping your life insurance coverage, you may want to consider converting your term life insurance policy to a permanent one. Many term policies include a conversion option that allows policyholders to convert their policies to a permanent policy without undergoing a medical exam. The premiums for a permanent policy will be higher than those for a term policy, but the coverage should be designed to last for the rest of your life.

While term life insurance is a popular and affordable option for many people, there are some potential disadvantages to consider.

One major disadvantage of term life insurance is that it provides coverage for a specific period of time, and if the policyholder outlives the term of the policy, there is typically no payout. This means that if you need coverage for a longer period of time, you will need to renew or purchase a new policy, which can be more expensive as you get older.

Additionally, term life insurance policies do not build cash value, which means that you can’t borrow against the policy or use it as an investment vehicle. If you’re looking for a policy that provides both protection and the potential for cash accumulation, you may want to consider a permanent life insurance policy.