Life Insurance Loan

Get a Life Insurance Loan or Advance

A Life Insurance Loan offers policy holders a unique opportunity to get cash from their insurance policy right away to cover medical expenses, unexpected expenses, or even traveling with family or friends. Unlike a viatical settlement or a life settlement, the policy owner retains ownership of the policy and the policy beneficiaries can receive a portion of the policy once the loan is settled.

Advantages of a Life Insurance Loan

A life insurance loan offers several unique advantages over other life settlement options.

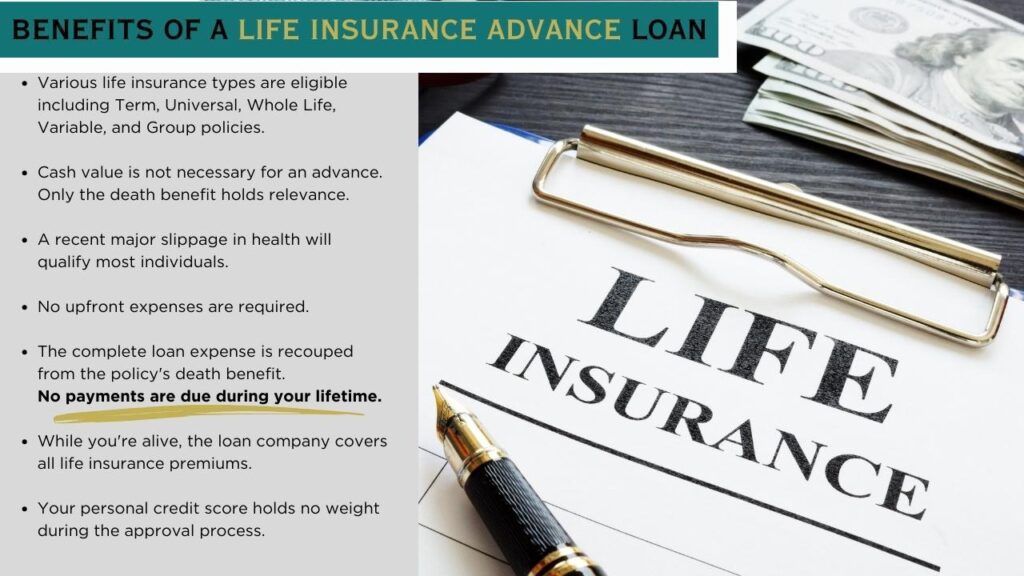

- All types of life insurance qualify: term, universal, whole life, variable, and even group policies

- An advance does not require cash value in the policy. Only the death benefit is considered

- Most individuals who have recently had a major slippage in health qualify

- Beneficiaries are not required to be terminally ill

- No out of pocket costs

- No more insurance premiums to pay

- Premium or Interest Loan payments are not required during your lifetime

- The entire cost of the loan is paid back from the death benefit of the policy

- All life insurance premiums are paid by loan company while you are still living

- Your personal credit score is not considered during approval

Eligibility for Life Insurance Advance

Do You Qualify?

Does your life insurance have hidden value?

Every case is different. Please fill out this form to learn if you qualify.

"*" indicates required fields

What are Viatical Life Settlements?

Life Insurance Loan: Unlocking the Hidden Value of Your Policy

If you are trying to get a life insurance loan, please know there are two ways to get a loan on your life insurance policy.

Borrowing your existing cash value from your life insurance is common, but if your health has slipped, you may be able to borrow money against your policy even if it has no cash value. Even term insurance could qualify.

What is a Life Insurance Advance?

Life insurance is often seen as a valuable safety net, providing financial protection for your loved ones in the event of your passing. But did you know that your life insurance policy can also be a valuable asset while you’re still alive? With a life insurance loan, you have the opportunity to access the hidden value within your policy to meet your financial needs.

Traditional Life Insurance Loans

When it comes to obtaining a life insurance loan, many people are familiar with the option of borrowing from their insurance carrier. This type of loan allows policyholders to borrow against the cash value they have accumulated within their policy. However, there is another option that you may not be aware of – a life settlement loan.

Life Settlement Loans: A Different Approach

A life settlement loan or viatical settlement loan follows a similar process to a life settlement, providing an alternative way to access funds based on the value of your existing policy. This option is available to individuals who qualify and have a serious or terminal health condition. Instead of borrowing against the cash value, you can leverage the value of your policy itself.

Unlocking the Benefits of a Life Insurance Loan

A life settlement loan, also known as a life insurance advance, is an option available to qualified policy owners who are terminally ill and in need of immediate cash. Unlike a typical viatical settlement where the policy is sold, a life insurance loan allows the policy owner to secure a lump sum of cash while retaining ownership of the policy.

For policy owners facing medical expenses, travel costs, and household needs, a life settlement loan or viatical advance can provide a practical solution. By obtaining a life settlement advance, policy owners can access the funds they require without selling their life insurance policy. This ensures that their loved ones will still receive a life insurance benefit upon their passing.

One of the major advantages of a life insurance settlement advance is that it offers a tax-free cash advance against the policy’s death benefit. The policy owner continues to retain ownership of the policy, and their beneficiaries will still receive a portion of the death benefit. Moreover, there are no loan payments, interest, or fees to be paid before the policy owner’s death. The lender covers all the premiums, ensuring that the policy remains active throughout the owner’s lifetime. After the owner’s passing, the life insurance policy covers the costs associated with the advance.

Qualifying for a Life Insurance Advance

Qualifying for a life insurance loan is a different process compared to obtaining a traditional loan. Income and credit score are not taken into consideration during the application process. This makes it a viable option for individuals who may be unemployed, disabled, or experiencing a negative impact on their income or credit due to unexpected medical expenses. The life insurance policy itself serves as the sole guarantee for the loan, making it a secured loan without the need for personal creditworthiness.

Whether you have a term life insurance, group life insurance, or a policy with no cash value, all types of life insurance can qualify for a life insurance advance. If you are a qualified policy owner in need of immediate funds, a life insurance loan can provide the financial assistance you require while ensuring that your loved ones are still protected by the policy’s death benefit.

While a life insurance advance or life insurance loan offers a viable financial solution for qualified policy owners with terminal health conditions, it’s important to note that not everyone will meet the eligibility criteria for this option. However, individuals who do not qualify for a life insurance or viatical advance may still explore alternative options such as viatical settlements or life settlements.

A life insurance advance is specifically designed for policy owners facing terminal or chronic illnesses. It allows them to receive a lump sum of cash while retaining ownership of their life insurance policy. This option is ideal for those who require immediate funds to cover medical expenses, travel, or other financial obligations. However, due to the specific eligibility requirements tied to terminal health conditions, many policy owners may not meet the necessary criteria.

Alternative Options – Viatical Settlements and Life Settlements

For those who do not qualify for a life insurance advance, there are alternative avenues to consider. Viatical settlements and life settlements offer potential solutions to policy owners seeking financial relief. In these scenarios, the policy owner has the opportunity to sell all or a portion of their life insurance policy to a third party in exchange for a lump sum payment.

A viatical settlement is typically available to individuals facing terminal illnesses, similar to the eligibility criteria for a life insurance advance. This arrangement allows policy owners to sell their life insurance policy for an immediate cash payment, which can be used to address pressing financial needs. The purchaser assumes ownership of the policy and becomes the beneficiary, receiving the death benefit upon the policy owner’s passing.

On the other hand, a life settlement is an option for policy owners who may not have a terminal illness but still wish to explore selling their policy. In a life settlement, the policy owner sells their life insurance policy to a third party in exchange for a lump sum payment. This option is typically available to policy owners who have outgrown their need for life insurance or are seeking to alleviate financial burdens.

Yes, it is possible to borrow money off your life insurance policy, providing you with a valuable financial resource in times of need. The ability to borrow from your policy depends on the type of life insurance you have.

Permanent life insurance policies, such as whole life or universal life insurance, are typically the types of policies that allow you to borrow against them. These policies accrue cash value over time, which can serve as collateral for a loan. The specific amount you can borrow from your life insurance policy will depend on the cash value accumulated and the terms outlined in your policy.

Additionally, for individuals facing a terminal illness, there is an option called a life insurance advance or loan. This specialized borrowing opportunity is available to those with a terminal health condition and allows them to access a portion of their life insurance death benefit while they are still alive.

A life insurance loan is a financial tool that allows policyholders to access the cash value accumulated in their whole life insurance policy. It functions as a line of credit, enabling individuals to borrow funds for various purposes without surrendering their policy. The loan amount is typically determined by the policy’s cash value and set terms by the insurance carrier. This type of loan is different from life settlements, which involve selling the policy for a lump sum payment. The amount borrowers can borrow depends on factors such as the policy’s cash value, type, and terms. However, it’s important to note that borrowing against the policy may reduce the death benefit and impact long-term performance.

Life insurance loans offer a unique financial solution, but many policyholders wonder if they need to repay these loans during their lifetime. Life insurance loans borrowed against the cash value of a policy do not typically require immediate repayment. The loan and any associated fees are typically repaid out of the policy’s death benefit when the insured passes away. This allows individuals to access funds when needed without the burden of monthly payments. The specific amount that can be borrowed from cash value life insurance and the timing of borrowing varies based on the policy’s terms and conditions.