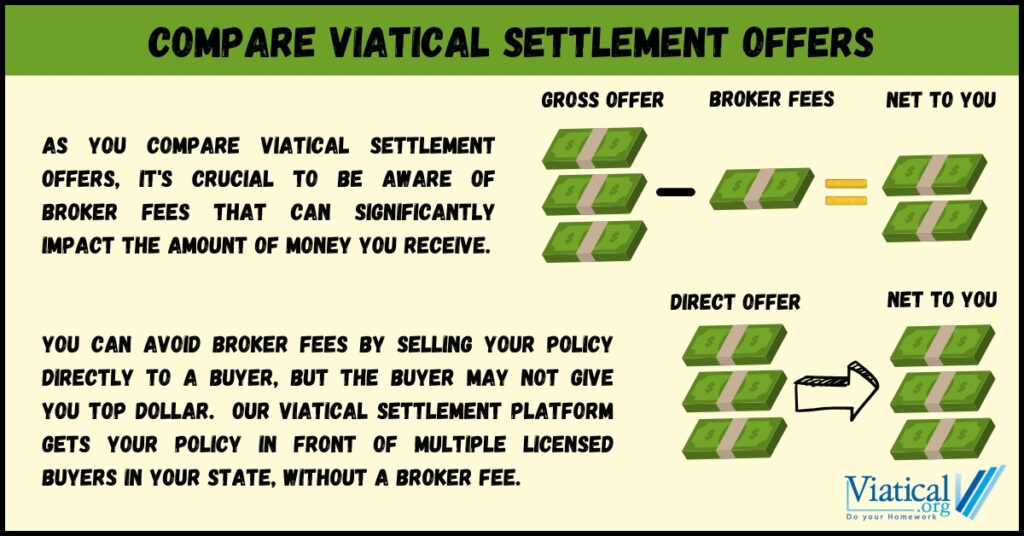

When it comes to managing financial needs during a challenging time, a viatical settlement can provide much-needed relief. However, not all viatical settlement offers are created equal. As you compare viatical settlement offers, it’s crucial to be aware of broker fees that can significantly impact the amount of money you receive. Fortunately, you can avoid these fees by using our direct viatical settlement platform in an effort to get the maximum value directly from licensed buyers in your state.

Understanding Viatical Settlements

A viatical settlement involves selling your life insurance policy to a third party for a lump sum payment. This option is often considered by individuals with a terminal illness who need immediate access to funds for medical expenses, living costs, or other financial obligations. It’s important to know that even people with life expectancies beyond 10 years can qualify to sell their life insurance policy, a viatical means that you have less than a 2 year life expectancy. Most of the people we help have a life expectancy beyond 2 years. The buyer of the policy assumes responsibility for paying the premiums and eventually collects the death benefit when the policyholder passes away.

The Role of Brokers in Viatical Settlements

Brokers act as intermediaries between the policyholder and potential buyers and maintain a fiduciary capacity to the policyowner. They are supposed to gather your insurance and health information, market your policy, solicit offers, and help you choose the best offer. While brokers can provide valuable services, they also charge fees for their efforts. These broker fees are typically a percentage of the settlement amount and are often 30% of your settlement or more. This significantly reduces the net amount you receive for your policy.

The Impact of Broker Fees

Consider a scenario where your life insurance policy is valued at $500,000. If a broker charges a 30% fee, you will lose $150,000 to fees alone, leaving you with $350,000. This substantial reduction highlights the importance of carefully evaluating broker fees when comparing viatical settlement offers. Some companies and some states limit fees to 6% of the face amount which can still be a very large fee.

Avoid Broker Fees with Our Direct Viatical Settlement Platform

Our direct viatical settlement platform offers a straightforward process to get your policy in front of licensed, experienced, accredited buyers in your state. The cost of assembling your medical file and insurance information as well as our platform fees are paid by the buyer. Here’s how it works:

- No Application: Typically, just a 5 of 10 minute phone call is all it takes for us to know if you’re likely to qualify to sell your life insurance policy.

- Digital Authorizations: Simple authorization allows the platform to gather all the information needed to value your life insurance policy.

- Direct Offers: All offers are made directly to you by a licensed buyer in your state.

- No Broker Fees: The offer from the licensed buyer is what you get, with no broker fee deducted.

Benefits of Using Our Platform

- High Payouts: Broker fees eat into the gross cash offer you receive for your insurance policy.

- Simplified Process: Our platform is a streamlined process. It requires little on your part.

- Expert Support: Our network of seasoned professionals is always available to answer your questions.

How to Compare Viatical Settlement Offers

When comparing viatical settlement offers, consider the following factors:

- Net Payout: Focus on the amount you will receive after all fees and expenses are deducted.

- Reputation of Buyers: Ensure the buyers are licensed, reputable and have a track record of fair dealings.

- Escrow Terms: Make sure the buyer escrows funds before you transfer ownership of your life insurance policy. We require this.

Take the time to compare viatical settlement offers, this is a crucial step in ensuring you maximize the value of your life insurance policy. While brokers can certainly assist in the process (some brokers make a very small effort), their fees can significantly reduce your net payout. By using our direct viatical settlement platform, you can avoid broker fees, simplify the process, and receive direct offers from licensed buyers in your state.

It truly does only take a 5 or 10 minute phone call to learn if you’re likely to qualify. If you qualify, our platform takes it from there. Selling all or a portion of your life insurance policy is a big decision.

Please call us with any questions and make sure you understand all your options. It’s why we are here. 800-973-8258