When exploring financial options related to life insurance, two terms often come up: viatical settlements and life settlements. While both offer a way to access the value of a life insurance policy before death, they serve very different purposes and apply to different situations. Understanding “Viatical vs Life Settlements” is essential for making an informed decision about which option may be right for you or a loved one. Let’s explore the differences between viatical settlements and life settlements.

What is a Viatical Settlement?

A viatical settlement involves selling a life insurance policy to a third party for a lump sum of cash, typically when the policyholder has a terminal illness. The viatical settlement purchaser pays the policyholder a portion of the policy’s death benefit, takes over the premium payments, and receives the full death benefit when the policyholder passes away. This option provides much-needed financial relief to individuals facing significant medical expenses or those who simply want to improve their quality of life in their remaining time.

What is a Life Settlement?

A life settlement, like a viatical settlement, involves selling a life insurance policy for cash. However, it is generally available to policyholders who are older, but not necessarily terminally ill. In most cases, the policy insured is over 65 and no longer needs or can no longer afford the premiums on their life insurance policy. The policy is sold for a value higher than the cash surrender value but lower than the full death benefit.

What is the Difference Between a Viatical Settlement and a Life Settlement?

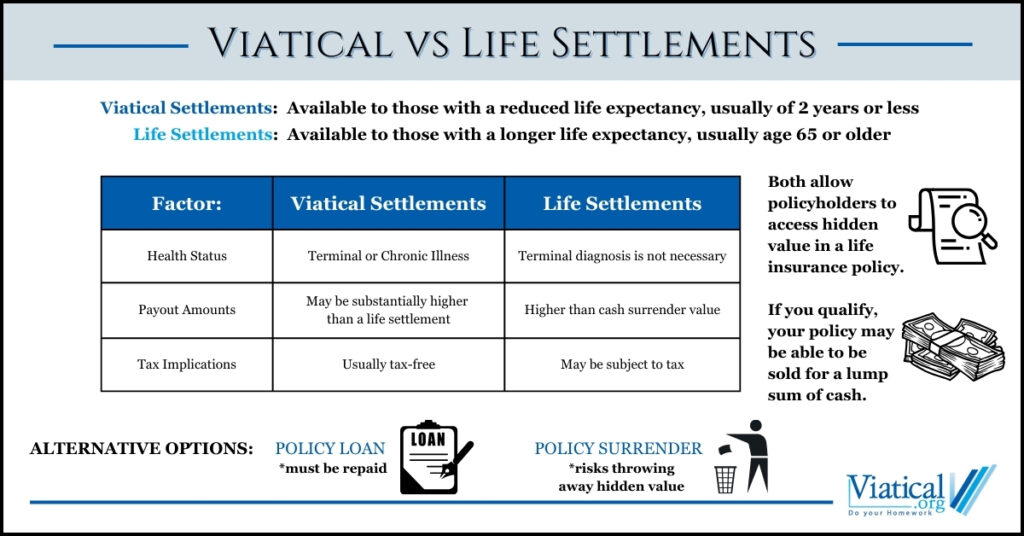

The main difference between a viatical settlement and a life settlement lies in the insured’s health status. A viatical settlement is typically available to individuals with a life expectancy of around 2 years or less, while a life settlement may be available to those with a longer life expectancy. Viatical settlements generally offer a larger percentage of the policy’s face value compared to life settlements. Another difference is that viatical settlements are typically not subject to tax, while life settlement proceeds may be taxed. It is always best to consult with your trusted tax advisor for guidance on your specific situation.

What is Another Name for a Life Settlement?

A life settlement is sometimes referred to as a senior settlement, especially in contexts where the policyholder is a senior citizen. This alternative name highlights the typical demographic that qualifies for a life settlement, those age 65 or older. Another popular term is reverse life insurance.

What is the Difference Between a Life Settlement and a Death Benefit?

The death benefit is the amount paid to the beneficiaries of a life insurance policy when the policyholder passes away. In contrast, a life settlement allows the policyholder to sell the policy while still alive for a lump sum. The key difference between a life settlement and a death benefit is that with a life settlement, the policyholder is able to receive cash now, rather than waiting for a death benefit.

Benefits of Viatical and Life Settlements

Both viatical and life settlements offer financial benefits, but they are used in different situations. For individuals with terminal illnesses, a viatical settlement can be a lifeline, providing immediate funds to cover medical bills, hospice care, or other essential needs. The policyholder can use the money however they choose, and in some cases, the proceeds from viatical settlements may be tax-free.

On the other hand, a life settlement can be a practical option for older individuals who no longer need life insurance or can no longer afford the premiums. Selling the policy allows them to receive a lump sum of cash, which can be used to fund retirement, pay off debt, or handle other expenses.

What is an Alternative to a Life Settlement?

If a policyholder is exploring alternatives to a life settlement, one option is borrowing against the cash value of their life insurance policy. Many permanent life insurance policies, such as whole life or universal life, accumulate cash value over time. The policyholder can take out a loan against this value while keeping the policy in place. The downside to this option is that the loan will need to be repaid. Another option is an accelerated death benefit, which allows terminally ill individuals to access a portion of the death benefit early, without selling the policy. Not everyone will qualify for this option.

What is the Difference Between a Life Settlement and a Surrender?

When a policyholder surrenders their life insurance policy, they terminate the policy and receive the cash surrender value, which is usually a smaller amount than what could be obtained through a life settlement. The key difference between a life settlement and a surrender is that a life settlement typically provides a larger payout. A life settlement involves selling the policy to a third party, whereas surrendering the policy means giving it back to the insurance company in exchange for the accumulated cash value.

Choosing Between a Viatical Settlement and a Life Settlement

Deciding between a viatical settlement and life settlements depends on the policyholder’s health, financial situation, and life insurance policy type. Here are a few factors to consider:

- Health Condition: If the insured has a terminal illness, a viatical settlement is likely the option they will qualify for. If they are older but in reasonably good health, a life settlement may be more appropriate.

- Policy Type: Most viatical and life settlements involve permanent life insurance policies, such as whole life or universal life, but term life insurance may also qualify if the policyholder is terminally ill or if the policy is convertible.

- Financial Needs: If the policyholder needs immediate cash for medical expenses, a viatical settlement can provide financial relief. In contrast, if the policyholder no longer needs their life insurance policy for estate planning or protecting dependents, a life settlement can offer an alternative to letting the policy lapse.

Understanding the differences between viatical and life settlements can help you make an informed decision about how to best use your life insurance policy to meet financial needs. Whether you’re facing a terminal illness or looking for a way to maximize the value of your life insurance policy in retirement, these settlements offer a way to unlock the hidden value of your policy.

Factors like health status, policy type, and financial goals will determine if a viatical or life settlement is available to you. If you’re unsure which option you qualify for, please give us a call at 800-973-8258.