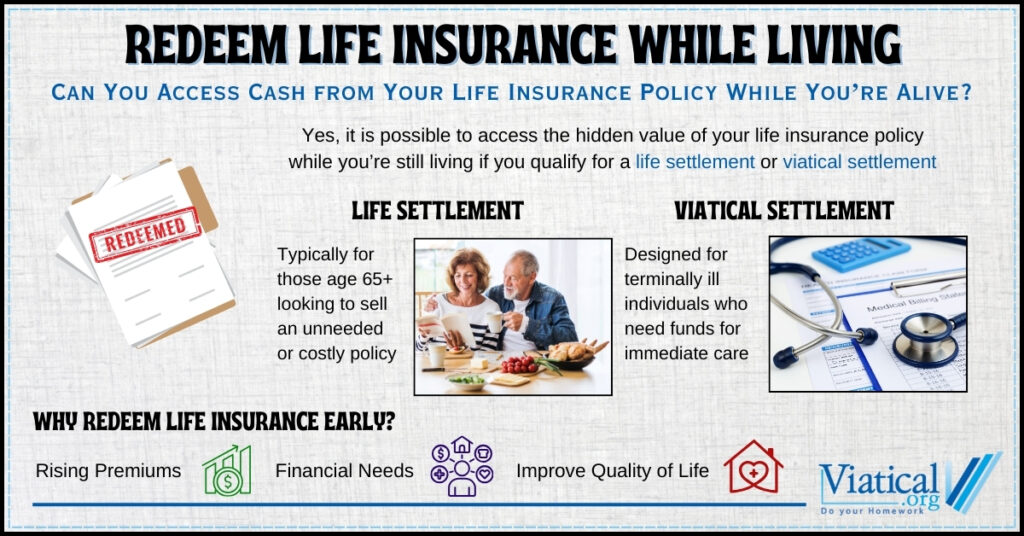

When most people purchase a life insurance policy, they intend it to provide financial protection for their loved ones after they’re gone. But what if you need access to funds sooner? Can you redeem life insurance while living? The answer is yes; it may be possible to access your policy’s value during your lifetime through options like a life settlement or a viatical settlement. Here’s how these options work, who qualifies, and the potential benefits they offer.

Can You Redeem a Life Insurance Policy While You’re Still Alive?

Yes, it can be possible to redeem your life insurance policy while you’re still alive. In many cases, policyholders can unlock the cash value of their policy through a life settlement or viatical settlement. These options allow you to sell your policy to a third party, who then takes over paying the premiums and eventually receives the death benefit. This approach provides an opportunity for immediate financial relief without waiting for the policy to mature.

The primary options for redeeming life insurance early include:

Life Settlement

Life settlements are a practical choice for policyholders who are typically age 65 or older, with policies that are no longer needed or that have become too costly to maintain. In a life settlement, a third-party buyer, such as an investment company, purchases your life insurance policy. They assume the responsibility for ongoing premium payments and become the beneficiary upon your passing, while you receive a lump sum cash payment now. This payment is typically more than the policy’s surrender value but less than the death benefit amount.

Life settlements are often appealing for those who may have originally taken out a policy to protect dependents, pay off a mortgage, or secure a legacy for family members. Over time, these needs can change, especially if dependents are now financially secure or the policy has become a financial burden. In such cases, selling the policy can redirect funds toward current needs like medical expenses, debt repayment, or enhancing retirement income.

Viatical Settlement

A viatical settlement is a similar process but is designed to provide financial assistance for terminally ill patients. Policyholders who qualify for a viatical settlement typically have a life expectancy of two years or less and need financial support for health-related expenses, end-of-life care, or other pressing needs. Because the policyholder has a shortened life expectancy, viatical settlements often pay out a higher percentage of the policy’s value than life settlements, providing more substantial financial assistance.

Viatical settlements can be particularly valuable when healthcare needs exceed what insurance or personal savings can cover. They can allow the policyholder to maintain their quality of life or secure necessary care without enduring significant financial hardship. With a viatical settlement, policyholders gain access to critical funds that can make a meaningful difference in their daily lives and the lives of their families.

Reasons to Consider Redeeming Life Insurance Early

There are several reasons why policyholders might choose to redeem life insurance early through a life settlement. Here are some of the most common motivations:

- Rising Premiums

Many life insurance policies, come with premium payments that increase substantially over time. For retirees or those on a fixed income, these costs can become unsustainable. Selling the policy can eliminate this expense while providing immediate funds to cover other priorities. - Immediate Financial Needs

Life can bring unexpected financial challenges, such as medical bills, long-term care, or emergency expenses that may require additional resources. If you have limited access to cash reserves or investments, a life or viatical settlement can offer a valuable alternative to cover these costs. - Policy No Longer Necessary

Over time, the original purpose of a life insurance policy can change. Dependents who once needed financial support may now be financially independent, or the policyholder’s financial goals may have evolved. By redeeming a policy early, you can access resources that may be better suited to your current situation. - Improving Quality of Life

For some, cashing in a life insurance policy is a way to improve their quality of life in retirement or during a serious illness. The funds can be used for anything from fulfilling a lifelong dream, such as traveling, to securing a higher level of care, such as in-home assistance or a more comfortable living arrangement.

Eligibility and Considerations

It’s important to understand that not every policyholder qualifies for a life settlement or viatical settlement, as eligibility depends on several factors. Here’s a closer look at what might affect your eligibility:

- Age and Health

For a life settlement, policyholders are generally 65 or older, while viatical settlements are available to those with a terminal illness. Younger, healthy individuals typically won’t qualify, as the policy’s long duration makes it less appealing to buyers. - Policy Type and Value

Whole life, universal life, and convertible term policies are the most common types considered for life or viatical settlements. Term policies that cannot be converted are generally ineligible for life settlements, but may qualify for a viatical settlement if the insured has a serious illness. Additionally, the policy’s face value plays a role, as buyers may prefer higher-value policies. Typically, the minimum face value of the policy should be $100,000 or more. - Premium Costs

Policies with very high premiums can be harder to sell since the buyer will need to cover these payments after purchasing the policy. For policies with lower, manageable premiums, the market is often more favorable.

Tax Implications and Financial Considerations

One important consideration in redeeming a life insurance policy while living is the potential tax liability. While the tax treatment can vary based on factors like your policy type, the length of time you’ve held the policy, and the amount you receive in a settlement, researching tax implications in advance is wise. Knowing the tax considerations can help you make an informed decision and manage any financial impact effectively.

If you’re wondering whether you can redeem life insurance while living, the answer is that you might be able to—especially if a life or viatical settlement suits your circumstances. These options allow policyholders to make use of their life insurance policy’s value during their lifetime, offering flexibility, financial relief, and sometimes even peace of mind. By exploring all available options, you can determine if this approach aligns with your financial needs and goals, making the most of your life insurance policy on your terms.

To find out if you’re likely to qualify to redeem your life insurance and access the policy’s hidden value today, please give us a call at 800-973-8258.