Debt consolidation is a common financial strategy for those juggling multiple debts. While it can simplify payments and reduce interest rates, it’s not always the best solution for everyone. If you’re struggling with debt and own a life insurance policy, you might want to consider life settlements an alternative to debt consolidation.

A life settlement allows policyholders to sell their life insurance policy for a lump sum of cash. This option could provide you with the funds you need to pay off debts without taking on additional loans or restructuring your existing obligations. Here’s how life settlements can be a viable alternative to debt consolidation.

What Is a Life Settlement?

A life settlement involves selling your life insurance policy to a third-party buyer, typically a financial institution, for more than the cash surrender value but less than the policy’s death benefit. The buyer assumes responsibility for paying the premiums and eventually collects the death benefit.

How Life Settlements Differ from Debt Consolidation

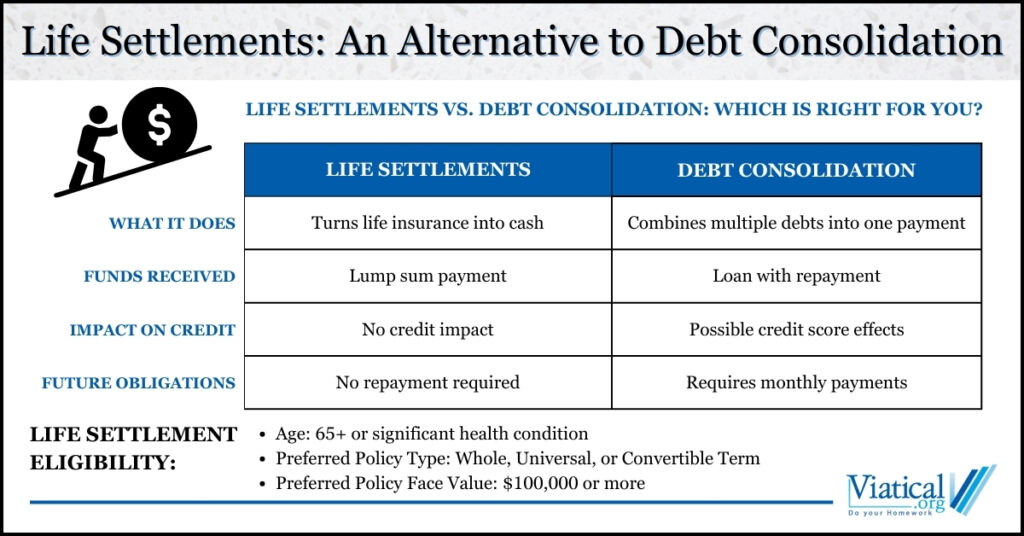

While debt consolidation combines multiple debts into a single loan or payment plan, it doesn’t reduce the total amount owed—just simplifies repayment. On the other hand, selling a life insurance policy through a life settlement can provide immediate cash to eliminate debt entirely. Here are some key differences:

| Life Settlements | Debt Consolidation |

| Provides a lump sum to pay off debts | Combines multiple debts into one loan |

| No repayment required | Requires monthly repayment |

| No impact on credit score | Can affect credit score |

| Access to cash without additional loans | Adds a new loan obligation |

When to Consider a Life Settlement Instead of Debt Consolidation

A life settlement may be a better choice if:

- Your Policy Is No Longer Needed

If your life insurance policy no longer serves its original purpose—such as providing for dependents or covering estate taxes—a life settlement can turn it into a valuable financial asset. - You Face High Interest Rates on Debt

Paying off high-interest credit cards or personal loans with the proceeds of a life settlement can save money in the long term. - You’re Looking to Avoid Further Debt

Unlike debt consolidation, a life settlement doesn’t require taking on additional financial obligations. - You Qualify for a Substantial Payout

If your policy has a high face value and you meet the eligibility criteria, a life settlement could provide significant funds.

Eligibility for a Life Settlement

To qualify for a life settlement, policyholders generally need:

- A life insurance policy with a death benefit of $100,000 or more.

- To be over the age of 65 or have a significant health condition.

- A policy type that is eligible, such as whole life, universal life, or convertible term life insurance.

How Life Settlements Can Help Pay Off Debt

Here’s an example of how a life settlement might work as an alternative to debt consolidation:

Scenario:

Mary, a 70-year-old retiree, has a $250,000 universal life insurance policy that she no longer needs. She’s accumulated $40,000 in credit card debt with high-interest rates and is struggling to make ends meet. Instead of consolidating her debt into a new loan, she sells her life insurance policy for $120,000 through a life settlement. Mary uses the proceeds to pay off her credit card balances and has money left over for other expenses, without taking on new debt.

Advantages of Choosing a Life Settlement

- Immediate Access to Cash: Provides funds right away to address financial challenges.

- No Debt Accumulation: Eliminates the risk of falling into a cycle of borrowing.

- Financial Freedom: Offers flexibility to use the funds as needed, whether for debt repayment, medical bills, or retirement expenses.

Is a Life Settlement Right for You?

While life settlements can be a powerful financial tool, they’re not for everyone. If your policy is crucial to your family’s financial security, or if you can manage your debts through other means, a life settlement may not be the best option. However, if you no longer need your policy and want to avoid further debt, a life settlement could provide the relief you need.

Next Steps

If you’re considering a life settlement as an alternative to debt consolidation, start by evaluating the value of your life insurance policy. We can assist you with obtaining a no obligation policy appraisal.

Life settlements can transform a financial burden into an opportunity for relief and stability. By unlocking the hidden value of your life insurance policy, you can address your debt without the added pressure of loans or monthly repayments.

However, it’s essential to weigh the pros and cons of this decision carefully. Consulting with financial advisors or life settlement specialists can help you understand the potential benefits and drawbacks tailored to your specific situation.

Life settlements are a unique and powerful financial tool. By converting an unneeded life insurance policy into immediate cash, you can take control of your financial future and achieve greater peace of mind.

To learn if a life settlement may be an option you qualify for, please contact us at 800-973-8258.