Many policyholders find themselves in a situation where they no longer need or can no longer afford their life insurance coverage. Selling an unneeded life insurance policy can provide a financial solution by turning the policy into a lump sum of cash. Instead of surrendering it for a fraction of its value or letting it lapse, a life settlement or viatical settlement may allow you to receive significantly more.

Why Sell a Life Insurance Policy?

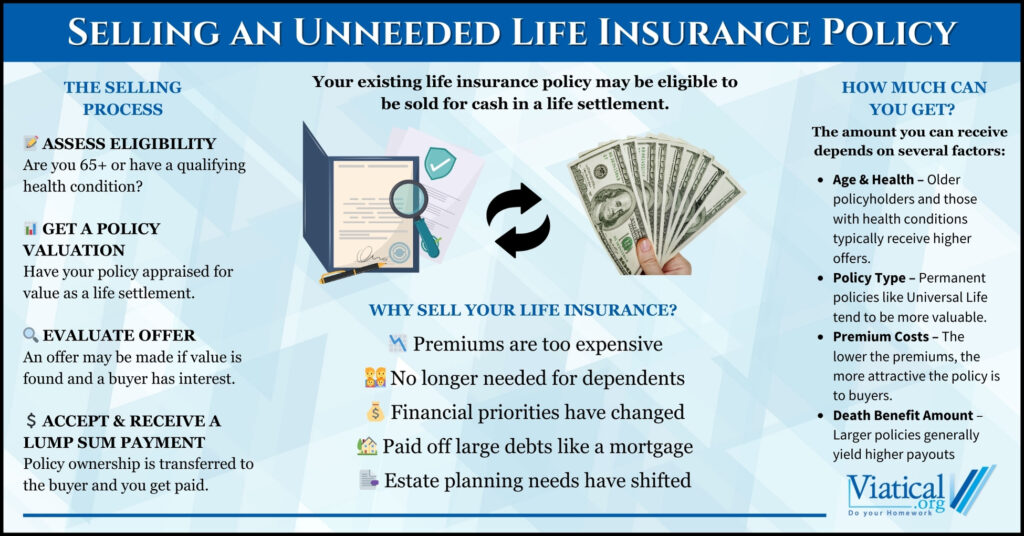

There are several reasons why a policyholder may no longer need their life insurance policy:

- The original purpose no longer applies – If your policy was intended to provide for dependents who are now financially independent, it may no longer be necessary.

- Premiums have become too expensive – Many policies become increasingly costly, especially as term policies expire and convert to annual renewable premiums.

- A change in financial needs – You may need funds for medical expenses, retirement, or other financial priorities.

- Estate planning changes – If your estate no longer requires a large life insurance payout to cover taxes or debts, a settlement could be a better option.

- You’ve paid off major debts – If your mortgage or other significant financial obligations have been settled, the need for coverage may diminish.

- Your spouse has passed away – If your policy was intended to provide for a spouse who has since passed, you may no longer need the coverage.

- You have significant savings or investments – A strong financial portfolio may make the insurance policy redundant.

- You’re downsizing or relocating – Moving to a lower-cost area or reducing expenses in retirement may change your insurance needs.

Case Study: A Retired Couple Turns a Policy into Retirement Funds

John and Linda purchased a $500,000 guaranteed universal life (GUL) insurance policy in their 50s as part of their financial planning strategy. Their goal was to ensure their children would be financially protected and that any estate taxes would be covered. Now in their 70s, John and Linda have built up sufficient retirement savings and both of their children are financially independent.

As they reviewed their finances, they realized that their GUL policy was no longer necessary. The premiums had become a burden, and they wanted to free up funds for other expenses. After researching their options, they discovered that they could sell their policy through a life settlement instead of surrendering it for a minimal cash value.

They accepted a $120,000 lump sum offer—far more than the surrender value the insurance company would have given them. This money allowed them to bolster their retirement savings, take a long-planned vacation, and cover some medical bills. By selling their unneeded life insurance policy, they eliminated ongoing premium payments and gained financial flexibility.

How Much Can You Get for Your Policy?

The amount you can receive from selling your life insurance policy depends on several factors, including:

- Age and health status – Policies held by older individuals or those with health conditions typically receive higher offers.

- Policy type – Permanent policies like whole or universal life are often more valuable than term policies, though convertible term policies can also qualify.

- Premium costs – Buyers evaluate how much they will need to continue paying premiums when determining an offer.

- Death benefit amount – Policies with larger death benefits generally command more interest from life settlement purchasers and higher payouts.

The Selling Process

The process of selling a life insurance policy is straightforward but requires careful consideration:

- Assess eligibility – Policyholders typically need to be at least 65 years old or have a qualifying health condition.

- Obtain policy valuation – A life settlement company or direct buyer will evaluate your policy and make an offer.

- Review offers – Review and accept a suitable offer.

- Complete the sale – Once an offer is accepted, ownership of the policy transfers to the buyer, and the seller receives a lump sum payment.

Is Selling the Right Choice for You?

Before selling your policy, consider your financial needs and any potential tax implications to determine whether a life settlement is the best option for your situation.

If you no longer need your life insurance policy, selling it can provide immediate financial relief and flexibility. Rather than letting a valuable asset lapse, exploring the option of life settlements may allow you to unlock funds that can be used for healthcare, retirement, or other financial goals. To learn if you’re likely to qualify, please give us a call at 800-973-8258