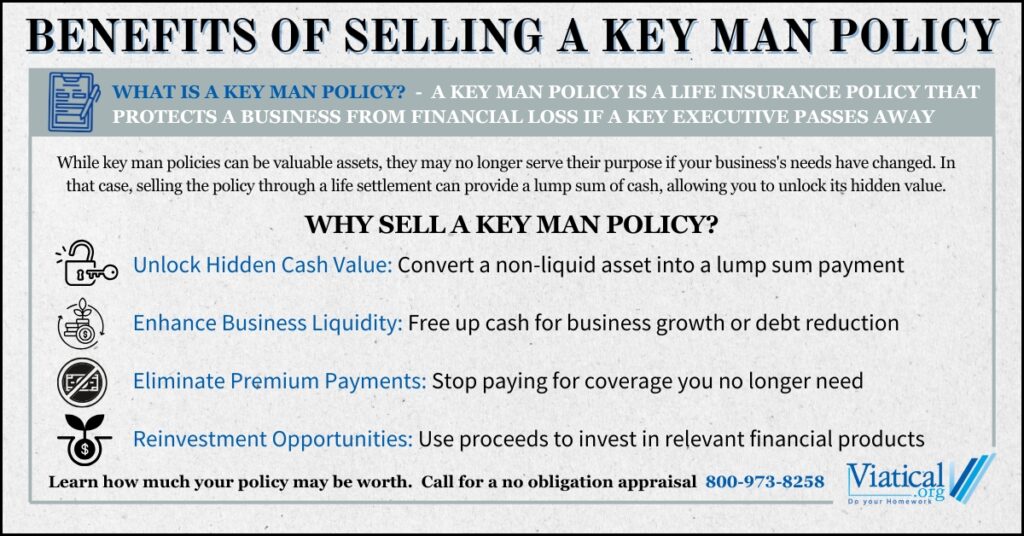

If your business no longer needs its key man life insurance policy, you might be wondering about the benefits of selling a key man policy for cash. Many business owners and financial professionals are unaware that key man policies can be converted into a lump sum payment through a life settlement. This strategic financial move can provide your company with immediate liquidity and unlock the hidden value of an otherwise dormant asset.

What is a Key Man Policy?

A key man policy is a life insurance policy purchased by a business to provide financial protection if a key executive, owner, or critical team member passes away. The company is typically the beneficiary and uses the death benefit to cover potential financial losses, recruit new talent, or stabilize operations. However, when the policy is no longer needed—perhaps due to a leadership change, retirement, or business restructuring—it may be more advantageous to sell the key person policy instead of letting it lapse or surrendering it for minimal cash value.

When Should You Consider Selling a Key Man Policy?

There are several situations where selling a key man policy makes strategic sense:

- Leadership Changes: When the insured executive retires, leaves the company, or business models shift, the policy may no longer serve its original purpose.

- Immediate Cash Flow Needs: Selling the policy provides immediate liquidity, which can be used for business expansion, debt reduction, or reinvestment in more relevant assets.

- Avoiding Premium Payments: If maintaining premium payments is a financial burden, selling the policy can eliminate this ongoing expense.

- Maximizing Policy Value: Often, the payouts from life settlements are significantly higher than the policy’s cash surrender value.

Top Benefits of Selling Your Key Man Policy

- Unlock Hidden Cash Value: Instead of allowing the policy to lapse, converting it to cash can provide a substantial financial boost to your business.

- Enhance Business Liquidity: Receive a lump sum payment to support business initiatives or address financial challenges.

- Reinvestment Opportunities: Reallocate funds to new insurance policies or investment products that better align with your business’s current needs.

- Reduce Financial Strain: Free up resources by eliminating future premium payments and gain access to capital without incurring debt.

How Much is Your Key Man Policy Worth?

The amount you receive when selling a key man policy depends on several factors, including:

- The Insured’s Age and Health: Older age or health concerns can increase the payout.

- Policy Type and Face Value: Universal, whole life, or convertible term policies with higher face values typically yield better offers. Some other types of policies may qualify.

- Premium Costs: Lower premiums relative to the face value are more attractive to buyers.

On average, life settlement offers range from 10% to 30% of the policy’s face value, but policies with insureds in declining health can yield higher returns.

Who Buys Key Man Life Insurance Policies?

The secondary market for life insurance policies includes:

- Institutional Investors: Seeking long-term investments with stable returns.

- Private Equity Firms: Looking to diversify their investment portfolios.

- Specialized Life Settlement Companies: Some life settlement companies purchase policies with the intent to sell at a later date in the tertiary life settlement market.

The Process of Selling a Key Man Policy

- Determine Eligibility: Confirm that the policy meets basic requirements for a life settlement, typically including a face value of $100,000 or more.

- Request a Policy Appraisal: A policy appraisal will provide an estimate of its market value. In order to have the policy appraised for value, the insured on the policy will need to sign a HIPAA authorization form. This allows the life settlement company to gather medical records to assess life expectancy, which directly impacts the policy’s market value. This step is crucial as medical underwriting is a key factor in determining policy value. The information remains confidential and is used solely for the purpose of policy valuation.

- Review Offer: If value is found and a buyer is interested, a direct offer will be presented to you.

- Complete the Sale: Once an offer is accepted and contracts are completed, ownership is transferred, and the policy owner receives a lump sum payment.

Is Selling Your Key Man Policy the Best Choice?

Before selling, consider:

- Current Business Needs: Does the policy still provide value, or is cash more useful to the business?

- Alternative Options: Weigh the benefits of selling the policy or maintaining it for potential future use.

- Financial Impact: Assess how the sale will affect the company’s financial position, including any potential tax implications.

Maximize the Value of Your Key Man Policy Today

Selling a key man policy can be a strategic move to enhance your business’s financial flexibility and capitalize on a valuable asset. If you are considering selling your policy, request a no-obligation appraisal today to learn how much your business could receive. 800-973-8258