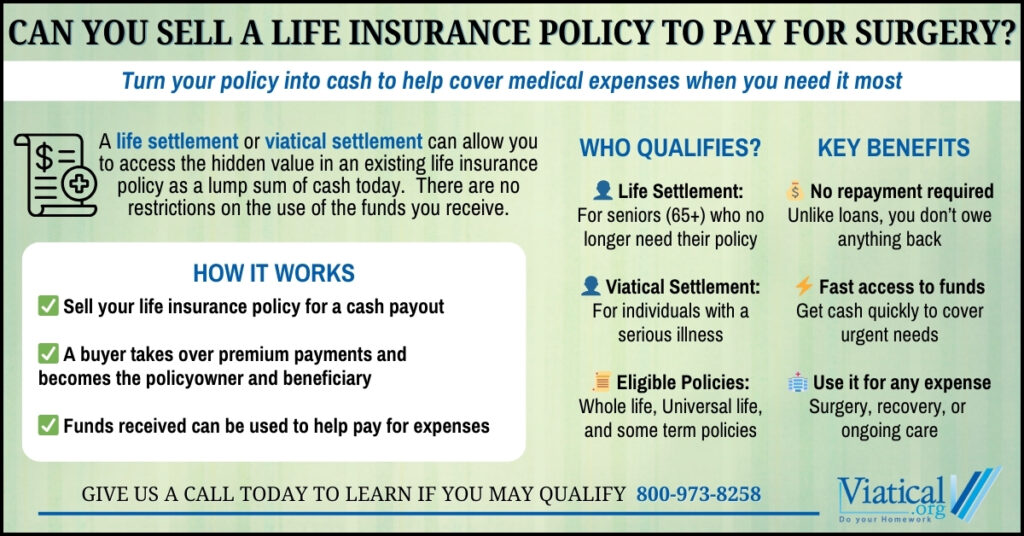

If you’re facing the high cost of surgery, you may be wondering: Can you sell a life insurance policy to pay for surgery? The answer is yes, you may be able to sell a policy for cash—many policyholders can sell their life insurance policy through a life settlement or viatical settlement, depending on their health status and policy type. This option can provide a much-needed financial lifeline for those struggling with medical expenses.

The Origin of Life Settlements: Grigsby v. Russell

The right to sell a life insurance policy was established over a century ago in the landmark 1911 U.S. Supreme Court case Grigsby v. Russell. The case arose when Dr. John B. Grigsby accepted a life insurance policy as payment for a medical procedure from a patient who could no longer afford treatment. After the patient passed away, a legal dispute emerged over the validity of the sale. The Court ultimately ruled that life insurance policies are transferable assets, just like real estate or stocks, allowing policyholders to sell them for cash. This decision laid the foundation for today’s life settlement and viatical settlement industry.

How Selling a Life Insurance Policy Works

Selling a life insurance policy is a process known as a life settlement (for seniors) or a viatical settlement (for those with a serious illness). In both cases, a third-party buyer purchases your policy in exchange for a lump sum cash payment. The buyer then takes over the premiums and becomes the new beneficiary, collecting the death benefit when the insured passes away.

The amount you receive for your policy depends on several factors, including:

- Your Age & Health – Viatical settlements often yield higher payouts. They are designed for individuals with a serious medical condition.

- Policy Type & Value – Permanent policies, such as whole life and universal life, are more commonly sold than term policies, but some term policies may qualify.

- Premium Costs – Lower premiums make a policy more valuable to buyers.

The High Cost of Surgery: Can Life Settlements Help?

Many people consider selling their life insurance when faced with expensive medical treatments, particularly for serious illnesses such as cancer. The cost of surgery alone can be overwhelming, not to mention additional expenses for hospital stays, post-operative care, and ongoing treatments like chemotherapy or radiation.

Here are some examples of cancer-related surgeries and their costs:

Breast Cancer Surgery (Lumpectomy or Mastectomy) – Average initial treatment cost: $43,516

Colorectal Cancer Surgery (Colectomy or Proctectomy) – Average initial treatment cost: $66,523

Lung Cancer Surgery (Lobectomy or Pneumonectomy) – Average initial treatment cost: $68,293

These figures represent only the initial treatment phase and do not include the cost of ongoing medical care, which can drive expenses even higher. For many individuals, selling a life insurance policy can help bridge the financial gap and provide immediate funds to cover these critical medical procedures.

Life Settlement vs. Viatical Settlement: Which Is Right for You?

- Life Settlement: Typically for seniors (65+) who no longer need or want their policy. It provides a lump sum that is more than the cash surrender value, but less than the full death benefit.

- Viatical Settlement: Designed for individuals with a serious illness. These settlements often offer higher payouts. In most cases, viatical settlement proceeds are not taxed, but it is always recommended to consult with your trusted tax specialist regarding your unique situation.

Benefits of Selling Life Insurance to Pay Medical Bills

- Immediate Cash for Medical Bills – Unlike loans, settlements provide a lump sum that can be used for surgery, hospital stays, or other healthcare costs.

- No Repayment Required – Unlike borrowing against a policy, selling eliminates financial burden without future payments.

- May Be Tax-Free – Viatical settlements are often exempt from federal taxes.

Things to Consider Before Selling Your Policy

Before selling, ask yourself:

- Do you have other financial resources? Consider all options before giving up your policy.

- Do your beneficiaries rely on the policy? If family members would struggle without the payout, weigh the decision carefully.

- Is your policy eligible? Some term policies may need to have an option to convert to permanent insurance in order to be eligible for a sale.

How to Get Started

If you’re considering selling your life insurance to pay for surgery, the first step is to find out if your policy qualifies. You can request a no obligation policy appraisal to help determine how much hidden value your policy may have.

For those struggling with medical costs, selling a life insurance policy can provide financial relief and make surgery and other necessities more accessible. Whether you qualify for life settlements or a viatical settlement, this option can turn your policy into the funds you need to cover essential healthcare expenses. To learn if you are likely to qualify, please give us a call at 800-973-8258.