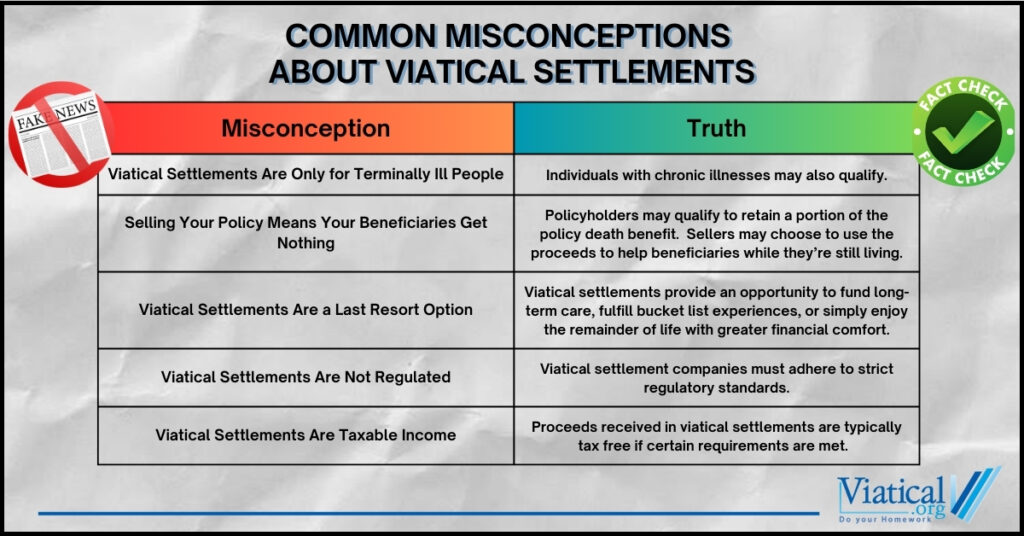

When considering a viatical settlement, it’s important to understand what this financial option truly entails. Unfortunately, there are many myths that can cloud the decision-making process. In this article, we will explain why the top 5 common misconceptions about viatical settlements simply aren’t accurate, clarifying what’s fact and what’s fiction. This way, you’ll have a clearer understanding of how viatical settlements work and whether they may be the right choice for you or a loved one.

1. Misconception: Viatical Settlements Are Only for Terminally Ill People

One of the most widespread myths about viatical settlements is that they are exclusively for people who are terminally ill. While it’s true that viatical settlements were originally designed for individuals diagnosed with terminal illnesses, the scope has since broadened. The impact of medical advances on life settlements is that many now have a longer life expectancy. Today, individuals with chronic illnesses, such as severe conditions that may shorten life expectancy but are not necessarily terminal, may still qualify. These settlements offer a way to access much-needed funds for medical care, daily expenses, or even debt management. In the event that an insured’s life expectancy is longer, they may still qualify for life settlements.

2. Misconception: Selling Your Policy Means Your Beneficiaries Get Nothing

A common fear among policyholders is that selling their life insurance policy through a viatical settlement means their loved ones will be left without financial support. In reality, when you sell your life insurance policy, the lump sum you receive from the settlement can be used however you see fit. For many, this includes providing financial security for their family members while they are still alive. Additionally, depending on the size of the settlement and how much of the policy is sold, there may be an option to retain a portion of the policy.

3. Misconception: Viatical Settlements Are a Last Resort Option

Another misconception is that viatical settlements are only used by people in desperate financial situations. While they can be a lifeline for those facing overwhelming medical bills or debt, many people choose viatical settlements as a strategic financial tool. For some, a viatical settlement provides an opportunity to fund long-term care, fulfill bucket list experiences, or simply enjoy the remainder of their life with greater financial comfort. This option allows individuals to access a significant portion of their life insurance policy’s value when they need it most, without waiting for the payout after their death. This makes viatical settlements a valuable option for those seeking flexibility and control over their financial decisions.

4. Misconception: Viatical Settlements Are Not Regulated

There’s a persistent myth that viatical settlements operate in a legal gray area, leaving policyholders vulnerable to fraud. This couldn’t be further from the truth. Viatical settlements are regulated by both state and federal laws to protect consumers and ensure fair practices. The regulation of viatical settlements varies from state to state, but most states have established clear guidelines for the sale of life insurance policies. Reputable viatical settlement companies must adhere to strict regulatory standards, and consumers have legal protections in place to ensure they receive fair market value for their policy.

5. Misconception: Viatical Settlements Are Taxable Income

Many people worry that if you sell your life insurance policy for cash in a viatical settlement it will lead to a hefty tax bill. However, in most cases, viatical settlements are not considered taxable income under U.S. law. As long as the policyholder is classified as chronically or terminally ill, the proceeds from the sale of the life insurance policy are typically tax-free. It’s important to consult with a tax advisor or financial professional to ensure you understand your specific tax situation, but for most people, this is a non-issue. This can make viatical settlements an attractive option, as they allow individuals to access cash without the burden of additional taxes.

Understanding the common misconceptions about viatical settlements is crucial for anyone considering this financial option. By dispelling these myths, we hope to provide clarity and insight into how viatical settlements work and their potential benefits. Whether you are looking for a way to cover medical expenses, enjoy financial flexibility, or plan for the future, a viatical settlement could offer a path to achieving your goals. Please call us today at 800-973-8258 to learn if you are likely to qualify and for a no obligation policy appraisal.