A diagnosis of a terminal illness can be overwhelming, especially when financial burdens add to the stress. If you’re considering selling your life insurance policy for cash, you might be asking yourself, “Do I qualify for a viatical settlement?” Understanding the eligibility criteria and factors that determine qualification is essential in making an informed decision.

What is a Viatical Settlement?

A viatical settlement is a financial transaction that allows individuals with terminal illnesses to sell their life insurance policies to a third party for a lump sum cash payment. This cash can be a crucial lifeline, helping to cover medical expenses, living costs, or other urgent financial needs. In many cases, the amount received from a viatical settlement is significantly higher than the policy’s cash surrender value and in most cases, funds received in a viatical settlement are tax-free.

Eligibility Criteria

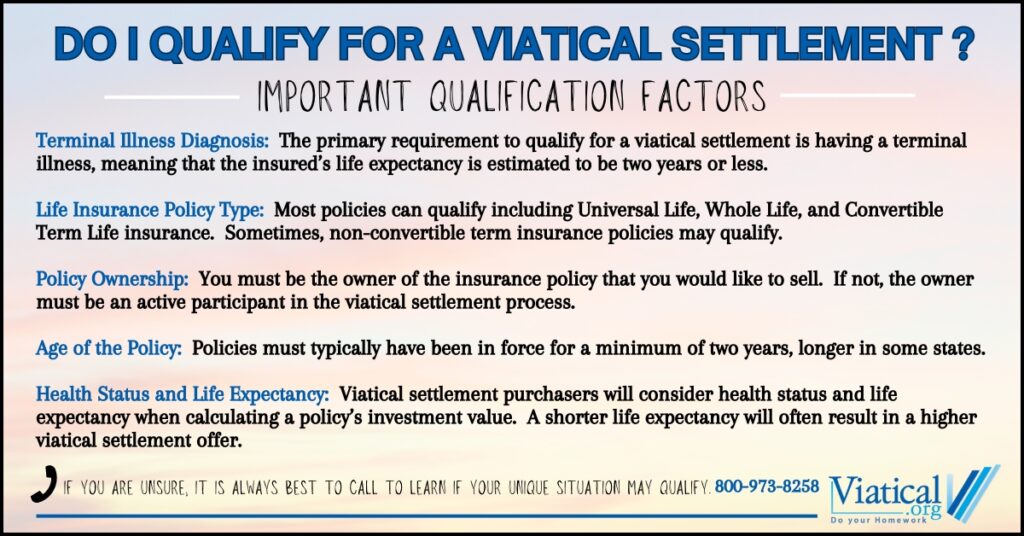

- Terminal Illness Diagnosis

- The primary requirement for qualifying for a viatical settlement is having a terminal illness. Most providers define this as a condition that is expected to result in a life expectancy of two years or less. Medical conditions qualifying for viatical settlements include advanced-stage cancer, heart disease, and other life-threatening conditions.

- Life Insurance Policy Type

- Not all life insurance policies are eligible for viatical settlements. Generally, permanent life insurance policies, such as whole life or universal life, are preferred. Term life insurance policies may also qualify, but this often depends on specific circumstances, such as the remaining term and health condition of the insured. Convertible term policies are more likely to qualify than non-convertible policies.

- Policy Ownership

- You must be the owner of the life insurance policy you wish to sell. If the policy is part of a trust or owned by someone else, the owner will need to be active in the sale process and eventually sign over ownership and beneficiary rights to a buyer if an offer to purchase the policy is accepted.

- Age of the Policy

- The age of your life insurance policy can also impact your eligibility. In most cases, a policy must have been in force for a minimum of two years prior to a sale. Some states require that the policy has been in force for as many as five years.

- Health Status and Life Expectancy

- Your health plays a critical role in determining eligibility for a viatical settlement. Life settlement buyers will typically evaluate your medical records and consider your estimated life expectancy. A shorter life expectancy will often result in a higher settlement offer.

The Viatical Settlement Process

Once you determine that you might qualify for a viatical settlement, the process generally involves the following steps:

- Assessment of Eligibility

- Contact a viatical settlement company to discuss your situation. They will review your health status, policy details, and any other relevant factors to assess your possible eligibility.

- Medical Underwriting

- After confirming potential eligibility, the company will obtain your medical records so that buyers can confirm and determine your health status.

- Valuation of the Policy

- Potential purchasers will calculate the present value of your life insurance policy based on factors like your age, health condition, policy type, and current market conditions. This valuation will help determine the offer you will receive.

- Receiving Offers

- Once your policy is evaluated, you will receive offers from interested buyers. You can compare these offers to choose the one that best meets your financial needs.

- Finalizing the Settlement

- After accepting an offer, you will complete the necessary paperwork to finalize the policy sale. This involves signing a viatical settlement contract and documents to transfer the ownership and beneficiary rights for your policy to the life settlement purchaser. Upon completion, you will receive your lump sum payment and the buyer will take over responsibility for the policy.

Viatical Settlement Frequently Asked Questions

1. What if I am not terminally ill? While traditional viatical settlements require a terminal diagnosis, some life settlements options may be available for those who are not terminally ill but have other qualifying health conditions.

2. Will I receive a fair offer for my policy? Offers can vary widely based on your health status, policy type, and market conditions. Working with reputable life settlement companies can help ensure you receive a competitive offer.

Make sure to be aware of any potential broker fees, which can be as much as 30% or more of your offer. If you receive a direct offer through a buyer on our platform, you do not need to subtract a broker fee. The offer made to you will be the full amount you will receive.

3. How quickly can I access funds? The timeline for receiving funds can vary, but many viatical settlements are completed within a few weeks to a couple of months, depending upon how quickly insurance documents and medical records can be gathered. Typically, gathering medical records is the most time-consuming element and obtaining your own records can greatly speed up the process.

If you’re facing a terminal illness and struggling with financial stress, understanding “do I qualify for a viatical settlement” is the first step toward accessing the hidden value in your life insurance policy, that can be a truly valuable resource. By familiarizing yourself with the eligibility criteria and the settlement process, you can make informed decisions that benefit your financial health and overall well-being.

To learn if you are likely to qualify for a viatical settlement or for a life settlement, please give us a call today. 800-973-8258