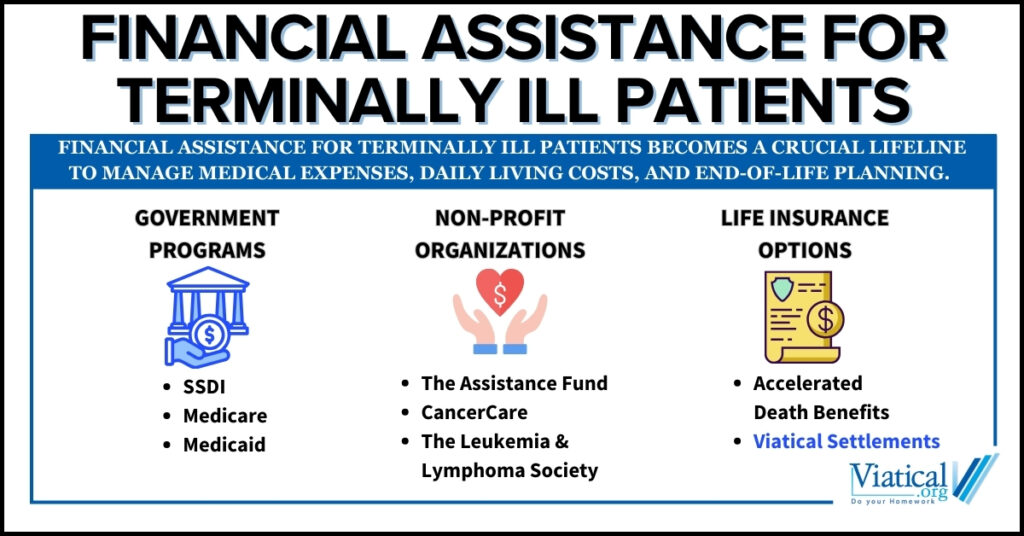

Facing a terminal illness is an overwhelming experience that affects not only your health but also your financial well-being. Financial assistance for terminally ill patients becomes a crucial lifeline to manage medical expenses, daily living costs, and end-of-life planning. This article explores various financial support options available.

Understanding the Financial Burden

Medical treatments, medications, and hospital stays can quickly deplete savings and strain finances. Additionally, the inability to work may reduce income, making it challenging to cover everyday expenses like mortgage payments, utilities, and groceries. Seeking financial assistance can alleviate stress and allow patients to focus on their health and spending quality time with loved ones.

Government Programs

Social Security Disability Insurance (SSDI)

Social Security Disability Insurance SSDI provides monthly payments to individuals who have worked and paid Social Security taxes but are now unable to work due to a medical condition expected to last at least one year or result in death. Terminally ill patients often qualify for expedited processing of their claims.

Medicare and Medicaid

- Medicare: Available to individuals over 65 or those who have been receiving SSDI for at least two years. Medicare helps cover hospital stays, hospice care, and some medical equipment.

- Medicaid: A state and federal program that assists with medical costs for those with limited income. Eligibility varies by state, but Medicaid often covers additional services not provided by Medicare.

Non-Profit Organizations

Several charities and non-profits offer financial assistance for medical bills, medication costs, and other expenses:

- The Assistance Fund: TAF provides financial support for out-of-pocket medical expenses.

- CancerCare: CancerCare offers grants to cancer patients for transportation, home care, and childcare.

- The Leukemia & Lymphoma Society: LLS provides co-pay assistance for blood cancer patients.

Life Insurance Options

Accelerated Death Benefits

Some life insurance policies offer accelerated death benefits, allowing policyholders to receive a portion of the death benefit while still alive. This option can provide immediate funds but will reduce the amount beneficiaries receive later. Not every policy has an accelerated death benefit rider and not all insureds will qualify to receive this benefit. Your life expectancy must typically be 6 months or less.

Viatical Settlements

A viatical settlement is a financial arrangement where a terminally ill patient sells their life insurance policy to a third party for a lump sum cash payment. The buyer becomes the policy’s beneficiary and assumes responsibility for premium payments.

Benefits of Viatical Settlements

- Immediate Access to Funds: Receive a lump sum payment higher than the policy’s cash surrender value but less than the death benefit.

- No Restrictions on Use: Funds can be used for any purpose—medical bills, living expenses, debt repayment, or even a dream vacation.

- Improved Quality of Life: Alleviates financial stress, allowing patients to focus on their health and personal affairs.

- No Repayment Required: Unlike loans, the money received does not need to be repaid.

- Potential Tax Advantages: In many cases, viatical settlement proceeds are tax-free if the insured is terminally ill. Consult your trusted tax professional for personalized advice.

Eligibility Criteria

- Must have a life-threatening illness with a life expectancy of two years or less. Insureds with longer life expectancies may qualify for life settlements.

- Own a qualifying life insurance policy (term, whole, or universal life commonly qualify).

- Policy must be beyond the contestability period, typically two years.

The Process

- Choose an experienced life settlement company: Viatical.org has been helping policyholders sell to direct buyers for nearly 20 years.

- Application and Documentation: Complete initial compliance forms to allow our platform to gather medical records and insurance information necessary for direct buyers to appraise your policy.

- Policy Evaluation: Buyers will assess the policy’s value based on factors like death benefit, premiums, and the insured’s health status.

- Offer and Agreement: Receive an offer if value is found. If accepted, legal documents are signed to transfer ownership and beneficiary rights to the policy.

- Receive Payment: After transfer of ownership is complete, funds are disbursed to you.

Other Financial Assistance Options

Health Savings Accounts (HSAs)

If you have an HSA, funds can be used tax-free for qualified medical expenses, providing some financial relief.

Negotiating Medical Bills

Hospitals and medical providers may offer discounts or payment plans. It’s worthwhile to discuss your situation with billing departments.

Disability Insurance

If you have private disability insurance, you may be eligible for benefits that replace a portion of your income.

Planning Ahead

- Estate Planning: Consult an attorney to organize wills, power of attorney, and healthcare directives.

- Financial Counseling: A financial advisor can help manage assets and explore additional assistance programs.

Navigating the financial challenges of a terminal illness is undoubtedly stressful, but multiple resources are available to help. Financial assistance for terminally ill patients, such as government programs, non-profit organizations, and life insurance options like viatical settlements, can provide much-needed relief.

Viatical settlements, in particular, offer significant benefits by unlocking the value of a life insurance policy, allowing patients to access funds when they need them most. It’s essential to explore all available options and make informed decisions that best suit your needs and those of your loved ones.

To learn if a viatical settlement may be an option for you, please give us a call today. 800-973-8258