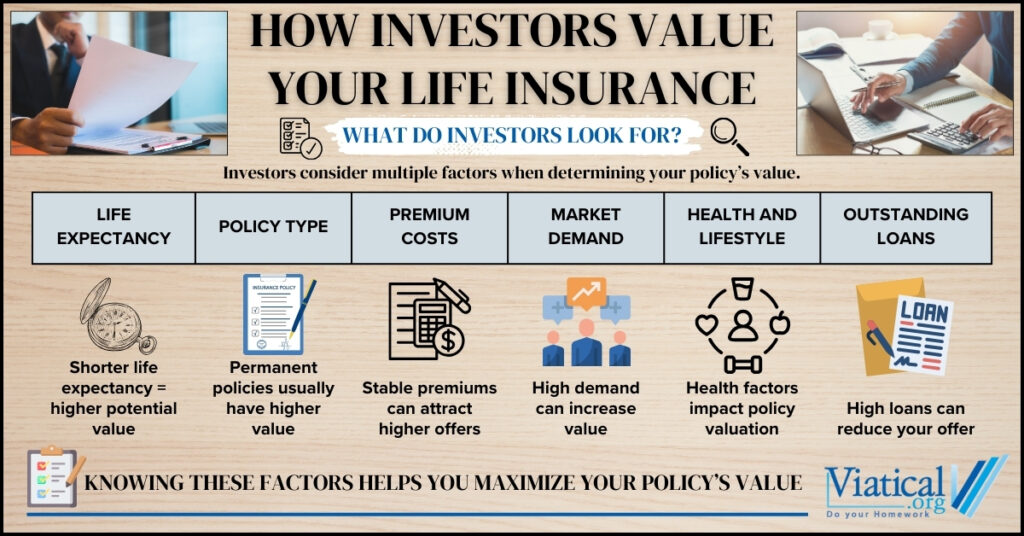

If you’re considering selling a life insurance policy, understanding how investors value your life insurance can help you navigate the process and potentially secure a higher payout. Life insurance policies are valued based on factors that indicate the potential profitability for investors, who typically aim to balance risk with return. From life expectancy and policy premiums to health factors and market demand, investors use a detailed approach to assess each policy before making an offer.

Key Factors in Life Insurance Valuation

- Life Expectancy of the Policyholder The life expectancy of the policyholder is one of the most significant factors impacting how investors value your life insurance. Shorter life expectancies generally increase a policy’s value to investors, as it indicates a quicker return on their investment. Typically, investors use actuarial tables and consider the policyholder’s age, health status, and medical history to estimate life expectancy. For example, a policyholder with a terminal illness or an advanced age may receive a higher offer because the return timeframe aligns with the investor’s risk tolerance and profitability goals.

- Policy Type and Terms The type of life insurance policy plays a central role in determining value. Permanent policies, such as whole or universal life insurance, are usually valued higher than term life policies because they accumulate cash value and do not have an expiration date. Conversely, term policies may hold value if they are convertible to permanent insurance, but they tend to be less appealing if they lack a conversion option or are close to expiration. Some non-convertible term policies can still qualify for a viatical settlement if the insured has a terminal medical condition.

- Premium Payments and Cost Structure Another critical factor investors assess is the premium cost. Investors evaluate whether future premiums are manageable and if the premium schedule is predictable. Policies with level premiums are generally more attractive because they allow investors to budget for a stable, predictable investment. Policies with rising premiums, however, might be viewed as a higher risk or less valuable unless the overall payout potential compensates for the increasing costs.

- Secondary Market Demand The demand for specific types of life insurance policies within the secondary market influences how investors value your life insurance. If the market is strong, and there is a demand for policies like yours, it’s possible to receive competitive offers. Policies issued by reputable insurance companies with solid financial ratings are often more desirable since the company’s stability reduces the risk of potential issues with future payouts.

- Health and Lifestyle Factors Beyond life expectancy, specific health conditions can impact your policy’s valuation. Investors take into account known risk factors, including chronic diseases, smoking status, and lifestyle factors that may affect mortality. However, they also look at current treatments or conditions that might suggest an extended lifespan, which could reduce the policy’s immediate appeal. This nuanced assessment ensures that investors align their valuation with their potential return, factoring in any aspects that could influence longevity.

- Policy Loans or Liens Policies with outstanding loans or liens may see a reduced value in the life settlement market. Investors consider any liens as a deduction from the final payout and typically view policies with large loans as higher-risk investments. Reducing or clearing loans on your policy before selling can increase its value since investors are less likely to take on policies with added financial burdens.

Additional Influences on Policy Valuation

Geographic and Legal Factors

The regulatory environment in the policyholder’s state can significantly impact valuation. Some states have strict regulations around life settlements that add compliance costs for investors, potentially affecting the offer. In most states, a policy must be at least 2 years old before it is eligible to be sold in a life settlement while some states have stricter requirements, specifying that a policy must be 5 years old to be considered to be beyond the period of contestability.

Economic and Market Trends

Broader economic trends and shifts in the secondary life settlement market can also influence how investors value your life insurance. During times of economic instability, investors might prioritize policies with minimal risk, favoring permanent policies or those with predictable premiums. In contrast, during stable market conditions, investors may have more flexibility, sometimes leading to higher offers as they pursue various types of policies to diversify their portfolios.

How Policyholders Can Maximize Their Policy’s Value

For policyholders, understanding how investors value your life insurance provides an advantage in preparing your policy for sale. Taking steps to minimize policy debt, maintain stable premiums, and ensure your policy meets eligibility criteria can improve the likelihood of receiving a competitive offer. Working with a knowledgeable life settlement company can further enhance your position, as experienced companies have insight into which investors may offer the best rates for your specific policy type.

Additionally, reviewing recent medical records and being transparent about your health condition can lead to a more accurate valuation. The more information an investor has, the better they can assess the policy’s value, potentially increasing the payout.

Knowing how investors value your life insurance can empower you to make informed decisions if you’re considering a life settlement. By familiarizing yourself with the factors that investors prioritize—such as life expectancy, premium costs, policy type, and market demand—you can strategically position your policy to receive a fair offer. In a market driven by both financial and health considerations, understanding these valuation metrics can be the key to maximizing the value of your life insurance and securing a payout that meets your financial needs.

To find out if you are likely to qualify, please give us a call at 800-973-8258. We can help you learn if your specific policy may have value in the secondary market for life insurance.