Viatical settlements are a valuable financial solution for those with life insurance policies who are facing terminal illnesses. If you’re wondering “how much can you get for a viatical settlement,” the answer depends on several factors, including the policy’s value, the insured’s life expectancy, and the current market conditions. This option allows policyholders to sell their life insurance policies to a third party in exchange for a lump sum payment, which is always more than the cash surrender value but less than the death benefit.

What is a Viatical Settlement?

A viatical settlement is a financial transaction in which a person with a terminal illness sells their life insurance policy to a third party, known as a viatical settlement purchaser. The purchaser pays the policyholder a lump sum, often between 50% to 80% of the policy’s death benefit. In return, this buyer becomes the beneficiary of the policy and assumes responsibility for all future premium payments. Upon the death of the insured, the buyer receives the death benefit.

Factors Affecting the Settlement Amount

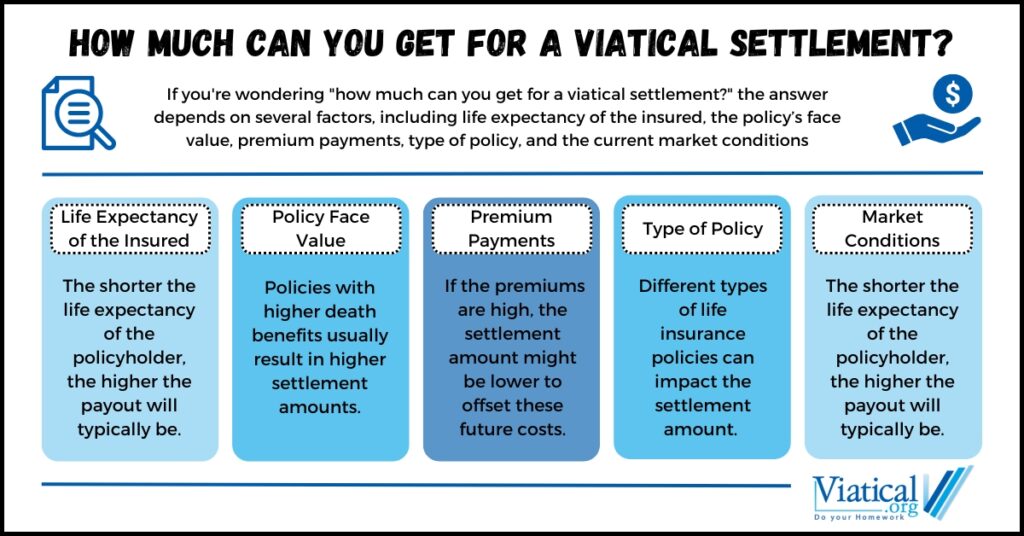

Several factors determine how much you can get for a viatical settlement. These include:

- Life Expectancy of the Insured: The shorter the life expectancy of the policyholder, the higher the payout will typically be. This is because the viatical buyer will receive the death benefit sooner, reducing the amount of premium payments they need to make.

- Policy Face Value: The face value of the life insurance policy, also known as the death benefit, plays a crucial role. Policies with higher death benefits usually result in higher settlement amounts.

- Premium Payments: The cost and frequency of premium payments required to keep the policy active are also considered. If the premiums are high, the settlement amount might be lower to offset these future costs. Some policies have a feature called waiver of premium that is activated under certain conditions, such as if the insured becomes disabled. Selling a life insurance policy with waiver of premium often yields a higher offer due to reduced costs.

- Type of Policy: Different types of life insurance policies can impact the settlement amount. Universal life policies, whole life policies, and term life policies are treated differently based on their terms and conditions.

- Market Conditions: The broader economic environment and market conditions can influence the amount offered. Factors such as interest rates and investor demand for such investments play a role.

Typical Payout Ranges

While it’s challenging to pinpoint an exact amount due to the individual nature of each case, typical viatical settlement payouts range between 50% and 80% of the policy’s death benefit. For example, if you have a life insurance policy with a death benefit of $500,000, you might receive between $250,000 and $400,000. This amount can vary greatly and it is prudent to have your policy appraised.

Steps to Obtaining a Viatical Settlement

- Determine Eligibility: Most viatical settlements are available to individuals with a life expectancy of two years or less, typically due to terminal illnesses.

- Choose a Viatical Settlement Company: It’s crucial to work with a reputable company. You may choose to work with a provider, a broker, or our direct viatical settlement platform. Some brokers charge as much as 30% or more in commission, so always make sure you are aware of any fees prior to accepting an offer.

- Application Process: Complete an application with the chosen viatical settlement provider. You will need to provide details about your life insurance policy and medical condition. While many companies have lengthy applications, our direct platform only requires a few short authorizations that can be completed online.

- Offer Evaluation: Buyers will evaluate your policy and medical records to determine an offer. This process can take several weeks.

- Receive and Review Offer: Once you receive an offer, review it carefully. Consider the implications of accepting the offer, including any fees or costs involved.

- Accepting the Offer: If you decide to accept the offer, you will sign a contract. The settlement provider will then pay you the agreed lump sum and take over the policy.

Benefits of Viatical Settlements

- Immediate Financial Relief: The lump sum payment can provide much-needed financial relief for medical bills, living expenses, and other costs associated with terminal illness.

- No Loan Repayments: Unlike taking out a loan against your life insurance policy, a viatical settlement does not require repayment. You receive the funds outright.

- Improved Quality of Life: The funds from a viatical settlement can be used to improve the quality of life, allowing policyholders to spend their remaining time more comfortably.

Drawbacks to Consider

- Change in death benefit: Accepting a viatical settlement means the death benefit will not go to your beneficiaries in most cases. However, some policyowners choose to retain a portion of the death benefit for loved ones while selling only a portion of the policy. Some prefer to share their viatical settlement with loved ones while they are still living.

- Tax Implications: Depending on your jurisdiction, the lump sum payment from a viatical settlement may be subject to taxes. It’s essential to consult with a tax advisor to understand your obligations.

- Impact on Public Assistance: Receiving a large lump sum could affect your eligibility for certain public assistance programs, such as Medicaid. There are programs, such as a Medicaid Life Settlement, that can help you avoid losing these benefits.

Alternatives to Viatical Settlements

- Accelerated Death Benefits: Some life insurance policies offer accelerated death benefits, allowing policyholders to access a portion of the death benefit while still alive.

- Policy Loans: You might be able to take out a loan against the cash value of your life insurance policy. This can provide funds without needing to sell the policy, but you will be responsible for repayment of the loan and not all policies will qualify.

- Life Settlements: Similar to viatical settlements, life settlements are available to older adults without terminal illnesses. These can be an option if you do not qualify for a viatical settlement.

Choosing the Right Option

Deciding whether to pursue a viatical settlement is a significant decision that requires careful consideration of your financial needs, health condition, and long-term goals. Here are some tips to help you make the right choice:

- Evaluate Your Financial Situation: Assess your current financial needs and future expenses. Determine if the lump sum from a viatical settlement will adequately meet these needs.

- Consult with Professionals: Speak with financial advisors and tax professionals to understand the full implications of a viatical settlement.

- Consider Your Beneficiaries: Think about the impact on your beneficiaries. If leaving an inheritance is important, weigh this against the immediate financial benefits.

- Explore All Options: Look into alternatives such as accelerated death benefits, policy loans, or life settlements. Compare these options to see which best fits your situation.

- Read the Fine Print: Ensure you understand all the terms and conditions of the viatical settlement offer. Be aware of any fees, costs, and tax implications.

Viatical settlements can provide crucial financial relief for individuals facing terminal illnesses, offering a way to access the value of life insurance policies when it’s needed most. While the payout can vary widely based on several factors, understanding these can help you learn how to get the best offer for your life insurance policy. It only takes a 5 to 10 minute call to learn if your policy is likely to qualify for a viatical settlement.

Please give us a call at 800-973-8258. We would be happy to help.