If you’re wondering how to get an accelerated death benefit, it’s important to understand that this provision allows you to access a portion of your life insurance policy’s death benefit early, in the event of a terminal or chronic illness. Many policyholders don’t realize that they may have this option available to them, which can provide financial relief during difficult times. Understanding the process of accessing this benefit, who qualifies, and other options available, like viatical settlements, can help you make informed decisions about which option may be best for you.

What is an Accelerated Death Benefit?

An accelerated death benefit is a rider or provision included in some life insurance policies that allows you to access a portion of your death benefit while you’re still alive. The funds can be used to cover medical expenses, living costs, or any other financial needs associated with a terminal or chronic illness.

Typically, this benefit is available to policyholders diagnosed with a terminal illness, but certain policies may also provide this benefit for individuals with chronic or critical illnesses, depending on the terms of the policy.

How to Get an Accelerated Death Benefit

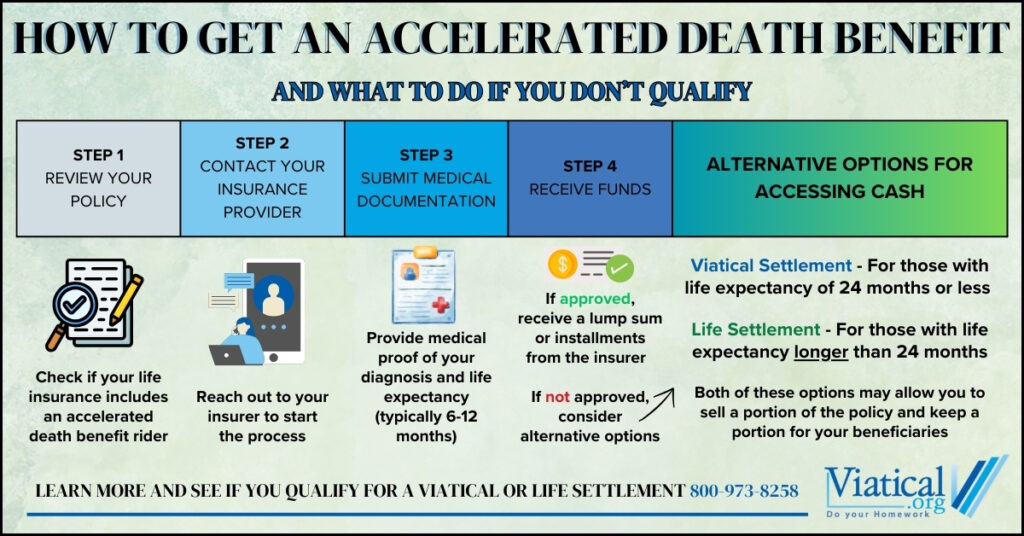

To access an accelerated death benefit, follow these general steps:

- Check Your Policy: Review your life insurance policy to see if an accelerated death benefit rider is included. Some policies automatically include it, while others may require you to add it as an option at the time of purchase.

- Contact Your Insurance Provider: Reach out to your insurance company or agent to inquire about the process for applying for an accelerated death benefit. They will guide you through the steps, including any required paperwork.

- Submit Medical Documentation: You will likely need to provide documentation from a medical professional confirming your diagnosis and life expectancy. For terminal illness claims, most policies require that you have a life expectancy of 6 to 12 months or less.

- Review the Terms: Once your application is submitted, your insurance provider will assess the claim and review your policy’s terms. If approved, the insurer will determine the portion of the death benefit you can access.

- Receive Your Funds: Once the claim is approved, you will receive a lump sum payment or installments, depending on the terms of your policy and your insurance company’s process.

Who Might Qualify for an Accelerated Death Benefit?

Typically, individuals with a terminal illness — usually defined as a prognosis of 6 to 12 months or less to live — are eligible to access an accelerated death benefit. However, some policies also provide accelerated death benefits for chronic conditions (such as those that impair your ability to perform daily activities) or critical conditions (such as heart attacks or strokes).

Qualifying conditions may include:

- Terminal illness with a life expectancy of 6-12 months or less

- Chronic illness that severely limits your ability to perform activities of daily living

- Critical illness that significantly affects your health, such as major organ failure, heart attack, stroke, etc.

Eligibility Criteria

Eligibility typically depends on the specific terms of your insurance policy, but common requirements include:

- Being diagnosed with a qualifying illness (terminal, chronic, or critical)

- Having a life expectancy of 6-12 months for terminal illness claims

- Providing the necessary medical documentation to support your claim

Who Might Not Qualify?

There are several reasons you might not qualify for an accelerated death benefit, including:

- No rider on the policy: If your policy doesn’t include the accelerated death benefit rider, or if it wasn’t added at the time of purchase, you may not be eligible.

- Non-terminal illness: If your illness does not meet the insurer’s definition of terminal, chronic, or critical, you may not qualify.

- Inadequate medical documentation: Without proper medical proof of your diagnosis and life expectancy, your claim may be denied.

- Policy exclusions: Some policies may have exclusions based on specific health conditions, like certain pre-existing conditions, which may prevent eligibility.

Viatical Settlements: An Alternative for Those Who Don’t Qualify

For individuals with a terminal illness but a longer life expectancy than what qualifies for an accelerated death benefit, a viatical settlement may be a good option. While an accelerated death benefit typically requires a prognosis of 6 to 12 months, viatical settlements are available to individuals with a terminal illness and a life expectancy of 24 months or less.

A viatical settlement allows you to sell your life insurance policy to a licensed direct buyer in exchange for a lump sum of cash. These funds can be used to cover medical expenses, living costs, or other financial needs, with no restrictions on how the funds are used.

In some cases, individuals may choose to sell just a portion of their policy, while retaining a portion of the death benefit for their beneficiaries. This option provides flexibility — you can access some of the policy’s value while leaving the remainder intact for your loved ones.

We have also worked with clients who took an accelerated death benefit for a portion of their policy and then sold the remaining portion of the policy through a viatical settlement. This allows individuals to access immediate financial relief from the accelerated benefit while still gaining additional funds by selling the rest of the policy.

If you’re facing a serious illness and don’t qualify for an accelerated death benefit, a viatical settlement might provide the financial relief you need.

Life Settlements: An Option for Those with Longer Life Expectancies

For those with a life expectancy longer than 24 months, you may qualify for a life settlement. Life settlements are typically available to individuals with a life expectancy of 2 to 10 years, and in some cases, even longer. This process is similar to a viatical settlement, but it is for individuals who are not eligible for a viatical settlement due to a longer life expectancy.

If you’re wondering how to get an accelerated death benefit, the process is relatively straightforward if you meet the eligibility requirements. However, if you don’t qualify for an accelerated death benefit or have a longer life expectancy, viatical settlements can offer an alternative option for accessing the value of your life insurance policy. For those with slightly longer life expectancies, life settlements can also be a viable option. To learn if you are likely to qualify, please give us a call at 800-973-8258.