What happens when you get diagnosed with cancer? Facing a cancer diagnosis is an overwhelming experience that brings numerous challenges, not least of which is the financial burden that leaves many wondering “how do you get treatment if you can’t afford it?” One of the most pressing concerns for patients and their families is how to pay for cancer care. With the cost of treatments escalating and a notable rise in cancer cases globally, understanding the financial avenues available is more crucial than ever.

The Rising Cost of Cancer Treatment

Cancer care involves a multifaceted approach that can include surgery, chemotherapy, radiation therapy, immunotherapy, targeted therapy, and supportive care medications. Each of these treatments comes with its own set of costs, which can accumulate rapidly. Hidden costs of cancer care can include indirect expenses such as transportation to treatment centers, lodging during extended treatments, home care services, and loss of income due to inability to work further exacerbate the financial strain.

Factors Contributing to High Costs

- Advanced Treatments: Newer, cutting-edge therapies often come at a premium. Take control of healthcare choices with viatical settlements which can provide funds to help cover these costs.

- Prolonged Care: Cancer treatment can span months or even years.

- Specialized Providers: Treatment by specialists and at renowned cancer centers can be more expensive.

- Geographical Variations: Costs can vary significantly depending on location.

Understanding these factors can help patients and families anticipate expenses and seek appropriate financial assistance.

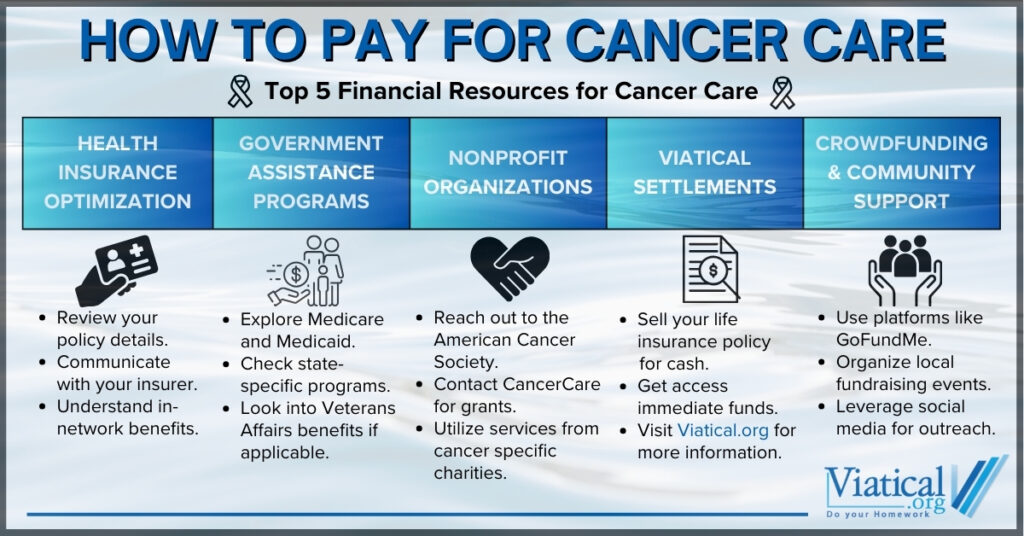

Health Insurance: Maximizing Your Benefits

Reviewing Your Policy Thoroughly

Begin by meticulously reviewing your health insurance policy documents. Key aspects to look for include:

- Covered Services: Determine which treatments and medications are covered.

- Network Restrictions: Identify in-network providers to minimize out-of-pocket costs.

- Pre-Authorization Requirements: Some treatments may require prior approval.

- Out-of-Pocket Maximums: Understand your deductible, co-pays, and annual maximums.

Communicating with Your Insurance Provider

Proactively engage with your insurance company to clarify uncertainties.

- Case Management Services: Some insurers offer personalized support.

- Exceptions and Appeals: Learn the process for disputing denied claims.

- Financial Assistance Programs: Explore if your insurer provides any aid for high-cost treatments.

Tips for Managing Insurance Claims

- Keep Detailed Records: Document all communications and paperwork.

- Submit Claims Promptly: Adhere to deadlines to prevent claim denials.

- Seek Professional Help: Consider hiring a patient advocate for complex cases.

Government Assistance Programs

Medicare and Medicaid

Government-funded programs are vital resources that may assist patients with paying for care.

- Medicare: Available to individuals over 65 or those with certain disabilities, Medicare covers many cancer-related services. Part A covers hospital stays, Part B covers outpatient care, and Part D covers prescription drugs.

- Medicaid: Provides health coverage to eligible low-income individuals and families. Coverage details vary by state but often include comprehensive cancer treatment services.

Veterans Affairs (VA) Benefits

Veterans may access cancer care through the VA health system, which offers:

- Specialized Cancer Centers: Providing cutting-edge treatments.

- Integrated Care: Coordinating between different services and specialists.

- Financial Support: Potential coverage of treatments and medications.

State and Local Programs

Many individuals wonder if the government provides direct financial assistance to those with cancer. While there isn’t a universal program that offers money solely based on a cancer diagnosis, various state and local programs exist that can provide support.

- State Health Insurance Assistance Programs (SHIP): Offer counseling on Medicare, Medicaid, and other insurance options.

- Local Health Departments: May provide screenings and treatment referrals.

- State Cancer Funds: Some states have funds allocated for cancer patient support.

Nonprofit Organizations and Charitable Foundations

Numerous nonprofits are dedicated to assisting cancer patients financially, helping them to afford cancer treatment.

- American Cancer Society: Offers programs like Hope Lodge for free lodging during treatment.

- CancerCare: Provides grants for transportation, home care, and child care.

- The Leukemia & Lymphoma Society: Offers financial support for blood cancer patients.

- Susan G. Komen Foundation: Provides financial assistance for breast cancer patients.

How to Access Support

- Application Processes: Each organization has its own eligibility criteria and application procedures.

- Documentation Needed: Be prepared to provide medical records and financial information.

- Timelines: Apply early, as funds may be limited.

Pharmaceutical Assistance Programs

High medication costs can sometimes be managed through Patient Assistance Programs or Co-Pay Assistance Foundations.

Patient Assistance Programs (PAPs)

Drug manufacturers often have PAPs to provide free or low-cost medications to those who qualify.

- Eligibility: Typically based on income level and lack of insurance coverage.

- Application: Involves forms completed by both patient and physician.

- Renewal: Assistance may need to be renewed periodically.

Co-Pay Assistance Foundations

These organizations help cover co-pays for expensive medications.

- CancerCare Co-Payment Assistance Foundation

- Patient Access Network Foundation

- HealthWell Foundation

Steps to Take

- Consult Your Doctor: They may have information on available programs.

- Contact Manufacturers: Inquire directly with the pharmaceutical companies.

- Use Online Resources: Websites like NeedyMeds provide information about programs that assist with certain prescription medications.

Viatical Settlements: Accessing Funds from Life Insurance

A viatical settlement allows individuals with a terminal illness to sell their life insurance policy for a percentage of the death benefit.

Understanding the Process

- Eligibility Criteria: Generally, an insured must have a life expectancy of two years or less. Those with a longer life expectancy may still qualify for life settlements.

- Valuation: Factors include policy face value, premiums, and the patient’s medical condition.

- Receiving Funds: The lump sum received in a viatical settlement can be used for any purpose, including medical bills and living expenses.

Advantages

- Immediate Cash Flow: Provides quick access to funds when needed most.

- No Restrictions: Money can be used at the patient’s discretion.

- Peace of Mind: Eases financial stress during a difficult time.

Considerations

- Impact on Beneficiaries: Beneficiaries will no longer receive the death benefit.

- Tax Implications: Generally proceeds are tax-free if the insured is terminally ill, but it is always wise to contact your trusted tax advisor regarding your specific situation. Some life settlement proceeds may be taxable.

Crowdfunding and Community Fundraising

The power of community can help alleviate financial burdens.

Online Crowdfunding Platforms

- GoFundMe: Widely used for personal fundraising.

- YouCaring: Focuses on compassionate crowdfunding.

- Fundly: Allows for customizable campaigns.

Tips for a Successful Campaign

- Tell Your Story: Share your journey to connect with donors.

- Use Social Media: Expand your reach by sharing on various platforms.

- Regular Updates: Keep supporters informed about your progress.

Local Fundraising Events

- Community Events: Organize charity walks, bake sales, or auctions.

- Church and Civic Groups: Many are willing to host fundraisers for members in need.

- Media Outreach: Local newspapers or TV stations may cover your story, increasing visibility.

Negotiating Medical Costs

Medical bills are often negotiable, but not always.

Direct Negotiation

- Contact Billing Departments: Discuss your financial situation openly.

- Request Itemized Bills: Review for errors or unnecessary charges.

- Propose Payment Plans: Many providers offer installment plans. Some offer interest free payment options. Make sure to ask about what plans may be available to you.

Professional Assistance

- Medical Billing Advocates: These are experts who can negotiate on your behalf.

- Nonprofit Credit Counselors: These counselors offer services to manage medical debt.

Legal Protections

- State Regulations: Some states have laws capping interest rates or providing other protections.

Exploring Clinical Trials

Clinical trials can provide access to new treatments at reduced costs, making cancer treatment more affordable.

Benefits

- Cutting-Edge Therapies: Access to treatments not yet widely available.

- Cost Savings: Study sponsors may cover treatment costs.

- Contribution to Science: Aid in the development of future cancer therapies.

Finding Trials

- National Cancer Institute: Offers a database of clinical trials.

- ClinicalTrials.gov: A registry of federally and privately supported studies.

- Consult Your Oncologist: They may know of trials suited to your condition.

Considerations

- Eligibility Criteria: Each trial has specific requirements.

- Location: Trials may require travel.

- Risks and Benefits: Understand the potential side effects and benefits.

Disability Benefits and Income Support

If cancer affects your ability to work, you may be eligible for several options.

Social Security Disability Insurance (SSDI)

- Eligibility: SSDI eligibility is based on work history and severity of disability.

- Compassionate Allowances: Certain cancers qualify for expedited processing of compassionate allowances.

Supplemental Security Income (SSI)

- Needs-Based: SSI is for individuals with limited income and resources.

- Benefits: This program provides monthly payments to help cover basic needs.

Employer Disability Insurance

- Short-Term and Long-Term Disability: Check if your employer offers these benefits.

- Application Process: Applying may require medical documentation and involve waiting periods.

Financial Planning and Budgeting

Taking control of your finances can be a way to reduce stress.

Creating a Comprehensive Budget

- Track All Expenses: Include medical and non-medical costs.

- Prioritize Spending: Focus on essential needs.

Seeking Professional Financial Advice

- Financial Planners: Can help manage assets and plan for future needs.

- Nonprofit Organizations: Offer free or low-cost financial counseling.

Legal Considerations

- Power of Attorney: Assign someone to make financial decisions if you’re unable.

- Estate Planning: Ensure your assets are distributed according to your wishes.

Emotional and Psychological Support

Financial stress can impact mental health. You may consider seeking support from support groups or counselors.

Support Groups

- In-Person Groups: Hospitals often host support meetings.

- Online Communities: Forums and social media groups can provide virtual support and provide a sense of community.

Counseling Services

- Psychologists or Therapists: Trained to help cope with anxiety and depression.

- Pastoral Care: Spiritual support is often available from clergy members.

Navigating how to pay for cancer care is a complex challenge. With the rise in cancer cases, awareness and utilization of available resources are more important than ever. From maximizing insurance benefits and accessing government programs to exploring viatical settlements and community fundraising, multiple avenues can alleviate the financial burden. Proactive planning, open communication with healthcare providers, and leveraging support networks can make a significant difference in managing costs during this difficult time.

If you would like to learn if you are likely to qualify for a viatical or life settlement to help alleviate the burden of these costs, please contact us at 800-973-8258. We have been helping people access the hidden value in life insurance for nearly 20 years and would be happy to help you.