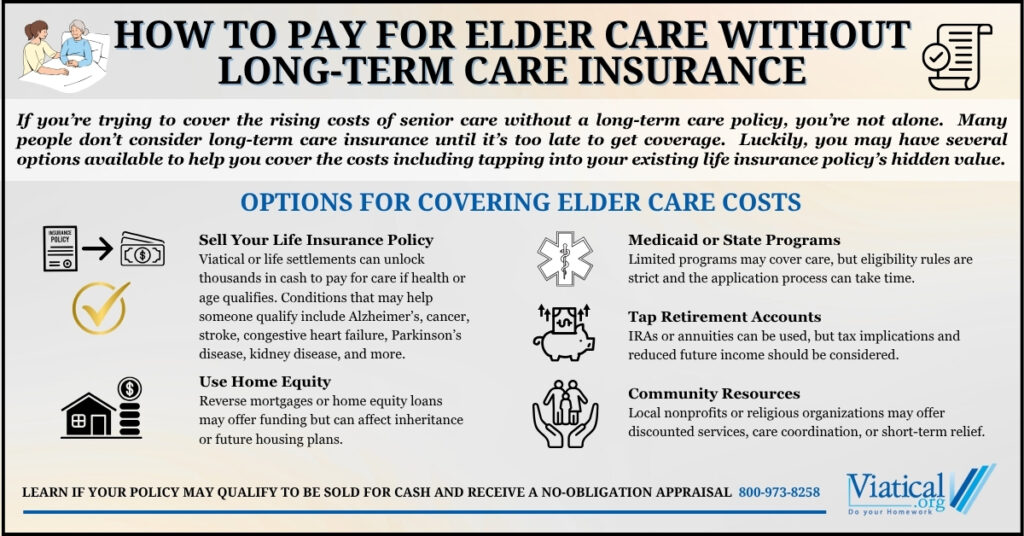

For families facing the rising costs of senior care, understanding how to pay for elder care without long-term care insurance is essential. Many older adults do not carry long-term care coverage, yet need help paying for assisted living, home care, or nursing services. One often overlooked option is selling an existing life insurance policy through a viatical or life settlement.

Use a Viatical or Life Settlement to Fund Care

If the policy insured has experienced a serious health decline, a viatical settlement may be an option. This allows individuals to sell their life insurance policy to a third-party buyer in exchange for a lump sum cash payment. The buyer takes over future premiums and receives the death benefit when the policyholder passes away. The money received can be used for any purpose, including paying for elder care services.

Common medical conditions that may lead to the need for elder care and could help qualify someone for a viatical settlement include Alzheimer’s disease, dementia, congestive heart failure, advanced Parkinson’s disease, stroke, ALS, cancer, and chronic kidney disease. These illnesses often require hands-on support, medication management, and help with daily living activities.

Viatical settlements are typically available to individuals with a terminal or chronic illness and a life insurance policy with a death benefit of $100,000 or more. In cases where the policyholder is generally healthy but older, usually age 65 or above, life settlements may be an option instead. Both types of settlements can provide significantly more than the cash surrender value of the policy.

Even term life policies may qualify if they include a conversion option. Many people are unaware that a policy with no cash value can still be sold for cash if certain criteria are met.

Other Ways to Help Pay for Elder Care

While viatical and life settlements are often the most immediate and impactful source of funding, families may also consider additional options:

- Home equity: Reverse mortgages or home equity loans may free up cash, but they can impact inheritance and come with long-term implications.

- Medicaid or state assistance: These programs may help cover care costs but require meeting strict income and asset limits.

- Retirement savings: IRAs or annuities can provide funds, though large withdrawals may result in tax burdens or reduced long-term income.

- Community resources: Some nonprofit or local programs offer short-term support or discounted services for elderly individuals.

Why a Settlement May Be the Best First Step

For families trying to act quickly or preserve other assets, selling a life insurance policy can be a practical and immediate solution. The process is typically faster than applying for Medicaid or securing a home loan and does not require borrowing or repayment.

If you’re exploring how to pay for elder care without long-term care insurance, reviewing the life insurance policy is one of the most important and often most financially beneficial steps you can take. A viatical or life settlement may unlock thousands of dollars that can be used now when it is needed the most.

To learn if you or your loved one qualify for a life settlement or viatical settlement, please give us a call at 800-973-8258. Viatical.org has been helping people access the hidden value in life insurance for nearly 20 years.