When considering life insurance policies, a question that frequently arises is, “Is the cash value of life insurance taxable?” Life insurance policies often have a cash value component that grows over time, but understanding how it is taxed—or if it is taxed—can be complex. In this blog post, we’ll discuss the potential tax implications of the cash value of life insurance policies, as well as the tax treatment of proceeds from life settlements and viatical settlements. It’s important to note, however, that every financial situation is unique, and it’s crucial to consult a trusted tax professional to ensure you’re navigating these issues correctly. We do not give tax guidance. This is for general information.

Understanding the Cash Value of Life Insurance

First, it’s important to understand what the cash value of a life insurance policy is. This is the portion of a permanent life insurance policy (such as whole life or universal life) that should grow over time as the policy owner pays premiums. It’s a living benefit that can often be accessed during the policyholder’s lifetime, either through withdrawals, loans, or even as collateral for financing.

The key tax question arises when you either borrow against the policy or withdraw funds from the cash value. The answer to whether the cash value of life insurance is taxable depends on how and when you access the funds.

When Is the Cash Value of Life Insurance Taxable?

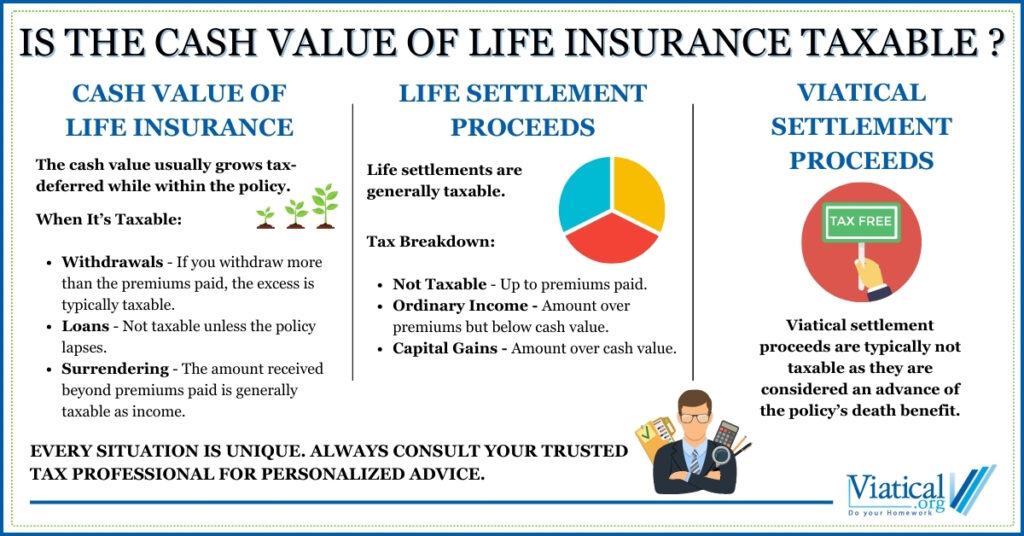

In general, the cash value of a life insurance policy grows tax deferred as long as it remains within the policy. The growth of the cash value is tax-deferred, meaning you do not have to pay taxes on it while it’s accumulating. However, there are certain instances when the cash value becomes taxable:

1. Withdrawals Over the Policy’s Basis

If you withdraw funds from the policy, the IRS treats the withdrawals differently depending on how much you’ve paid in premiums. The amount that represents the premiums you’ve paid is considered the “cost basis” of the policy and is generally not taxable. However, if you withdraw more than what you’ve paid in premiums (i.e., you withdraw from the earnings or interest), that excess amount is typically taxable.

For example, if you’ve paid $50,000 in premiums and your policy has a total of $70,000 in cash value, withdrawing $50,000 should be tax-free. But if you withdraw $60,000, the extra $10,000 would likely be subject to taxation.

2. Policy Loans

Borrowing against the cash value of your life insurance policy is typically not considered a taxable event. As long as the policy remains in force, loans are tax-free. However, if the policy lapses, any outstanding loan amount exceeding the premiums paid will be considered in the taxation calculation.

It’s crucial to keep track of the loan balance and make sure the policy doesn’t lapse, as that could trigger an unintended tax liability.

3. Surrendering the Policy

If you choose to surrender (cancel) your life insurance policy and receive the cash value, any amount you receive that exceeds the total premiums paid into the policy will typically be taxable as income.

Each of these scenarios can carry tax implications, but how they apply to your specific circumstances may vary. It’s essential to speak with your tax advisor to fully understand how withdrawing or borrowing from your cash value policy could affect you.

Taxation of Life Settlements and Viatical Settlements

Life settlements and viatical settlements provide policyholders with a potential option to sell their life insurance policy for a lump sum payment that exceeds their cash value. While both types of settlements involve selling your policy, they have different tax treatments.

What Is a Life Settlement?

A life settlement occurs when a policyholder sells their life insurance policy to a third party for a lump sum, which is typically greater than the cash surrender value but less than the death benefit. Life settlements are common for policyholders who no longer need their insurance coverage or find that the premiums are too expensive to maintain.

Are Life Settlement Proceeds Taxable?

Yes, proceeds from a life settlement are generally taxable. Life settlement taxation is divided into three parts:

- The amount received up to the policy’s basis (premiums paid) is usually not taxable.

- The amount received that exceeds the basis but is less than the total cash value is likely to be taxed as ordinary income.

- Any amount received beyond the cash value is typically taxed as a capital gain.

For instance, if you sold a life insurance policy for $150,000, and the total premiums paid were $100,000, the first $100,000 should be tax-free. The remaining $50,000 of sales proceeds would likely be taxed as ordinary income up to the cash value, and anything beyond the cash value should be taxed as a capital gain.

It’s critical to work with your tax professional to ensure you understand the tax implications of a life settlement in your specific financial situation.

What Is a Viatical Settlement?

A viatical settlement is a type of life settlement designed for individuals who are terminally ill. In these cases, policyholders sell their life insurance policy to a third party in exchange for immediate cash. Viatical settlements are typically used when the policyholder has a life expectancy of less than two years.

Are Viatical Settlement Proceeds Taxable?

No, viatical settlement proceeds are generally not taxable. The IRS considers viatical settlements to be and advance of your death benefit, which is typically tax-free. This tax exemption applies as long as the insured is considered chronically or terminally ill and the viatical settlement company is properly licensed.

Again, it’s advisable to confirm your specific tax obligations with a professional as personal circumstances can affect how proceeds are treated.

Key Takeaways on Taxation

- Cash value inside the policy: As long as it remains in the policy, the cash value usually grows tax deferred.

- Withdrawals and loans: Withdrawals over the amount of premiums paid are taxable. Loans are not taxable unless the policy lapses.

- Surrendering the policy: If the policy is surrendered, the amount received over the premiums paid is typically taxable as income.

- Life settlement proceeds: Taxable, with the amount up to the policy’s basis being tax-free, amounts over the basis but under the cash value taxed as income, and amounts over the cash value taxed as capital gains.

- Viatical settlement proceeds: Generally not taxable if the insured is terminally ill.

The taxation of life insurance cash value, life settlements, and viatical settlements can be complex, and every individual’s situation is different. While the cash value inside a life insurance policy grows tax-deferred, accessing or surrendering that value may trigger taxes under certain circumstances. Additionally, life settlement proceeds are taxable, but viatical settlements typically are not. Given the variations in tax treatment and the uniqueness of each financial situation, it’s always advisable to consult your trusted tax professional who can help you navigate these tax implications effectively.

By seeking professional advice, you can ensure that you’re making informed decisions about your life insurance policy and settlement options, maximizing your benefits while avoiding any unintended tax consequences.

To learn if you’re likely to qualify to access the hidden value in your existing life insurance policy, please give us a call today at 800-973-8258.