When it comes to paying for Parkinson’s care, many families face a daunting financial challenge. The cost of managing this progressive neurological disorder can be substantial, with expenses often covering a range of needs from daily care assistance to medications and specialized therapies. For some, the financial burden can become overwhelming. Fortunately, options like viatical settlements and life settlements allow individuals with life insurance policies to access cash from their policy to help cover these costs.

The Cost of Parkinson’s Care

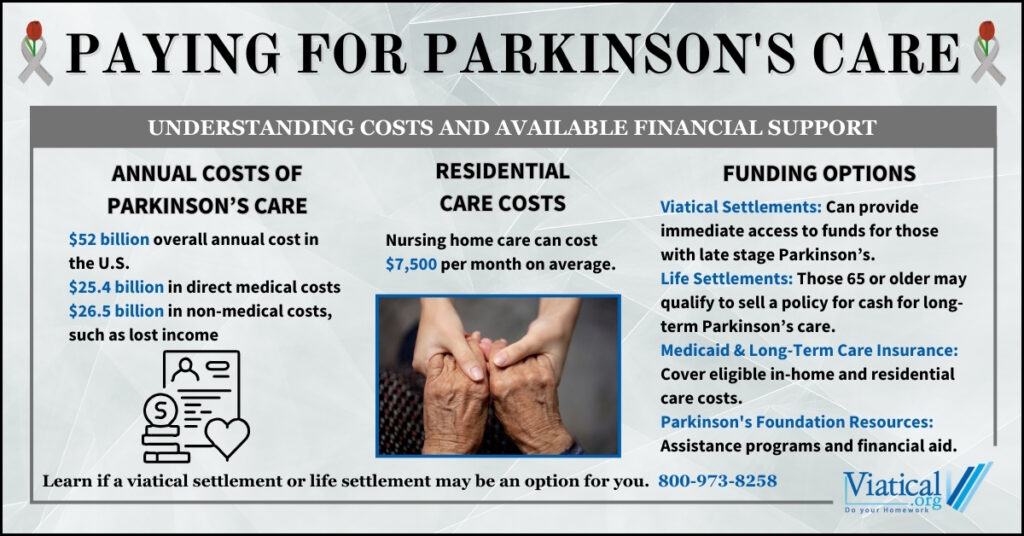

Parkinson’s disease care costs vary based on the severity of the condition, location, and level of care required. According to a study by The Michael J. Fox Foundation, the total annual cost of Parkinson’s disease in the United States is around $52 billion. Of this amount, $25.4 billion represents direct medical expenses, while $26.5 billion accounts for non-medical costs, such as missed work, lost wages, early retirement, and family caregiver time.

For individuals, costs related to Parkinson’s care can vary widely, but late-stage residential care typically falls between $7,500 per month for nursing home care, depending on the facility and level of care.

Viatical Settlements Can Provide Funds for Parkinson’s Care

A viatical settlement is an option for those diagnosed with a terminal or severe chronic illness, including late-stage Parkinson’s. In a viatical settlement, the policyholder sells their life insurance policy to a third-party buyer for a percentage of its death benefit. This sale provides an immediate cash payout, allowing the individual to use the funds as needed for care and support expenses.

The payout amount in a viatical settlement depends on factors such as the policy’s death benefit, the policyholder’s age, and health condition. Typically, those with a shorter life expectancy receive a higher percentage of the policy’s value. This option can be especially helpful for those needing immediate funds to cover rising healthcare costs, specialized medical equipment, or residential care.

Benefits of Viatical Settlements:

- Immediate access to funds that can be used without restrictions.

- No obligation to pay back the funds received.

- Can alleviate financial strain on families, helping them focus on caregiving and emotional support.

Life Settlements for Parkinson’s Care

For individuals who do not meet the health criteria for a viatical settlement, life settlements may be an alternative. In a life settlement, a policyholder over a certain age (typically 65 and older) can sell their life insurance policy for a cash payout. Unlike viatical settlements, life settlements are generally available to those with a longer life expectancy, making them more accessible for people with early to mid-stage Parkinson’s who still need funds to cover ongoing care.

The payout in a life settlement is typically lower than in a viatical settlement but still offers a valuable source of financial support. Funds from a life settlement can be used to offset the costs of Parkinson’s-related expenses such as medications, home care services, and specialized therapy sessions.

Benefits of Life Settlements:

- Provides a financial resource for those who do not qualify for a viatical settlement.

- Can be used to manage ongoing care costs over the longer term.

- Offers flexibility to help policyholders maintain quality of life without having to liquidate other assets.

Making the Decision: Is a Viatical or Life Settlement Right for You?

Before deciding on a viatical or life settlement, it’s crucial to carefully review your options and understand how each settlement type could impact your financial situation. Consulting a financial advisor can help clarify how much of your policy’s value you could receive, and any tax implications involved.

While life insurance settlements may not be the right choice for everyone, they can be a lifeline for families facing high costs associated with Parkinson’s care. These settlements provide a way to turn an asset into a much-needed source of funding, reducing the financial stress on families and allowing them to prioritize the well-being of their loved ones.

Other Resources for Paying for Parkinson’s Care

Beyond settlements, some families may also look into other funding options to help cover the costs of Parkinson’s care. These can include:

- Medicaid: For those who qualify, Medicaid can help cover long-term care costs.

- Long-Term Care Insurance: If purchased before the onset of the disease, long-term care insurance can provide significant assistance in covering in-home care, assisted living, or nursing home expenses.

- Nonprofit Assistance Programs: Organizations like the Parkinson’s Foundation offer support resources and may connect families with financial assistance programs.

Paying for Parkinson’s care can be a financial strain, especially as the disease progresses and care needs increase. For families with an existing life insurance policy, viatical and life settlements offer a way to tap into funds to cover these costs. By exploring these options, individuals with Parkinson’s and their families can access crucial financial resources to ensure quality care and support during every stage of the disease.

To find out if a viatical settlement or life settlement is an option for you or your loved one, please give us a call at 800-973-8258.