Receiving a terminal diagnosis can bring not only emotional challenges but also significant financial burdens. Selling a life insurance policy after a terminal diagnosis can be a practical solution for individuals seeking financial relief to cover medical expenses, improve their quality of life, or secure their family’s future. A viatical settlement allows policyholders to convert the hidden value in their life insurance into a cash payout, providing immediate funds during a difficult time.

What Is a Viatical Settlement?

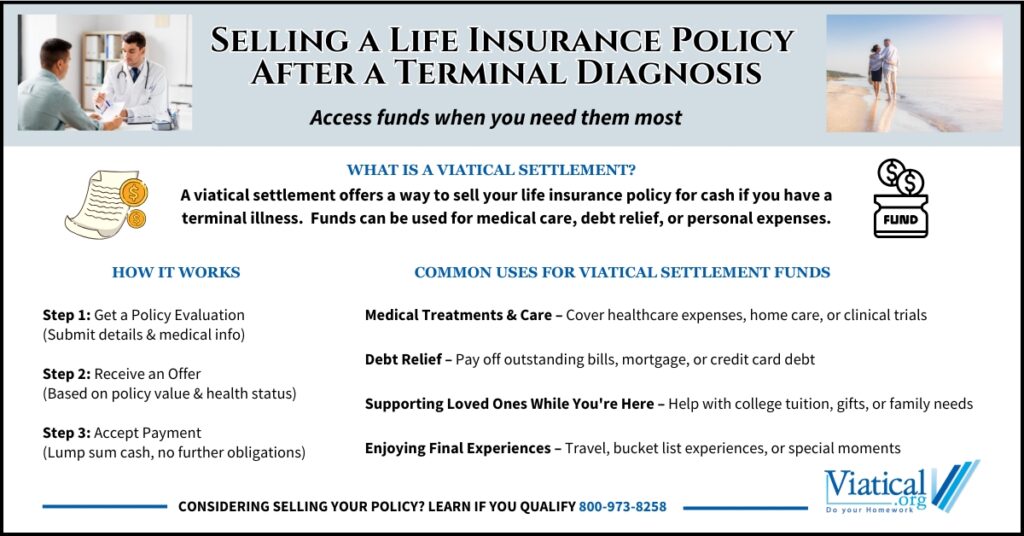

A viatical settlement is the process of selling a life insurance policy to a third-party buyer for a lump sum payment. The payout is higher than the policy’s cash surrender value but less than the full death benefit. In exchange, the buyer assumes responsibility for future premium payments and collects the policy’s death benefit when the insured passes away.

To qualify for a viatical settlement, policyholders generally must have a terminal illness with a life expectancy of two years or less. Those with a longer life expectancy may still qualify for life settlements.

Why Consider Selling Your Life Insurance Policy?

For many individuals facing a terminal illness, a viatical settlement offers crucial financial flexibility. The funds can be used for:

- Medical Treatments – Covering out-of-pocket costs, alternative therapies, or experimental treatments not covered by insurance.

- End-of-Life Care – Paying for hospice care, home healthcare services, or assisted living arrangements.

- Reducing Debt – Settling outstanding medical bills, mortgage payments, or credit card balances.

- Supporting Loved Ones While You’re Still Here – While selling your policy means your beneficiaries won’t receive the death benefit, it allows you to provide financial support now. You can help with college tuition, assist with living expenses, or gift funds to family members while you’re still around to see them benefit.

- Enjoying Final Experiences – Allowing the policyholder to create lasting memories through travel or personal wishes.

How the Process Works

The process of selling a life insurance policy after a terminal diagnosis typically involves the following steps:

- Assess Eligibility – A policyholder submits their policy details and medical information to a viatical settlement company for review.

- Receive an Offer – Potential viatical settlement purchasers evaluate the policy’s value based on the death benefit, premium costs, and life expectancy before making an offer.

- Accept the Offer & Transfer Ownership – If value is found and the policyholder accepts the offer, they sign documents to transfer ownership and beneficiary rights of the policy to the buyer.

- Receive the Payment – The seller receives a lump sum cash payment, which can be used however they choose.

- No Further Obligations – The new policy owner assumes all premium payments and eventually collects the death benefit. You no longer have any premium payment obligations.

Key Considerations Before Selling

While selling a life insurance policy after a terminal diagnosis can provide financial relief, policyholders should consider the following:

- Impact on Beneficiaries – The sale of the policy means that the death benefit will no longer go to family members or other beneficiaries.

- Tax Implications – Viatical settlements are typically tax-free if the seller is terminally ill, but consulting your trusted tax professional is recommended.

- State Regulations – Some states have specific laws governing viatical settlements, so it’s important to ensure that your viatical settlement is closed by a licensed provider in your state.

- Alternatives – Before proceeding, policyholders may want to explore options such as accelerated death benefits (if available in their policy) or life insurance loans. Keep in mind not everyone will qualify for living benefits and loans do need to be repaid.

Finding a Reputable Life Settlement Company

It’s essential to work with a trustworthy viatical settlement company. Look for experienced companies that provide transparent terms without hidden fees. All viatical settlements should be closed by a licensed provider in your state.

Selling a life insurance policy after a terminal diagnosis can be a valuable financial option for individuals who need immediate funds for medical care, debt relief, or personal expenses. A viatical settlement offers flexibility and peace of mind during a difficult time, helping policyholders make the most of their remaining years.

For those considering this option, we can provide clarity on eligibility, potential value, and how to proceed with a viatical settlement. In a short 5-10 minute phone call, you can learn if you’re likely to qualify for a viatical settlement or a life settlement. 800-973-8258