Many policyholders find themselves wondering whether selling their life insurance policy is a viable financial option. Whether due to changing financial needs, an inability to keep up with premium payments, or a desire to access cash for immediate expenses, selling your life insurance policy can provide much needed funds. This process, known as a life settlement or viatical settlement, allows policyholders to receive a lump sum payment in exchange for their coverage.

Why Consider Selling Your Life Insurance Policy?

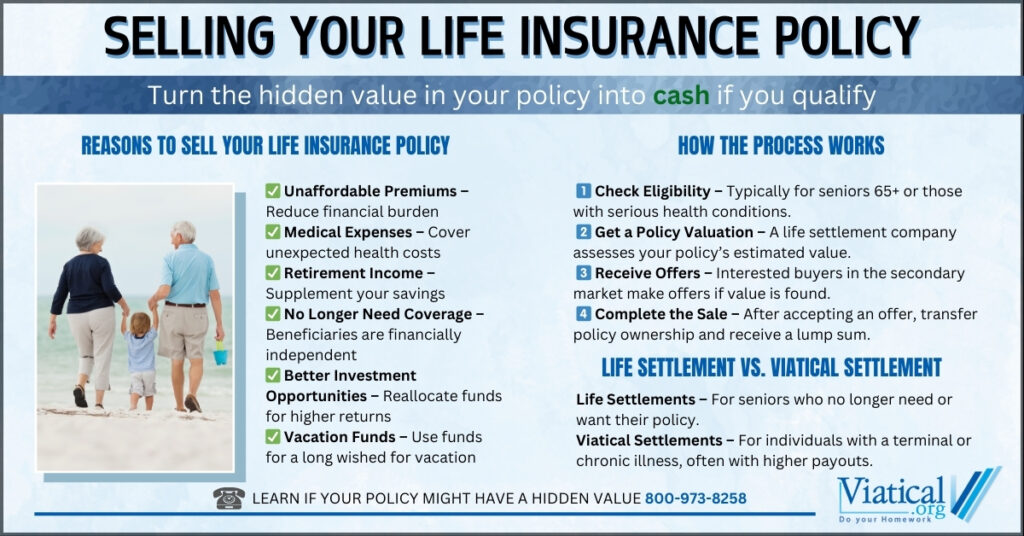

There are several reasons why someone might choose to sell their life insurance policy. Some common scenarios include:

- Unaffordable Premiums: If premium payments have become too expensive, selling your policy may provide relief from financial strain.

- Changing Financial Priorities: Policyholders may prefer to use the proceeds for medical expenses, retirement, or other pressing financial needs.

- No Longer Need Coverage: If beneficiaries no longer require the policy’s death benefit, cashing out may make more sense than continuing to pay premiums.

- Better Investment Opportunities: Some individuals choose to reinvest the funds from a policy sale into higher-yield investments.

In addition to these reasons, some policyholders sell their policies as part of estate planning. A life settlement can help liquidate assets for more flexible financial management, particularly if estate taxes or changing inheritance plans make a cash payout more practical. Additionally, individuals who have experienced significant health changes may find that their policy is now more valuable in the secondary market, potentially leading to a higher payout.

How the Life Settlement Process Works

Selling your life insurance policy involves a few key steps:

- Determine Eligibility: Generally, policies with face values of $100,000 or more from individuals aged 65 or older, or those with serious health conditions can qualify for a life settlement.

- Obtain Policy Valuation: A settlement company will assess your policy based on factors such as age, health status, policy type, and premiums.

- Receive Offers: Buyers in the secondary market make offers based on the policy’s value.

- Complete the Sale: Once an offer is accepted and contracts are completed, ownership of the policy transfers to the buyer, who then takes over premium payments and collects the death benefit upon the insured’s passing.

This process can take anywhere from a few weeks to a couple of months, depending on the complexity of the policy and market conditions. While some transactions close quickly, others require additional medical records or underwriting reviews before finalizing an offer.

Life Settlements vs. Viatical Settlements

It’s important to differentiate between a life settlement and a viatical settlement. A viatical settlement is specifically for individuals with a terminal or chronic illness, often resulting in a higher payout. Life settlements, on the other hand, are typically for seniors who no longer need or can no longer afford their policies.

Additionally, some states regulate viatical settlements differently than life settlements, so it’s crucial to understand the legal requirements in your state.

Is Selling Your Life Insurance Policy the Right Choice?

While selling your life insurance policy can provide immediate financial relief, it’s essential to weigh the pros and cons. Consider whether keeping the policy, exploring alternative financial options, or adjusting your coverage might be more beneficial in the long run. If you decide to proceed, working with a reputable settlement company can help ensure a smooth and profitable transaction.

Before moving forward, it’s also important to understand the tax implications of a life settlement. While some portions of the proceeds may be tax-free, others could be subject to taxes depending on the policy’s cost basis and your personal tax situation. Consulting a tax professional can help you maximize your benefits while avoiding unexpected tax liabilities. Additionally, if you receive government benefits such as Medicaid, the payout from selling your policy could impact your eligibility, so it’s crucial to factor this into your decision. If this is a concern, a Medicaid Life Settlement may be a good option.

For more information about life settlements and to determine if you may qualify, please give us a call at 800-973-8258.