Can You Sell Your Life Insurance Policy If You Have CHF?

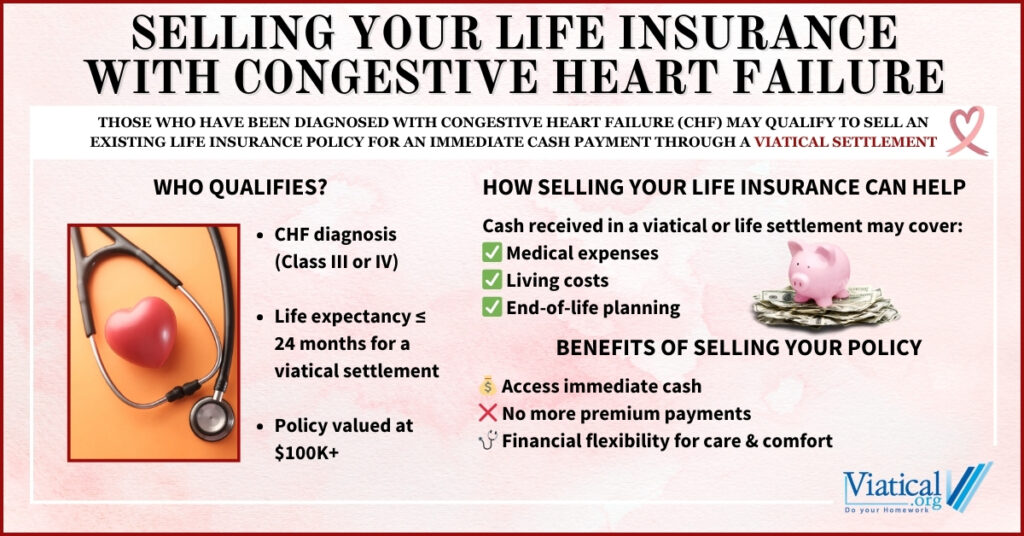

Congestive Heart Failure (CHF) is a progressive condition that can lead to increasing medical costs and financial strain. If you or a loved one has been diagnosed with end-stage CHF, selling your life insurance with congestive heart failure can allow you to access an immediate cash payment through a viatical settlement.

If your life expectancy is longer than two years, you may still be eligible for a life settlement, which offers similar benefits but typically provides a lower payout than a viatical settlement.

Understanding CHF and Its Impact on Life Expectancy

CHF occurs when the heart struggles to pump blood effectively, leading to fluid buildup in the lungs and other parts of the body. As the disease progresses, patients may experience:

- Shortness of breath, even at rest

- Swelling in the legs, ankles, and feet

- Fatigue and weakness

- Frequent hospitalizations

Treatment for CHF often includes medications such as ACE inhibitors (e.g., lisinopril, enalapril) or ARBs (e.g., losartan, valsartan) to help relax blood vessels, beta-blockers (e.g., metoprolol, carvedilol) to reduce heart strain, and diuretics (e.g., furosemide, spironolactone) to manage fluid buildup. Some patients may also be prescribed SGLT2 inhibitors (e.g., dapagliflozin, empagliflozin) to improve heart function. In advanced cases, devices like implantable cardioverter defibrillators (ICDs) or left ventricular assist devices (LVADs) may be recommended, and heart transplantation remains an option for some with end-stage disease. Despite these treatments, CHF remains a progressive condition, and many patients face significant limitations in daily life.

Patients with Class III or IV heart failure, especially those requiring frequent hospital visits, oxygen therapy, or hospice care, often have a life expectancy of two years or less—making them potential candidates for a viatical settlement. Knowing how to get cash from life insurance if you’re sick can help relieve some of the financial strain of treatment costs.

How a Viatical or Life Settlement Works for CHF Patients

A viatical settlement allows individuals with a life expectancy of 24 months or less to sell their life insurance policy to a third-party buyer in exchange for an immediate lump-sum payment. This cash can help cover:

✅ Medical expenses (hospital stays, medications, home care)

✅ Daily living costs (mortgage, bills, food)

✅ End-of-life planning (hospice care, financial security for loved ones)

There are no restrictions on the use of the funds you receive, and some individuals decide to use the money to fund a long wished for vacation. If your life expectancy is greater than two years, you may still be able to sell your policy through life settlements, though the payout may be lower.

Who Qualifies for a Viatical or Life Settlement with CHF?

You may be eligible to sell your life insurance policy if you:

- Have a CHF diagnosis in advanced stages (Class III or IV heart failure)

- Have a life expectancy of 24 months or less (for a viatical settlement)

- Have a longer life expectancy but still want to access funds (for a life settlement)

- Own a life insurance policy valued at $100,000 or more

Even term life insurance may qualify, especially if it is convertible to a permanent policy.

Benefits of Selling Your Policy

💰 Access cash now – Use funds for medical care or improve your quality of life.

❌ No more premium payments – Reduce financial burdens.

🩺 More financial flexibility – Cover healthcare, home modifications, or bucket-list experiences.

Is It the Right Choice for You?

If you’re living with end-stage CHF, a viatical settlement could provide much-needed financial relief. If your life expectancy is longer than two years, you may still qualify for a life settlement—a valuable option for those who no longer need or want their policy.

If you’re considering selling your life insurance policy due to CHF, call us today to learn if you are likely to qualify and to obtain a no obligation policy appraisal. 800-973-8258