If you’re still paying monthly or annual premiums for a policy that no longer serves your needs, you’re not alone—and you’re not stuck. It may be time to stop paying for life insurance you don’t need. Whether your original reasons for purchasing the policy have changed or your financial priorities have shifted, there are smarter ways to handle an unneeded policy than simply letting it lapse.

Why You Might No Longer Need Your Policy

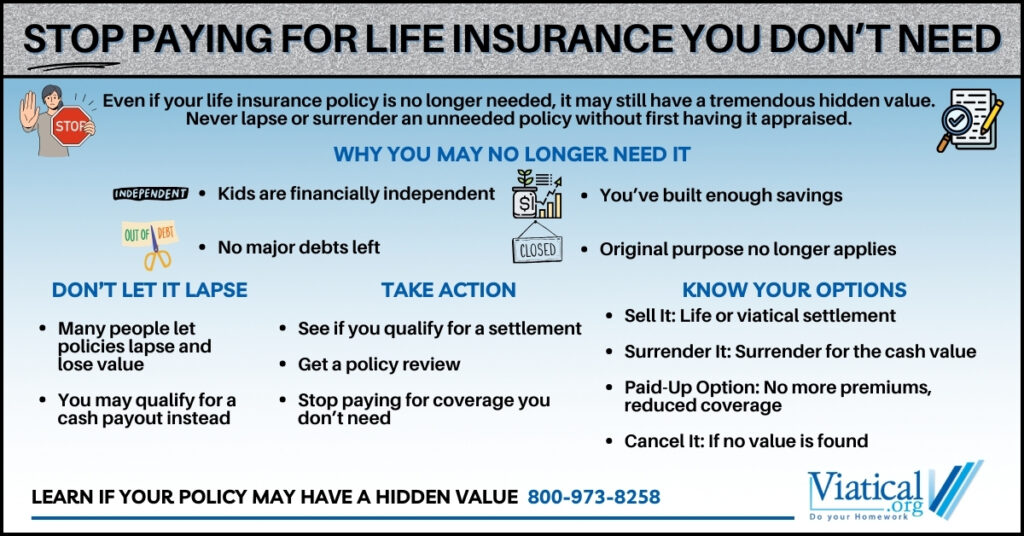

Life insurance is a valuable tool, but it’s meant to serve a purpose. If that purpose has passed, the policy may no longer be worth keeping. Common reasons that you may no longer need your life insurance policy include:

- Your children are financially independent

- Your spouse or beneficiary has passed away

- You’ve paid off your mortgage or other major debts

- You’ve accumulated enough assets to self-insure

- The policy was for business or estate planning needs that no longer apply

Despite these changes, many people continue to pay premiums out of habit or uncertainty—sometimes for years. But paying for a policy you don’t need can quietly drain your finances, especially in retirement.

Don’t Let Your Policy Lapse Without Exploring Options

Every year, thousands of seniors allow life insurance policies to lapse because they believe the only alternatives are surrendering the policy or continuing to pay premiums. What most don’t realize is that their policy may have value on the secondary market for life insurance—many times, far more than the cash surrender value.

Before you make any final decisions, here are your primary options:

1. Sell Your Policy for a Lump Sum

If you’re over 65—or younger with a serious health condition—you may qualify to sell your life insurance policy in a life settlement or viatical settlement. These are legal, regulated financial transactions that allow you to exchange your policy for a cash payout.

Benefits include:

- No more premium payments

- A lump sum that can be used for medical expenses, debt, or daily living

- Payouts that are often 4–8 times higher than the surrender value

To qualify, you typically need a policy with a face value of at least $100,000, though some exceptions apply.

2. Sell a Convertible Term Policy Without Converting It

If you have a convertible term life insurance policy, there’s a good chance you can sell it on the secondary market—even without converting it to permanent insurance. Buyers are often interested in these policies because they can convert them themselves during or after purchase.

This is a key advantage, as many people mistakenly believe they must convert their term policy before selling. In reality, it’s often better not to convert the policy yourself, since the buyer may prefer to do it based on their own strategy and underwriting guidelines.

The important distinction is that:

- Convertible term policies are often eligible for life settlements or viatical settlements.

- Non-convertible term policies rarely qualify, since they can’t be turned into a longer-term investment for the buyer. It is important to note that some non-convertible term policies may qualify for a viatical settlement if the insured has a terminal illness.

If your term policy is nearing the end of its term but still convertible, it may still hold value—even if it has no cash value and no remaining years of guaranteed coverage. Always have your policy appraised before surrendering or lapsing.

3. Surrender the Policy for Cash Value

If you have a whole life, universal life, or variable life policy, it likely has accumulated cash value. You can surrender the policy and receive the cash value, minus any fees or outstanding loans. However, this option usually pays much less than a settlement—and it’s irreversible.

4. Explore Paid-Up or Reduced Coverage

Some permanent policies offer a reduced paid-up option, allowing you to stop paying premiums while still keeping a smaller death benefit. This is a useful choice if you no longer want to make payments but still want to leave behind a modest benefit for your family.

5. Cancel the Policy

If your policy has no cash value, no conversion option, and no secondary market value, cancellation may be your only option. Canceling will stop the premium drain and free up funds for other needs. Just make sure you’re comfortable with the decision, as this ends the policy with no return.

Know Your Policy’s True Value Before You Cancel

The most important thing is this: don’t assume your policy is worthless just because you no longer need it. Even term policies that are convertible—or permanent policies with limited cash value—may be worth thousands in the life settlement market.

If you’re ready to stop paying for life insurance you don’t need, start by understanding your options. A short conversation or eligibility review could uncover value you didn’t know was there.

See If Your Policy Qualifies

You don’t have to keep paying for a policy that no longer fits your life. Give us a call today to learn whether your policy may qualify for a viatical or life settlement. 800-973-8258