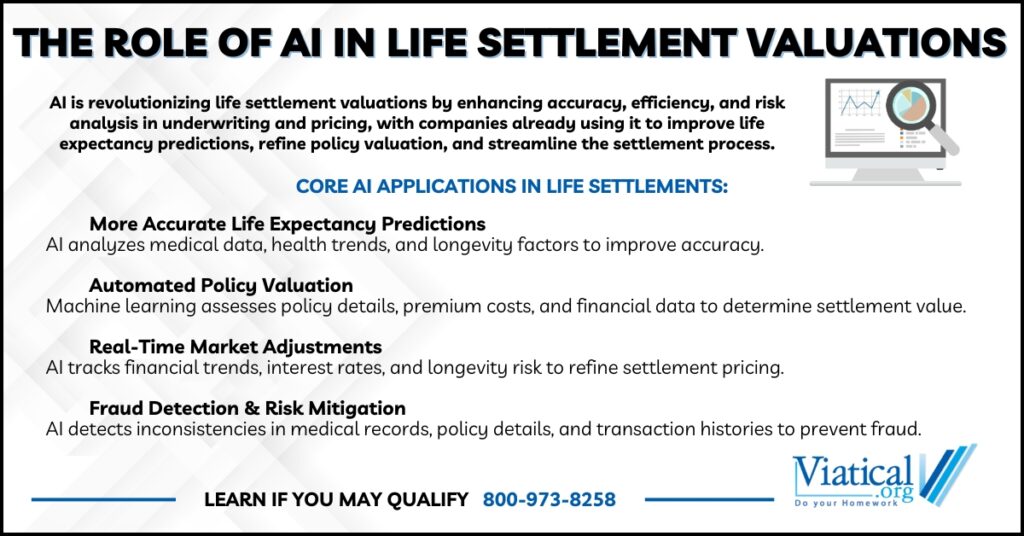

The role of AI in life settlement valuations is transforming how policies are assessed, priced, and transacted within the viatical and life settlements markets. Traditionally, underwriting and policy valuation relied on manual assessments, actuarial tables, and extensive human-driven analysis. Today, artificial intelligence (AI) and machine learning are streamlining these processes, leading to faster, more accurate, and data-driven decision-making.

How AI is Revolutionizing Life Settlement Valuations

- Enhanced Life Expectancy Predictions

AI-driven models analyze vast datasets, including medical histories, demographic information, and mortality trends, to estimate life expectancy with greater accuracy. Unlike traditional actuarial methods, AI can continuously refine its predictions based on real-time health data and advancements in medical treatments. Life expectancy is the determining factor in whether your policy qualifies as a life settlement or a viatical settlement. - Automated Policy Analysis

Machine learning algorithms can instantly assess the key variables of a life insurance policy, such as premium schedules, cash values, and conversion options, helping life settlement providers quickly determine the policy’s potential value. This automation reduces human error and speeds up the underwriting process. - Real-Time Market Adjustments

AI-powered tools analyze financial and actuarial trends, adjusting life settlement pricing models in real time. By incorporating factors such as interest rates, investment market fluctuations, and longevity risk, AI ensures valuations reflect the latest industry conditions. - Fraud Detection and Risk Mitigation

AI-driven fraud detection systems flag inconsistencies in medical records, policy applications, and transaction histories. By identifying anomalies and patterns that suggest potential fraud, these systems help protect both policyholders and investors in the secondary life insurance market.

Machine Learning and Predictive Analytics in Underwriting

- Data-Driven Health Analysis

Advanced algorithms evaluate electronic health records, prescription drug usage, and wearable device data to assess an individual’s health trajectory. This enables more personalized and precise underwriting decisions. - Predicting Policy Lapse Rates

AI models can estimate the financial sustainability of a life settlement by analyzing factors such as life expectancy, premium costs, and investment risk, helping investors determine whether a policy is a viable long-term asset. - Optimizing Pricing Models

Instead of relying on static mortality tables, machine learning continuously refines valuation models based on new datasets, ensuring that policy offers remain competitive and aligned with market conditions.

The Future of AI in the Life Settlement Industry

- Fully Automated Life Settlement Platforms

AI-driven platforms will likely enable policyholders to receive instant settlement offers without the need for lengthy manual underwriting processes. These systems will incorporate digital health data, policy records, and real-time market trends to generate accurate valuations on demand. - Improved Consumer Transparency

AI can enhance transparency by providing policyholders with clearer explanations of how their policy was valued and what factors influenced their settlement offer. - Regulatory Challenges and Ethical Considerations

As AI plays a larger role in underwriting and valuation, regulatory bodies may need to establish guidelines to ensure fairness, data privacy, and consumer protection. The industry must strike a balance between innovation and ethical responsibility.

Life settlement companies are already using AI to improve life expectancy predictions, enhance policy valuation accuracy, and streamline underwriting processes. Advanced machine learning algorithms analyze medical data, health trends, and insurance policy details to provide more precise assessments than traditional methods. These AI-driven tools help investors and providers make better-informed decisions while offering policyholders faster and more competitive settlement offers. As these technologies continue to evolve, they will further refine risk analysis, increase efficiency, and improve overall market transparency.

The role of AI in life settlement valuations is revolutionizing the industry by improving accuracy, efficiency, and risk management. As artificial intelligence continues to evolve, it will further enhance the valuation and underwriting processes, benefiting both policyholders seeking settlements and investors looking for well-assessed policies.

To learn if you’re likely to qualify for a life settlement, please give us a call at 800-973-8258. In a short 5-10 minute phone call, you can find out if you’re eligible to access the hidden value in life insurance.