Amyotrophic lateral sclerosis (ALS), also known as Lou Gehrig’s disease, is a progressive neurodegenerative disorder that affects nerve cells in the brain and spinal cord. As the disease advances, individuals with ALS often face significant medical expenses, including specialized care, assistive devices, and experimental treatments that may not be covered by insurance. Using viatical settlements to pay for ALS treatments can provide a financial solution that allows patients to access a lump sum of cash to help cover these costs.

What Is a Viatical Settlement?

A viatical settlement involves selling a life insurance policy to a third-party buyer in exchange for an immediate cash payment. The amount received is typically higher than the policy’s cash surrender value but less than the full death benefit. The buyer takes over premium payments and ultimately collects the death benefit when the policyholder passes away.

Individuals with a terminal illness, such as ALS, often qualify for a viatical settlement because buyers consider life expectancy when determining an offer. Since ALS is a progressive disease with no known cure, policyholders with a diagnosis may receive favorable settlement offers.

Covering the Costs of ALS Care

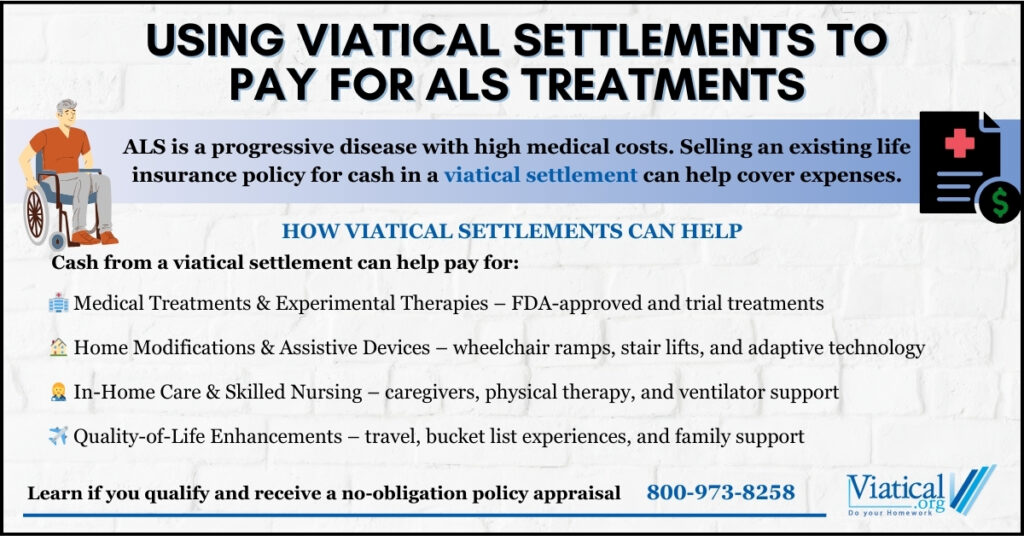

ALS treatment costs can be overwhelming, and many families struggle to afford necessary medical care, home modifications, and support services. A viatical settlement can provide financial relief in the following ways:

- Medical Treatments and Experimental Therapies: While standard ALS treatments, such as Riluzole and Radicava, may be covered by insurance, experimental treatments and clinical trials often require out-of-pocket payments. A viatical settlement can help fund access to these emerging therapies.

- Home Modifications and Assistive Devices: Many individuals with ALS require modifications to their living space, such as wheelchair ramps, stair lifts, and accessible bathrooms. Viatical settlements can provide funds to help pay for these necessary changes.

- In-Home Care and Nursing Support: As ALS progresses, patients often require 24-hour care, which can be expensive. A viatical settlement can help cover the cost of skilled nursing, in-home care, and specialized equipment like ventilators and communication devices.

- Quality-of-Life Enhancements: Whether it’s traveling to see loved ones, fulfilling bucket list goals, or reducing financial burdens for family members, a viatical settlement provides flexibility to use the funds in a way that best suits the patient’s needs. There are no restrictions on the use of funds you receive.

Who Qualifies for a Viatical Settlement?

To qualify for a viatical settlement, individuals typically must have a life insurance policy and a diagnosis of a terminal illness with a limited life expectancy, usually two years or less. However, each case is evaluated individually, and some policyholders with ALS may qualify even if their projected life expectancy is slightly longer.

Policies that may be eligible include:

- Term life insurance (In most cases, the policy will need to be convertible.)

- Whole life insurance

- Universal life insurance

- Group life insurance (if convertible to an individual policy)

Tax Advantages of Viatical Settlements for ALS Patients

In most cases, proceeds from a viatical settlement are tax-free if the policyholder is considered terminally il. This makes viatical settlements a more attractive financial option compared to traditional life settlements, which may be subject to taxation. Always consult with your trusted tax professional for clarification regarding your specific situation.

How to Get Started

If you or a loved one has been diagnosed with ALS and are considering a viatical settlement, it’s essential to work with an experienced life settlement company. The process typically involves:

- Policy Review: A viatical settlement company will assess your life insurance policy to determine eligibility.

- Medical Assessment: Potential buyers will review medical records and life expectancy projections.

- Offer Presentation: If eligible and there is interest, you will receive an offer based on your policy’s value and your health condition.

- Payout and Policy Transfer: If you accept the offer, you will receive a lump sum payment, and the buyer will take over premium payments.

For individuals with ALS, financial concerns should not stand in the way of receiving necessary care and support. A viatical settlement can provide much-needed funds to cover medical treatments, home care, and other expenses, allowing patients to focus on their well-being and quality of life.

If you’re considering selling your life insurance policy, please give us a call at 800-973-8258 to learn if you are likely to qualify and for help in obtaining a no obligation policy appraisal.