If you’re living with diabetes and facing financial strain, you may be wondering whether you qualify to sell your life insurance policy. Viatical settlements for patients with diabetes are possible in certain cases, particularly when the disease has led to severe complications that limit life expectancy. While well managed diabetes alone usually does not qualify, many people develop progressive or life-threatening complications that could make them eligible.

When Does Diabetes Qualify for a Viatical Settlement?

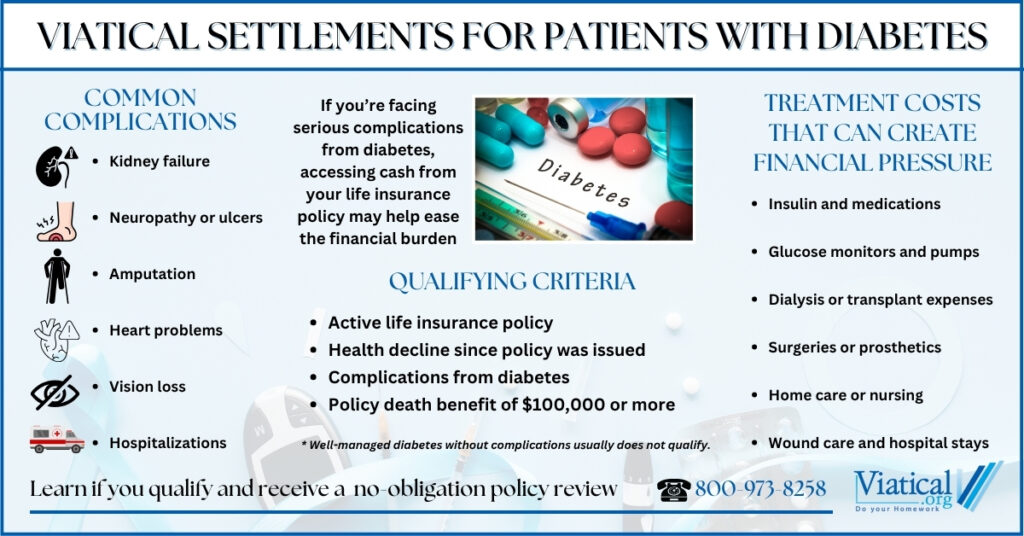

In general, life insurance buyers are looking for cases in which a policyholder has experienced a significant decline in health. For patients with diabetes, this typically means advanced stage complications or other conditions resulting from long-term damage caused by the disease. Examples include:

- Chronic kidney failure requiring dialysis

- Severe neuropathy or non-healing ulcers

- Amputations due to poor circulation

- Progressive cardiovascular disease such as congestive heart failure or past heart attacks

- Diabetic retinopathy with vision loss

- Frequent hospitalizations due to blood sugar complications or infections

- Comorbidities like advanced liver disease or stroke

If one or more of these complications has occurred, the policyholder may meet the health criteria for a viatical settlement, even if the original diagnosis of diabetes was many years ago.

Common Treatments and Their Costs

Diabetes is a chronic condition that often requires lifelong care and the costs can add up quickly especially when complications develop. Common treatments and expenses may include:

- Daily insulin or other injectable medications

- Continuous glucose monitors (CGMs) or insulin pumps

- Frequent lab work and physician visits

- Hospital stays for infections, ulcers, or blood sugar emergencies

- Dialysis treatments for kidney failure

- Amputation surgery and prosthetics

- Home care or skilled nursing following complications

- Specialized foot or wound care to prevent infection

- Vision treatments or surgeries for diabetic retinopathy

Even with insurance, out-of-pocket expenses can be overwhelming, especially for those who are no longer able to work or who need long-term care. In these situations, selling a life insurance policy through a viatical settlement may provide critical funds.

Well-Controlled Diabetes Alone Usually Isn’t Enough

If your diabetes is well managed with medication, diet, and lifestyle changes and you haven’t developed serious complications, your policy likely won’t meet the requirements for a viatical settlement at this time. Buyers typically assess health using life expectancy projections, and individuals with stable Type 2 diabetes can often live many years without major limitations. However, this can change over time if new complications develop.

If you are over 65, you may still qualify for a life settlement even without severe complications. Life settlements offer seniors a way to access the hidden value in their life insurance policies. In most cases, you must have experienced a slippage in health since the time the policy was originally issued. However, unlike viatical settlements, you are not required to have a severely shortened life expectancy.

The Type of Policy Matters

Most types of life insurance policies can qualify for a viatical settlement, including universal life, whole life, and convertible term policies. However, the policy must be active and have a death benefit of at least $100,000 in most cases. Term policies without conversion options or those nearing expiration may not be eligible. If you aren’t sure whether your policy type qualifies, please give us a call. Each case is unique and it is always best to ask.

How to Find Out if You Qualify

If you or someone you care about is managing diabetes with serious health complications and holds an active life insurance policy, it may be worth exploring whether a viatical settlement is an option. The process is confidential and there is no obligation to accept an offer. A viatical settlement may offer a way to relieve the financial pressure of managing a serious chronic illness, especially when medical costs and caregiving needs begin to outpace available resources.

To learn if you qualify and to obtain a no obligation policy appraisal, please give us a call at 800-973-8258