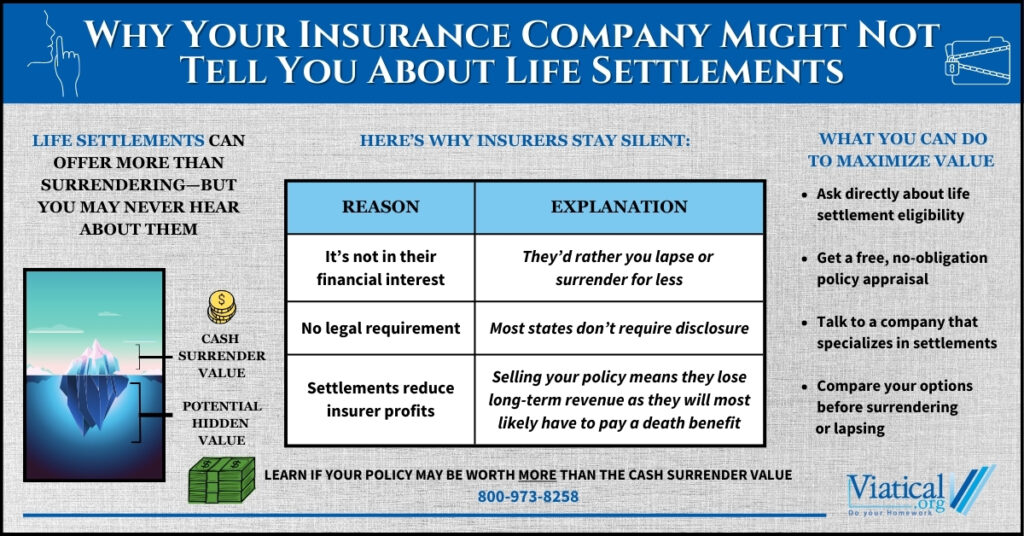

If you’ve ever wondered why your insurance company didn’t mention the option to sell your life insurance policy, you’re not alone. Why your insurance company might not tell you about life settlements comes down to one simple fact: it’s not in their financial interest to do so. Life settlements offer policyholders a way to receive more than the policy’s surrender value—but that means the insurance company may ultimately have to pay out a death benefit they were hoping to avoid.

What Is a Life Settlement?

A life settlement is the sale of an existing life insurance policy to a third-party buyer in exchange for a lump sum cash payment. After the sale, the buyer becomes responsible for paying the premiums and eventually collects the death benefit. The original policyholder walks away with cash they can use while they’re still living—often far more than they’d receive by simply surrendering the policy.

The Conflict of Interest

Insurance companies make money when policies lapse or are surrendered for low cash value. When you surrender a policy, they keep the premiums you’ve paid and avoid paying out the death benefit. Life settlements disrupt this model.

If policyholders learn they can sell their policy for a significantly higher amount, they may be less likely to let the policy lapse or surrender it back to the insurer. That’s a direct loss for the insurance company, which is why many don’t proactively mention life settlement options—even when asked about alternatives.

They’re Not Required to Tell You

In most states, life insurance companies are not legally obligated to inform policyholders about the life settlement market. Unless you work with an advisor who’s aware of the option—or you do your own research—it’s entirely possible to miss out on this opportunity altogether.

Agents and life settlements typically don’t mix as many insurance companies prohibit them from mentioning this valuable option. This is slowly changing though. Some states have started introducing disclosure laws that require insurance companies or agents to inform clients about life settlements in certain situations, like when a policy is about to lapse. But many of these laws are still in early stages or apply only in limited circumstances.

Protecting Yourself: What You Can Do

If you’re considering canceling your policy or letting it lapse because premiums are unaffordable—or because you no longer need the coverage—explore all your options first. That includes:

- Getting a free, no-obligation life settlement estimate

- Asking your agent directly if a life settlement might apply to your policy

- Speaking with a company that specializes in life settlements to evaluate your eligibility

Being proactive can make all the difference in what you walk away with.

Why This Matters

For seniors facing medical bills, rising living costs, or simply needing more financial flexibility in retirement, the decision to sell a policy can be life-changing. It may mean affording better care, staying in your home longer, or supporting family needs—yet the option is still too often kept in the shadows.

Understanding why your insurance company might not tell you about life settlements is the first step toward protecting your financial future. Don’t assume that surrendering or lapsing your policy is your only option. By asking the right questions and learning about the secondary market for life insurance, you could turn an unwanted policy into meaningful cash.

Please give us a call today to learn if you may qualify and for a no obligation policy appraisal. 800-973-8258