Life insurance is designed to provide financial security to your loved ones in the event of your passing. However, there may be times when you need to access the value of your policy while you’re still alive. There are several ways you may be able to cash out a life insurance policy.

Understanding the Cash Value of Life Insurance

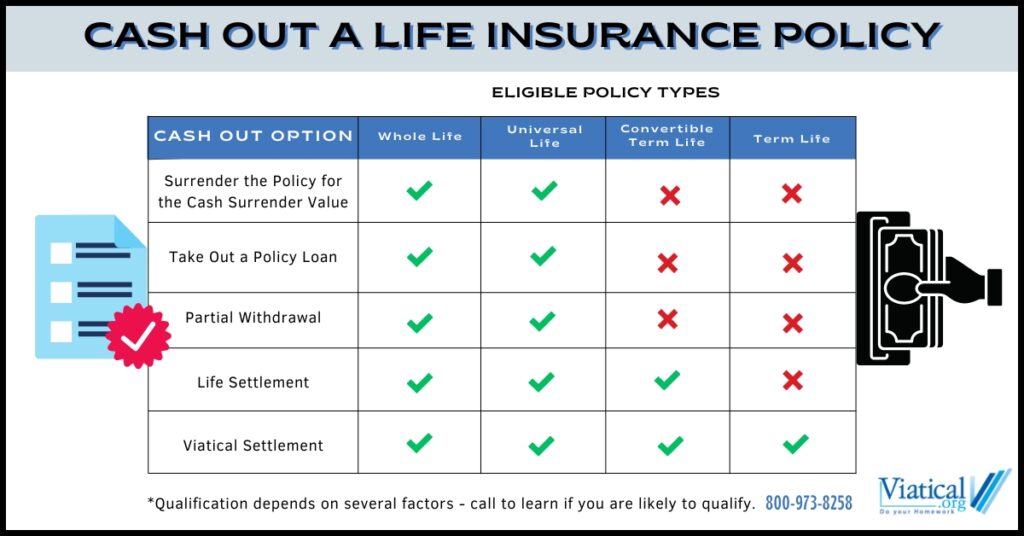

Before delving into the methods of cashing out, it’s essential to understand that not all life insurance policies accumulate cash value. Permanent life insurance policies, such as whole life, universal life, and variable life insurance, build cash value over time. In contrast, term life insurance policies do not have a cash value component and cannot be cashed out.

Options for Cashing Out a Life Insurance Policy

Surrendering the Policy

- What It Is: Surrendering your policy means canceling it and receiving the accumulated cash value, minus any surrender charges or outstanding loans.

- Process: Contact your insurance provider to request a surrender form. Once submitted, the insurer will process your request and provide the cash value.

- Considerations: Surrender charges can be significant, especially if the policy is relatively new. Additionally, surrendering the policy means you forfeit the death benefit.

- Types of Policies: Only permanent insurance, such as Whole Life or Universal Life build up a cash surrender value. If you choose to surrender a Term Life Insurance policy, you will receive nothing.

Taking Out a Policy Loan

- What It Is: You can borrow against the cash value of your policy. The loan does not need to be repaid, but unpaid loans will reduce the death benefit.

- Process: Contact your insurer to request a loan. The amount you can borrow is usually a percentage of the cash value.

- Considerations: Interest accrues on the loan, and unpaid loans reduce the death benefit available to your beneficiaries.

- Types of Policies: Only permanent insurance, such as Whole Life or Universal Life are eligible for loans. Not all policies are eligible. Check with your insurance carrier to learn about eligibility and terms.

Partial Withdrawals

- What It Is: You can withdraw a portion of the cash value without surrendering the policy. This option is typically available for universal and variable life policies.

- Process: Request a partial withdrawal from your insurer. The withdrawal amount will be deducted from the cash value.

- Considerations: Withdrawals may reduce the death benefit and could have tax implications.

- Types of Policies: Only permanent insurance policies (Whole and Universal Life policies) build up a cash value. Term policies will not be eligible for this option.

Viatical Settlements

- What It Is: If you are terminally ill, you can sell your policy to a third party for a lump sum payment that is less than the death benefit but more than the cash value.

- Process: Work with a licensed viatical settlement provider to evaluate and sell your policy.

- Considerations: This option provides immediate cash but requires a terminal illness diagnosis.

- Types of Policies: Most policies can qualify for viatical settlements, including Whole Life, Universal Life, Group Policies, Term Life Insurance, Convertible Term Life, and Survivor Life Insurance Policies.

Life Settlements

- What It Is: If you are not terminally ill but are aged 65 or older, you can sell your policy in a life settlement for more than the cash value but less than the death benefit.

- Process: Work with a licensed life settlement provider to sell your policy.

- Considerations: This option provides immediate cash and can be a good alternative for seniors who no longer need the policy.

- Types of Policies: Many types of policies can qualify for a life settlement, including Whole Life, Universal Life, Group Policies, Convertible Term Life, and Survivor Life Insurance Policies. Term Life policies that are not convertible usually will not qualify for a life settlement unless the insured has a significant health concern.

Factors to Consider

- Tax Implications: Some methods of cashing out a life insurance policy may have tax consequences. Consult with a tax advisor to understand the implications.

- Impact on Beneficiaries: Cashing out a policy may reduce or eliminate the death benefit, affecting your beneficiaries’ financial security.

- Fees and Charges: Be aware of any fees, surrender charges, or interest that may apply to your chosen method. If choosing the viatical or life settlement option, make sure you are informed of any broker fees taken out of your offer.

Cashing out a life insurance policy can provide much-needed financial relief, but it’s essential to understand the options and implications. How do I convert my life insurance to cash? Whether you choose to surrender the policy, take out a loan, make a partial withdrawal, or pursue a viatical or life settlement, each option has its benefits and drawbacks. By carefully evaluating your needs and consulting with financial professionals, you can make an informed decision that best suits your circumstances.

If you’re considering cashing out your life insurance policy and need expert guidance, contact Viatical.org today. Our team of experienced professionals can help you navigate the process and explore the best options for your financial situation. In a brief 5-10 minute phone call, you can learn if you are likely to qualify for either a viatical settlement or a life settlement. 800-973-8258

You can also fill out this short form to learn if you are likely to qualify.