When people think about life insurance, they often view it as a way to provide financial protection for loved ones. However, there is also a market where existing life insurance policies can be bought and sold. But who buys life insurance policies once they are in place? Life settlement buyers and viatical settlement purchasers purchase policies in the secondary market. These buyers acquire existing policies from those who no longer need or want the coverage, offering a lump sum cash payment in exchange. Understanding who buys life insurance and the roles of various market players is key for anyone considering selling their policy.

Types of Life Insurance Buyers

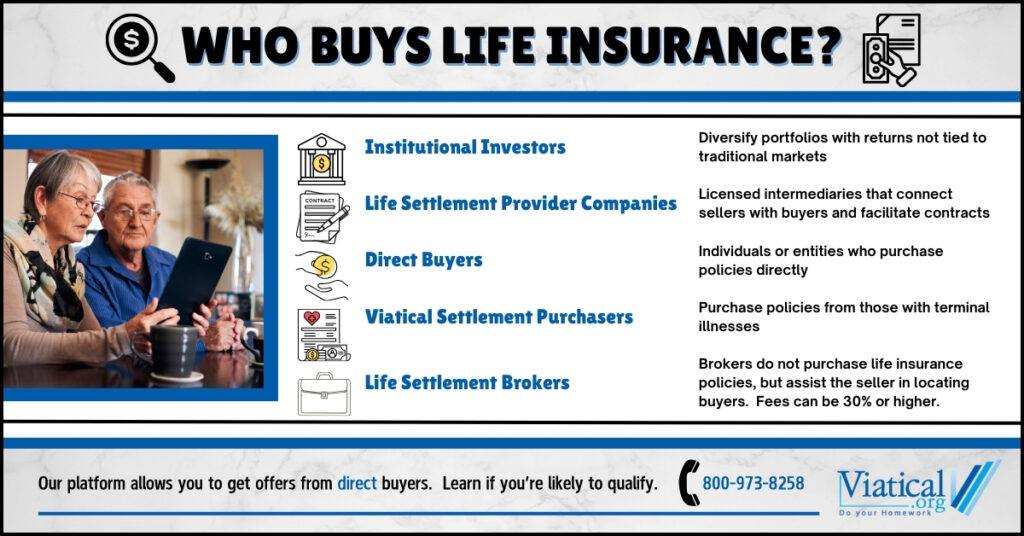

Institutional Investors

Institutional investors, such as hedge funds, pension funds, and private equity firms, are some of the primary buyers of life insurance policies. They purchase these policies to diversify their investment portfolios and seek returns that are not directly tied to the stock market or other traditional assets. The stable payouts from life insurance policies, which occur upon the insured’s death, make them an attractive option for these investors. Because the return on investment from life settlements and viatical settlements is not tied to traditional markets, it offers a way to hedge against market volatility. This appeal lies in the fact that life insurance payouts are determined by the policy’s face value and the insured’s life expectancy, rather than the performance of stocks or bonds.

Life Settlement Provider Companies

Life settlement provider companies serve as intermediaries in the life settlement market. These companies connect sellers with potential buyers, either purchasing policies directly or presenting them to interested institutional investors. As licensed entities, they ensure transactions comply with regulatory standards. Life Settlement Providers facilitate contracts and closings once an offer is accepted.

Direct Buyers

Direct buyers are individuals or companies that buy life insurance policies direct without using brokers or other intermediaries. These buyers can be institutional investors or private accredited investors looking to add life settlements to their investment portfolio. Working directly with buyers can simplify the process, and our life settlement platform is designed to present policies to direct buyers. There is no need to subtract a broker commission from the direct offer you receive, which can make the process more straightforward for sellers.

Viatical Settlement Purchasers

Viatical settlement purchasers buy life insurance policies specifically from individuals with a terminal illness who have a life expectancy of two years or less. This type of sale allows policyholders to access funds to cover medical expenses, debt, or other financial needs. Investors who choose to invest viatical settlements find them appealing because the shorter life expectancy of the insured can lead to a quicker payout compared to traditional life settlements. The return on investment in viatical settlements is linked to the timing of the insured’s passing, which offers a predictable element that is not influenced by traditional financial markets.

The Role of Life Settlement Brokers

Although life settlement brokers are not buyers themselves, they facilitate the sale of life insurance policies by acting as intermediaries between sellers and potential buyers. Brokers are supposed to work to negotiate the best price for the policyholder, but their services typically come at a cost. How much to life settlement brokers make? Commissions can be as high as 30% or more of the life settlement offer, which can significantly reduce the payout received by the seller. While brokers can provide valuable assistance for policyholders unfamiliar with the market, some sellers may prefer to avoid these additional costs by working directly with buyers.

Selling to Life Settlement Buyers Through Our Platform

Selling a life insurance policy may seem complex, but our life settlement platform simplifies the process by connecting policyholders directly with buyers. By presenting policies to a range of direct buyers, sellers can increase the chances of receiving competitive offers. Since there is no need to subtract a broker commission from the direct offer you receive, policyholders can benefit from a straightforward approach that avoids additional fees. Our platform makes it easy for sellers to initiate the process through the ability to electronically sign compliance documents and securely submit policy details.

Understanding who buys life insurance policies and the various types of buyers helps policyholders make informed decisions when considering a life settlement. Institutional investors, life settlement provider companies, direct buyers, and viatical settlement purchasers all play a role in the secondary market for life insurance. The appeal for investors lies in the fact that life settlements and viatical settlements offer returns that are not tied to traditional financial markets, providing a unique opportunity to diversify portfolios. Our life settlement platform connects sellers with direct buyers, allowing them to receive offers without the need to subtract broker commissions.

Selling a life insurance policy is a significant financial decision and knowing the different buyer types can help you navigate your options. Our platform is designed to streamline the process and connect you directly with buyers, making it easier to explore your life settlement options. To find out if you’re likely to qualify to access the hidden value in your life insurance policy, please give us a call at 800-973-8258. It usually only takes a 5-10 minute phone call to learn if you may be eligible to sell your policy for cash.