Term life insurance is a popular choice because it offers affordable, straightforward financial protection for a set period—typically 10, 20, or 30 years. But what happens when that period ends? If you’re approaching the end of your term, it’s essential to understand your options. In this post, we’ll explain what happens when term insurance expires and explore how you might still benefit from your policy, including the potential to sell it through a life or viatical settlement.

What to Expect When Your Term Life Insurance Ends

When a term life insurance policy reaches its expiration, coverage stops, and the policyholder is no longer insured. Unlike permanent life insurance, term policies do not have a cash value component. If the policyholder outlives the term, the policy simply lapses, and there is no payout.

Years of premium payments may seem to go to waste, but that doesn’t have to be the case. There are ways to potentially extract value from a term policy, especially if you act before it expires.

Convertible Term Policies: Unlocking More Options

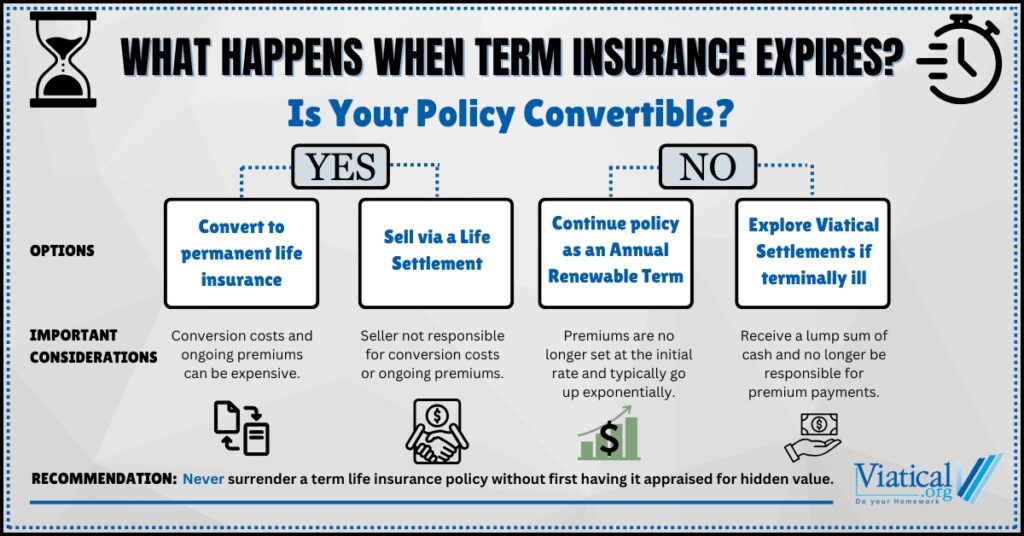

One of the appealing features of some term life policies is the conversion option. If your term policy is convertible, it means you can convert it to a permanent policy—like whole or universal life—without having to undergo a new medical exam. This allows you to extend your coverage beyond the original term.

Here’s where things get interesting: you don’t necessarily need to handle the conversion yourself. If your policy is eligible, you might be able to sell it to a third party through life settlements. The buyer takes care of the conversion process, so you don’t have to navigate it alone. Instead, you can receive a cash payout if you qualify. Although term policies do not build up a cash value like permanent insurance, they may have substantial hidden value. This can provide a financial boost, especially if you no longer need the insurance.

Viatical Settlements: A Lifeline for Those with Serious Illness

If the insured person is diagnosed with a terminal illness, a viatical settlement may be an option. The process is similar: the policyholder sells the policy to a third party in exchange for a lump sum, and the buyer takes over the policy, paying any future premiums. Proceeds from viatical settlements are typically tax free, but make sure to consult with your trusted tax professional about your unique situation.

Non-Convertible Term Policies: Are There Still Options?

If your term policy is non-convertible, it cannot be switched to a permanent policy, which limits your options for extending coverage. Generally, these policies won’t qualify for a life settlement as the premiums on annual renewable term policies can increase greatly each year.

However, there are sometimes exceptions. If the insured has a terminal illness, a non-convertible term policy may still qualify for a viatical settlement. This can be a way to access funds when they are needed most, despite the limitations of a non-convertible policy.

Act Before Your Policy’s Conversion Period Ends

Timing is everything. If you’re considering selling your policy, it is very important to act before the conversion period ends. For convertible term policies, the conversion option may expire a few years before the term does. It is important to check with your life insurance company to make sure you’re aware of the deadline for conversion. By getting an appraisal of your policy’s value at least six months before the conversion period ends, you can explore whether selling the policy is a feasible option.

Working with a reputable life settlement company can help you navigate the process, from appraising the policy’s value to connecting you with potential buyers. Remember, once a policy lapses, it cannot be converted or sold, and any opportunity to receive financial benefits from it will be lost.

Convertible vs. Non-Convertible Policies: A Quick Comparison

| Feature | Convertible Term Policy | Non-Convertible Term Policy |

| Conversion to Permanent | Yes | No |

| Life Settlement Eligible | Potentially | Usually not, some exceptions for terminal illness |

| Viatical Settlement Eligible | Potentially | Potentially, if the insured is terminally ill |

| Action Step | Have policy appraised 6 months before conversion ends | Be aware of any changes in health |

Take Action Before It’s Too Late

As the end of your term policy approaches, being proactive is crucial. If you’re considering selling, don’t wait until the last minute. By understanding your options and acting early, you can make the most of your expiring policy and potentially secure a financial return instead of letting your coverage lapse without benefit.

Find Out If Your Policy Qualifies for a Life or Viatical Settlement

Unsure if your policy is eligible for conversion or sale? Professional advice can help. Viatical.org specializes in helping policyholders navigate their options and can assist in determining whether your policy qualifies for a life settlement or viatical settlement.

Turn Your Expiring Term Policy into a Financial Asset

Term life insurance offers peace of mind for a specific period, but as the term ends, it’s essential to know what comes next. Selling your policy through a life or viatical settlement can turn an expiring term policy into a valuable asset. Acting early and seeking guidance are the keys to making the most of your life insurance.

If you would like to find out if your term life insurance has a hidden value, please call us today at 800-973-8258