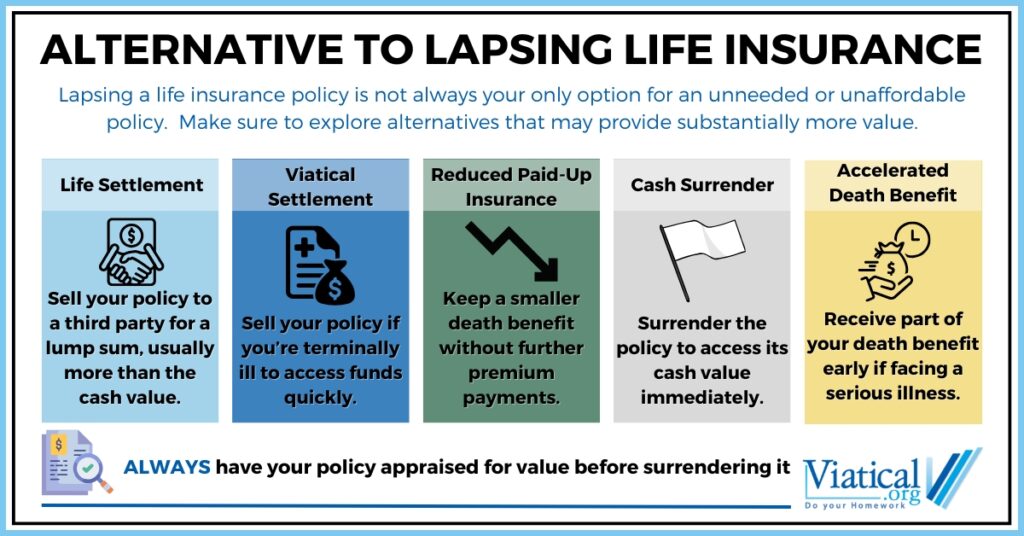

If you are considering letting your life insurance policy lapse, you should explore an alternative to lapsing life insurance that could provide you with more financial value. Many policyholders face rising premium costs or simply feel they no longer need the coverage they once had. However, letting a policy lapse can mean losing out on years of premiums with no return. There are alternatives that allow you to recover some of the value from your policy instead of letting it go to waste.

What Happens When a Life Insurance Policy Lapses?

A life insurance policy lapses when the policyholder stops paying premiums, which leads to the termination of coverage. This means that all benefits are forfeited, and the policyholder’s beneficiaries will receive nothing. For many people, this can be a significant loss, especially after paying into the policy for years. Often, policyholders choose to lapse a policy because the premiums have become unaffordable or because their needs have changed. But before letting a policy lapse, it’s important to consider the alternatives that can provide value for your investment.

Alternatives to Lapsing Life Insurance

Instead of letting your policy lapse, consider these alternatives that can help you make the most of your life insurance policy:

Life Settlement

A life settlement allows you to sell your life insurance policy for cash and is one of the most effective alternatives to lapsing life insurance. In a life settlement, you sell your life insurance policy to a third-party investor for a lump sum payment. This amount is usually greater than the cash surrender value but less than the death benefit. The new policy owner takes over premium payments and becomes the beneficiary of the policy. Life settlements are particularly suitable for individuals over the age of 65 who no longer need the coverage and would prefer a cash payout instead.

Viatical Settlement

If you are diagnosed with a terminal illness, a viatical settlement is another potential alternative to lapsing life insurance. In this case, you sell your policy to an investor in exchange for a cash payout. Viatical settlements are typically available to those with a life expectancy of two years or less and can provide much-needed funds for medical treatment, end-of-life care, or other financial needs.

Reduced Paid-Up Insurance

Reduced paid-up insurance allows you to stop paying premiums while still maintaining a portion of your coverage. Instead of lapsing, your policy is adjusted to provide a smaller death benefit, but you no longer have to make any additional payments. This is a good option if you still want to leave something for your beneficiaries but can no longer afford the premiums.

Cash Surrender

If your policy has built-up cash value, you can surrender it and receive a cash payout. The cash surrender value is less than the death benefit, but it’s better than receiving nothing if you are considering lapsing the policy. Keep in mind that surrender charges may apply, and you may have to pay taxes on the payout, but it is still a better option than simply letting the policy lapse without any return. Always make sure to have your policy appraised for value as a life settlement first, as life settlements and viatical settlements can provide substantially more value if you qualify.

Accelerated Death Benefit

An accelerated death benefit (ADB) is a feature that may be included in your life insurance policy or available as a rider. This option allows you to access a portion of the death benefit early if you are diagnosed with a terminal or chronic illness. The remaining death benefit will still go to your beneficiaries after your passing. An ADB is an effective way to receive needed funds without entirely giving up your policy.

Why You Should Consider an Alternative to Lapsing Life Insurance

Letting a life insurance policy lapse might seem like an easy solution when premiums become too costly or when you no longer feel you need the coverage. However, allowing a policy to lapse means you forfeit all the benefits and value you’ve built up over time. There are alternatives to lapsing life insurance that can help you make the most of your investment. Whether it’s receiving a lump sum payment through a life or viatical settlement, maintaining reduced coverage, or accessing the cash value, there are better options that allow you to capitalize on your policy rather than letting it go to waste.

Lapsing a life insurance policy may seem like the only option when the premiums become unaffordable, but it often means losing out on years of invested value. Before making the decision to lapse your policy, consider alternatives to lapsing life insurance that can help you recover some of its value. Life settlements, viatical settlements, reduced paid-up options, cash surrender, and accelerated death benefits are all ways you can benefit financially instead of letting your policy lapse.

To learn if you might qualify to access your policy’s hidden value through a life settlement or viatical settlement, please give us a call at 800-973-8258. It usually only takes a 5-10 minute phone call to find out if this option may be available to you.