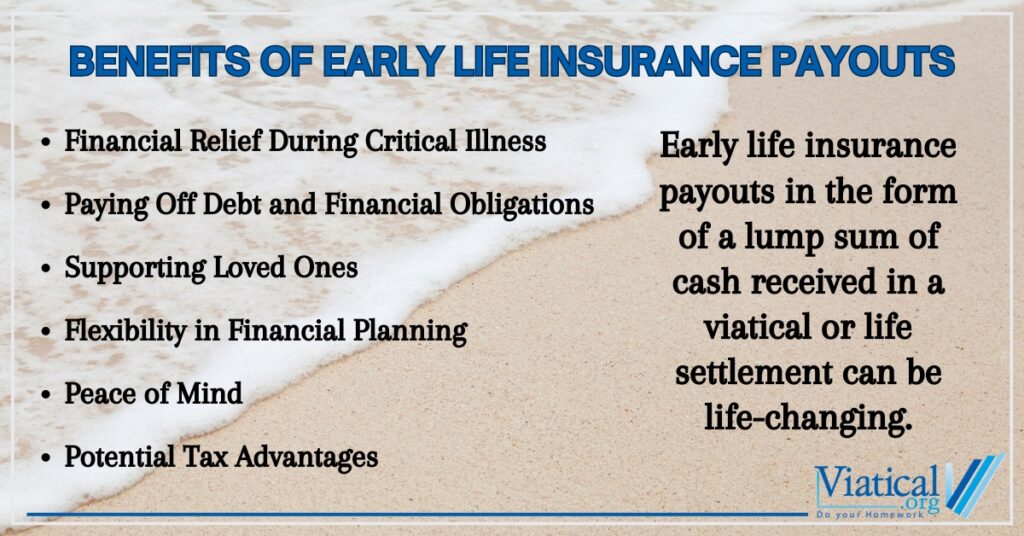

Life insurance is often viewed as a safety net for loved ones after a policyholder’s passing, but it can also serve as a valuable financial resource during the policyholder’s lifetime. Early life insurance payouts, often obtained through viatical settlements or accelerated death benefits, provide policyholders with immediate access to cash, which can be a crucial lifeline in times of need. This post explores the various benefits of early life insurance payouts and how they can significantly impact a person’s financial well-being.

Financial Relief During Critical Illness

One of the most significant benefits of early life insurance payouts is the financial relief they provide during a critical illness. When a policyholder is diagnosed with a terminal or chronic illness, the costs of medical treatment, caregiving, and everyday living expenses can quickly become overwhelming. Early payouts offer a way to cover these expenses without depleting other financial resources. This immediate cash influx can help ensure that the policyholder receives the necessary medical care and maintains their quality of life without the added stress of financial strain.

Paying Off Debt and Financial Obligations

Early life insurance payouts received through life settlements or a viatical settlement can also be used to pay off outstanding debts and financial obligations. Whether it’s a mortgage, credit card debt, or other loans, these payments can provide peace of mind by reducing or eliminating debt burdens. For those facing a shortened life expectancy, settling debts early can be an essential part of financial planning, ensuring that loved ones are not left with the responsibility of managing these obligations after the policyholder’s passing.

Supporting Loved Ones

The ability to support loved ones during a difficult time is another key benefit of early life insurance payouts. Policyholders may choose to use these funds to help family members with various expenses, such as education, housing, or daily living costs. For example, a parent with a terminal illness might use an early payout to fund a child’s college education or contribute to a down payment on a home. This financial support can provide lasting benefits to loved ones, allowing them to achieve their goals and secure their futures.

Flexibility in Financial Planning

Early life insurance payouts offer policyholders flexibility in their financial planning. Unlike traditional life insurance benefits, which are only available after death, early payouts can be used for any purpose the policyholder chooses. This flexibility allows individuals to make decisions that best suit their unique circumstances, whether it’s investing in a new business venture, traveling, or making charitable donations. The ability to access funds while still alive provides a sense of control over one’s financial future, enabling policyholders to live their remaining years on their terms.

Peace of Mind

Perhaps one of the most intangible yet valuable benefits of early life insurance payouts is the peace of mind they provide. Knowing that financial resources are available can alleviate the stress and anxiety often associated with serious illness and end-of-life planning. Policyholders can focus on spending quality time with loved ones and enjoying life rather than worrying about financial uncertainties. This sense of security can significantly improve the overall well-being of both the policyholder and their family during a challenging time.

Potential Tax Advantages

In some cases, early life insurance payouts may offer tax advantages. Depending on the type of payout and the policyholder’s specific circumstances, these funds may be received tax-free. For example, viatical settlements are often exempt from federal income tax if the policyholder is terminally ill. However, it’s important to consult with a tax advisor to understand the potential tax implications of an early payout fully.

The benefits of early life insurance payouts extend far beyond financial relief—they offer a lifeline during critical times, provide flexibility in financial planning, and grant peace of mind. Whether used to cover medical expenses, pay off debts, support loved ones, or simply enjoy life, these payouts can make a significant difference in the lives of policyholders and their families. As with any financial decision, it’s essential to carefully consider the options and consult with a professional to determine the best course of action based on individual circumstances. Early life insurance payouts can be a powerful tool for those who need immediate access to funds, allowing them to live their remaining years with dignity and financial security.

Please give us a call at 800-973-8258 to learn if your existing life insurance may have a hidden value that can provide an early life insurance payout in the form of a lump sum cash offer.