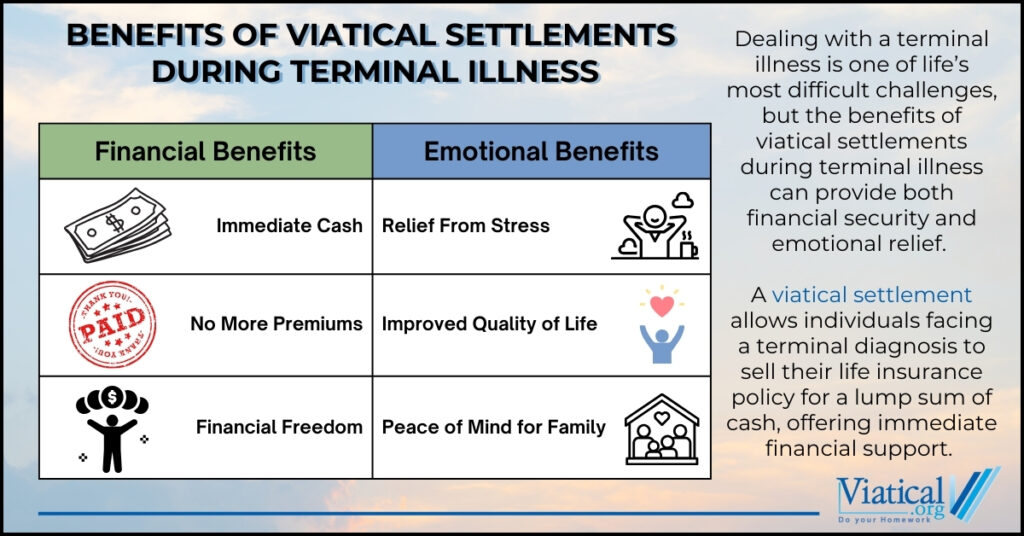

Dealing with a terminal illness is one of life’s most difficult challenges, but the benefits of viatical settlements during terminal illness can provide both financial security and emotional relief. A viatical settlement allows individuals facing a terminal diagnosis to sell their life insurance policy for a lump sum of cash, offering immediate financial support. In this article, we’ll explore both the emotional and financial advantages of viatical settlements and how they can help ease the burden on patients and their families.

Understanding Viatical Settlements

Before diving into the specific benefits, it’s important to understand what a viatical settlement is. A viatical settlement allows terminally ill individuals to sell their life insurance policy to a third-party investor in exchange for a lump sum of cash. The amount received is typically higher than the surrender value of the policy but less than the death benefit. The investor then assumes responsibility for paying the premiums and receives the death benefit when the original policyholder passes away.

This financial arrangement is designed to provide immediate cash to individuals who need to cover medical expenses, improve their quality of life, or reduce the financial burden on their families.

Financial Benefits of Viatical Settlements

Immediate Access to Cash

One of the most immediate and impactful financial benefits of a viatical settlement is the lump sum of cash that the policyholder receives. Terminal illnesses often come with significant medical bills, treatments, and care costs. Having access to this cash can help cover these expenses, reducing the stress of mounting bills and allowing individuals to focus on their health and well-being.

- Case Study: John, a 56-year-old man diagnosed with late-stage cancer, had a $500,000 life insurance policy. Faced with costly chemotherapy and home care services, John chose to sell his policy through a viatical settlement. He received $300,000, which allowed him to pay for his treatments, hire a full-time caregiver, and set aside some funds for his family’s future needs. The financial relief allowed him to focus on spending quality time with his family, free from the stress of medical debt.

No Future Premium Payments

Another major financial benefit of a viatical settlement is that the policyholder no longer needs to make premium payments. Once the policy is sold, the investor who purchases the policy assumes responsibility for the premiums. For individuals facing a terminal illness, this can be a huge relief, as it eliminates one more financial obligation.

Freedom to Use Funds However You Want

The lump sum received from a viatical settlement can be used in any way the policyholder chooses. Unlike some other financial options that come with restrictions, a viatical settlement provides complete flexibility. Whether the money is used for medical bills, home renovations, travel, or leaving a financial gift for loved ones, the choice is entirely up to the individual.

Financial Legacy for Loved Ones

While the original death benefit is forfeited in a viatical settlement, many people find that the immediate financial relief allows them to preserve other assets or leave behind a different form of financial legacy for their loved ones. The funds can be used to create a trust, pay off debt, or secure a more comfortable future for the policyholder’s family.

Emotional Benefits of Viatical Settlements

Relieving Financial Stress

The emotional relief that comes from eliminating financial worries cannot be overstated. A terminal diagnosis is emotionally devastating in itself, but adding financial concerns can exacerbate the strain. By securing a viatical settlement, individuals and their families can alleviate a significant portion of the stress related to money, which allows them to focus on spending meaningful time together.

- Real-World Scenario: Susan, diagnosed with ALS, felt the weight of medical bills piling up as her condition worsened. She chose to pursue a viatical settlement, which provided her with $200,000. This not only covered her medical expenses but also allowed her to take a dream vacation with her family, creating lasting memories. The emotional benefit of reducing her financial stress gave her the peace of mind she needed to cherish her remaining time.

Increased Quality of Life

The funds from a viatical settlement can also improve the quality of life for terminally ill individuals. Whether it’s accessing better medical care, hiring in-home assistance, or enjoying experiences that would have otherwise been unaffordable, the emotional benefit of enhancing one’s life during a terminal illness is profound.

- Example: For many, being able to afford better pain management or more personalized healthcare can dramatically improve daily comfort and well-being. The ability to reduce suffering and improve quality of life creates emotional relief for both the individual and their loved ones.

Greater Control and Autonomy

A terminal illness can make individuals feel as though they have lost control over their lives. By choosing a viatical settlement, patients regain a sense of autonomy over their financial decisions. They can decide how to spend their settlement and what priorities they want to focus on during their remaining time. This can be empowering and provide a renewed sense of purpose.

Peace of Mind for Family

Terminally ill individuals often worry about the financial strain their illness places on their family. A viatical settlement can alleviate these concerns, ensuring that loved ones are not left with overwhelming debts or financial obligations. This peace of mind allows both the patient and their family to focus on emotional healing rather than financial problems.

- Case Study: Maria, a 65-year-old woman with terminal heart disease, sold her life insurance policy for $250,000 through a viatical settlement. She used part of the money to pay for her hospital bills and the rest to set up a college fund for her grandchildren. Knowing that her family was taken care of brought Maria immense emotional comfort during her final months.

For individuals facing the emotional and financial toll of a terminal illness, a viatical settlement can offer both immediate financial relief and the emotional comfort that comes with regaining control over life decisions. By addressing pressing financial needs and easing the burden on loved ones, viatical settlements provide a valuable option that allows terminally ill individuals to focus on what truly matters during their remaining time.

To find out if a viatical settlement may be an option for you, please give us a call at 800-973-8258. We will let you know if you are likely to qualify and assist you with a no obligation policy appraisal.