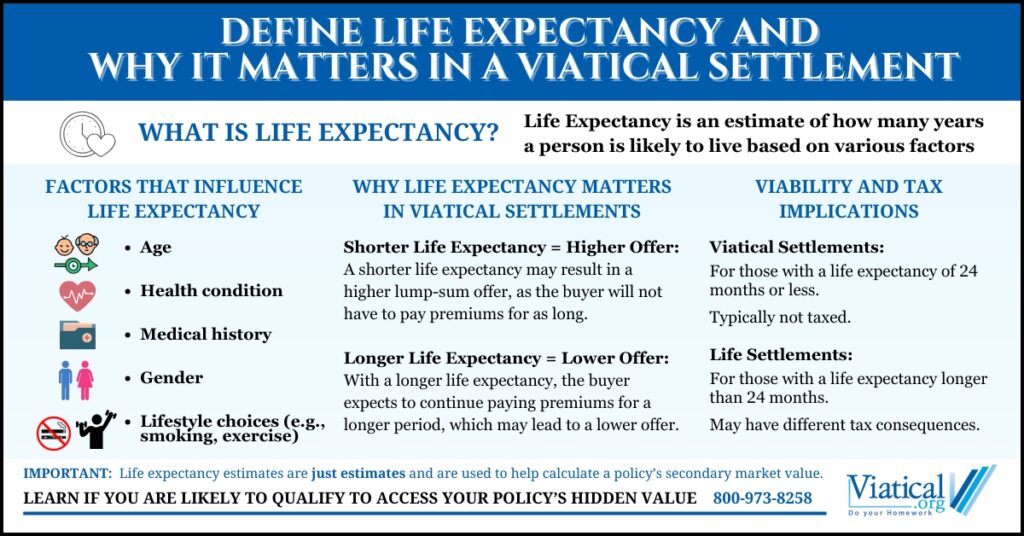

In the context of a viatical settlement, it’s important to define life expectancy and why it matters in a viatical settlement. Life expectancy is a key factor that helps determine the value of your life insurance policy in this type of transaction. It refers to the average number of years a person is expected to live, based on factors such as age, health, and gender. Understanding life expectancy is crucial for anyone considering selling their life insurance policy, as it directly impacts the amount of money you may receive in exchange.

Life Expectancy and Its Role in Viatical Settlements

In a viatical settlement, individuals who are terminally ill or have serious medical conditions can sell their life insurance policy for a lump-sum payment. Life expectancy plays a pivotal role in determining how much that payment will be. The shorter the life expectancy, the higher the potential payout, as the buyer expects the policyholder to pass away sooner and will collect the death benefit more quickly.

Life expectancy estimates are also crucial for policy valuations because they have a direct impact on how long a prospective buyer can expect to be paying premiums. In cases with lower life expectancies, buyers are able to make higher offers, as the cost of holding the policy is presumably lower. Buyers anticipate that they will not have to continue paying premiums for an extended period, making the policy more attractive.

However, it’s important to remember that life expectancy estimates are just that—an estimate. While medical professionals use available data and mortality tables to predict life expectancy, the reality is that these are educated guesses, not guarantees. Sometimes, policyholders may greatly outlive these estimates, and in other cases, they may pass away much sooner than anticipated. There is no way to truly and accurately predict an individual’s exact life expectancy.

How Life Expectancy Is Determined

Life expectancy estimates are typically provided by medical professionals who work for third-party life expectancy providers. These providers are independent entities that specialize in assessing life expectancy by thoroughly reviewing the policyholder’s medical records. Their doctors will consider the person’s age, health conditions, medical history, and any current treatments being undergone. The review is meant to give the underwriters a comprehensive picture of the individual’s health, helping to determine a more accurate life expectancy estimate.

It is imperative that policyholders provide up-to-date, complete medical records to these life expectancy providers. This ensures that the assessment is as accurate as possible and reflects the full scope of the individual’s health status. If any medical records are incomplete or outdated, it could affect the accuracy of the life expectancy estimate, ultimately impacting the settlement offer. This thorough review process helps the life expectancy provider assess the true risk involved and determine a fair payout amount.

In some cases, the process can take longer, especially for individuals with rare diseases or complex medical conditions. These cases may require additional time for the life expectancy provider to gather and analyze relevant medical data, which can affect the speed at which the settlement offer is made.

Why Life Expectancy Matters in a Viatical Settlement

Life expectancy is important because it affects both the payout you will receive and the risk involved for the buyer. If your life expectancy is shorter, the buyer anticipates a quicker payout, which may result in a higher lump-sum offer. A longer life expectancy could lead to a lower payout, as the buyer would have to wait longer to receive the death benefit.

Additionally, it’s important to understand that a policy sale by someone with a life expectancy of 24 months or less is considered a viatical settlement, while longer life expectancies are categorized as life settlements. This distinction is important, as these two types of settlements may have different tax implications. Viatical settlements are typically not taxed, providing a significant financial benefit for those who qualify under the 24-month life expectancy threshold.

Knowing how to define life expectancy and why it matters in a viatical settlement is crucial to understanding how much you might receive when selling your life insurance policy. Life expectancy is a determining factor in the settlement offer, and a shorter life expectancy often leads to a higher payout.

To ensure that your life expectancy estimate is as accurate as possible, it is essential to provide up-to-date, complete medical records. These records are used to gain a full and detailed picture of your health, which ultimately impacts your settlement offer. However, it’s important to understand that life expectancy estimates are never guaranteed, as life expectancy can be unpredictable.

To learn if you are likely to qualify to access the hidden value in your life insurance through a viatical settlement, please give us a call at 800-973-8258