When diagnosed with stage 4 cancer, individuals often face overwhelming medical bills and financial pressures. One potential way to alleviate some of these burdens is through a viatical settlement. This type of settlement allows individuals with life-threatening conditions, including certain cancers, to sell their life insurance policy for a lump sum of cash. But does stage 4 cancer always qualify for a viatical settlement?

Understanding Viatical Settlements

A viatical settlement involves the sale of a life insurance policy to a third party for a lump sum that is a percentage of the death benefit. The buyer then assumes the responsibility for paying premiums and eventually receives the full death benefit when the policyholder passes away. This option is often used by individuals with terminal illnesses to access immediate funds, which can be used to cover medical costs, living expenses, or other needs.

Does Stage 4 Cancer Always Qualify?

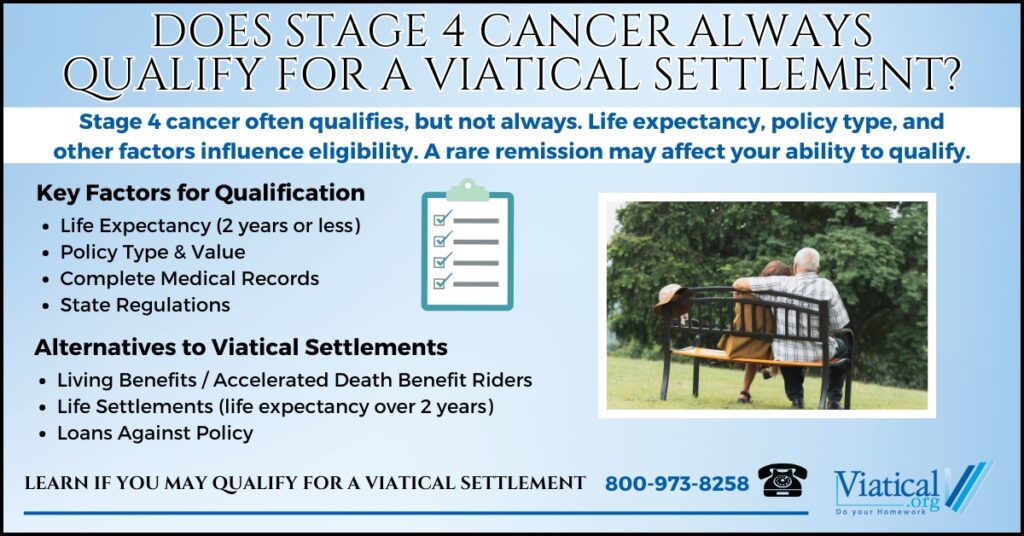

While having stage 4 cancer is a serious condition, it does not always guarantee eligibility for a viatical settlement. The qualification for a viatical settlement depends on several factors beyond just the diagnosis of stage 4 cancer. These include:

- Life Expectancy: Viatical settlements typically require a life expectancy of 2 years or less. While stage 4 cancer often carries a poor prognosis, some individuals may still live for longer than expected, especially with advancements in treatment. As a result, life expectancy can influence whether the individual qualifies for a viatical settlement.

- Policy Type and Value: The type of life insurance policy you hold matters. A term life insurance policy, universal life, or whole life insurance policy may be eligible for a viatical settlement, but the policy terms must meet certain criteria. Policies with high premiums or small death benefits may not provide enough value to make a settlement worthwhile.

- Underwriting Process: Life settlement companies use underwriting guidelines to assess eligibility. This includes reviewing medical records and consulting with medical professionals at third party life expectancy provider companies to evaluate the severity of the condition. In some cases, stage 4 cancer patients may not meet the underwriting requirements for a viatical settlement, especially if they do not have a short life expectancy.

- State Regulations: The rules for viatical settlements vary by state, and some states may have stricter guidelines around life expectancy. It’s important to consult with a professional who understands the regulations in your state to determine your eligibility.

The Possibility of Remission

While rare, some people with stage 4 cancers do go into remission, which can make them less likely to qualify for a viatical settlement. Remission means that the cancer is no longer detectable or the disease is under control, which can significantly improve life expectancy. Since viatical settlements are typically offered to those with terminal illnesses and a life expectancy of 2 years or less, individuals in remission may no longer meet these criteria. In such cases, a viatical settlement may no longer be an option. However, those with a longer life expectancy may still qualify to access their policy’s hidden value through a life settlement.

Alternatives to Viatical Settlements

While a viatical settlement may be a helpful option for some, it is not the only choice. Here are some alternatives to consider:

- Life Settlements: Similar to viatical settlements, life settlements allow individuals to sell their life insurance policy. Life settlements typically apply to people who are older and may not have a terminal illness but still want to sell their policy for financial reasons. This option might be available even if you don’t meet the strict criteria for a viatical settlement.

- Living Benefits / Accelerated Death Benefit Riders: Many life insurance policies offer living benefits or accelerated death benefit riders, which allow policyholders to access a portion of their death benefits while still alive. Not everyone will qualify for this option and qualification factors vary by carrier.

- Loans Against the Policy: Another option is taking a loan against the cash value of your life insurance policy. While this can provide immediate funds, it will reduce the death benefit unless repaid.

Having stage 4 cancer can certainly make someone eligible for a viatical settlement, but it is not a guarantee. Several factors—such as life expectancy, the type and value of the insurance policy, and underwriting guidelines—play a role in determining eligibility. Additionally, while rare, some individuals with stage 4 cancer may go into remission, which can affect their ability to qualify for a viatical settlement. It’s crucial to consult with an experienced life settlement expert to understand your specific situation and explore the best options for financial support during this challenging time.

If you are considering a viatical settlement, please give us a call to learn if you’re likely to qualify and for a no-obligation policy appraisal. 800-973-8258