If you’re researching options to cover the high cost of medical care, prescriptions, or daily living expenses while managing a serious cardiac condition, you may be wondering about viatical settlements for patients with heart disease. This option allows eligible individuals to sell their life insurance policy to a third-party buyer in exchange for a lump sum of cash, which can then be used however the seller chooses.

Understanding Viatical Settlements

A viatical settlement is a financial transaction in which a person with a life-threatening illness sells their life insurance policy for immediate cash. The buyer becomes the policy’s beneficiary and takes over premium payments. Upon the policyholder’s death, the buyer receives the death benefit. For the policyholder, the benefit is being able to use the cash now, when it’s most needed.

Viatical settlements are typically available to those diagnosed with a terminal illness and a life expectancy of 24 months or less. While cancer is a common qualifying condition, many patients with advanced cardiovascular disease also meet the eligibility requirements.

Heart Disease and Financial Stress

Many people living with heart disease face mounting financial pressure, especially when dealing with advanced or chronic conditions such as:

- Congestive heart failure (CHF)

- Coronary artery disease (CAD)

- Cardiomyopathy

- End-stage heart disease

- Severe arrhythmias requiring implantable devices or interventions

Ongoing treatment, frequent hospital visits, and an inability to work full-time can result in significant financial hardship. A viatical settlement can provide critical relief by unlocking the value of a life insurance policy that might otherwise go unused.

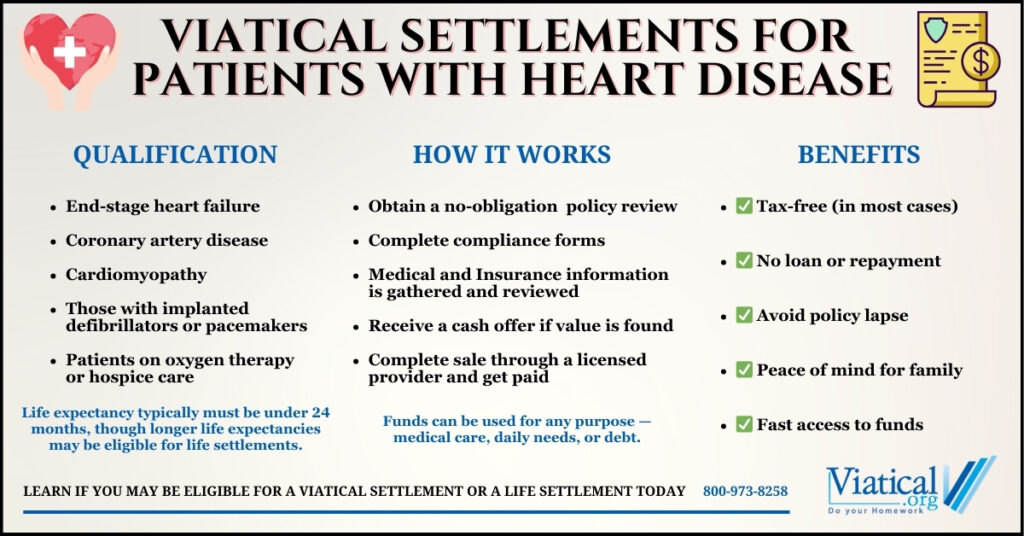

Who Qualifies for a Viatical Settlement with Heart Disease?

To qualify for a viatical settlement, one should have:

- A life expectancy of 24 months or less (though some buyers may be flexible depending on comorbidities)

- A life insurance policy with a death benefit of at least $100,000 (in most cases)

- Documented medical records

Patients with end-stage heart failure or those on long-term medication, oxygen therapy, or palliative care may be eligible. If heart disease is accompanied by other serious health conditions such as diabetes, kidney disease, or COPD, this may also influence eligibility.

Benefits of a Viatical Settlement for Cardiac Patients

There are several reasons why patients with heart disease might consider a viatical settlement:

- Immediate cash to cover medical bills, home care, or everyday expenses

- Tax-free proceeds (in most cases, viatical settlement proceeds are considered an advance of the death benefit and are not subject to tax)

- No repayment or restrictions on how the funds are used

- Avoiding policy lapse if premiums can no longer be maintained

- Improved peace of mind during an emotionally and physically challenging time

How the Process Works

The process typically involves:

- Initial Consultation: Speak with a viatical settlement company to determine if your policy and condition qualify.

- Document Submission: Provide medical records, policy information, and consent for review.

- Offer Review: Receive an offer based on your life expectancy, policy value, and other factors.

- Settlement Agreement: If you accept the offer, sign the necessary paperwork to transfer ownership.

- Receive Payment: Funds are typically disbursed in a lump sum within weeks.

Finding the Right Buyer

It’s important to work with a reputable and experienced viatical settlement company who prioritizes transparency and patient care. Working with our platform allows your policy to be shown to direct buyers without the need to subtract a broker fee (often 30% or more) from your offer.

If you or a loved one is living with severe heart disease, exploring a viatical settlement could help ease financial burdens during an already challenging time. Selling a life insurance policy is a personal decision, but for many, it provides the financial flexibility to maintain quality of life and focus on what matters most.

Learn more about whether your policy qualifies and how to start the process 800-973-8258