Stomach cancer, also known as gastric cancer, can be an overwhelming diagnosis—not just physically and emotionally, but financially as well. For patients facing late-stage or terminal forms of the disease, the cost of care, travel, and loss of income can add up quickly. Viatical settlements for patients with stomach cancer offer a potential financial lifeline by allowing individuals to access cash now from their existing life insurance policies.

What Is a Viatical Settlement?

A viatical settlement is a financial transaction in which a person with a life-threatening illness sells their life insurance policy to a licensed buyer in exchange for a lump-sum cash payment. The payout is higher than the policy’s cash surrender value but less than the death benefit. Once the policy is sold, the buyer takes over premium payments and becomes the beneficiary.

The funds received in a viatical settlement can then be used however the seller chooses—whether to pay for medical treatment, hire in-home care, or simply improve their quality of life.

Why Stomach Cancer Patients May Qualify

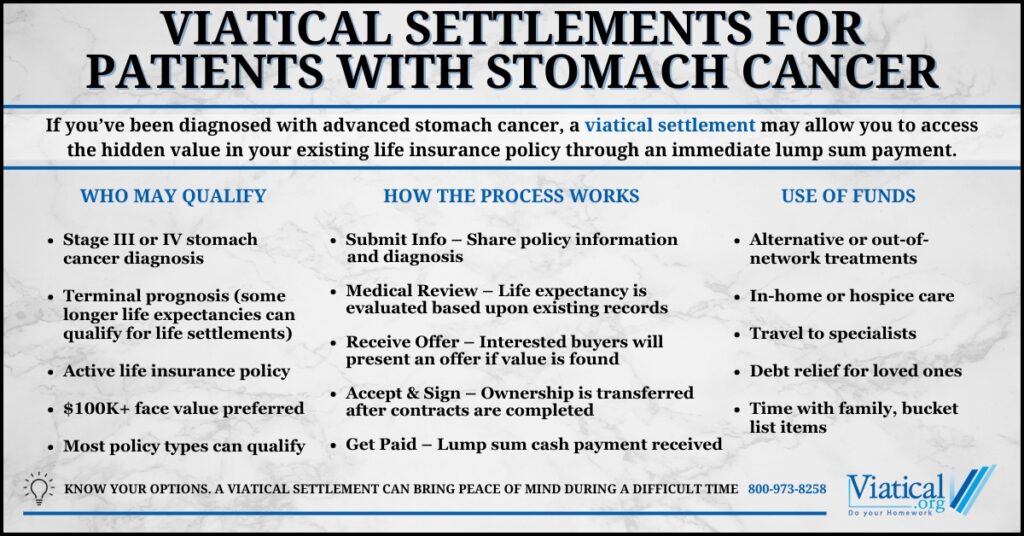

Stomach cancer can often go undetected until it’s already in an advanced stage, which may result in a shortened life expectancy. Viatical settlements are typically available to individuals with a life expectancy of 24 months or less, making many stomach cancer patients eligible. Even if your prognosis is not that bleak, you still may qualify to sell your policy for cash with a longer life expectancy. Every case is different; it’s always best to call.

Some qualifying factors may include:

- A diagnosis of stage III or stage IV gastric cancer

- Terminal prognosis confirmed by a physician

- Active life insurance policy (term, whole, universal life, even group policies may qualify)

- Policy typically must have a face value of $100,000 or more, though smaller policies may be considered in some cases

How the Process Works

The viatical settlement process for stomach cancer patients is generally straightforward and confidential:

- Initial Review – The policyholder or their representative submits basic information about the policy and medical condition.

- Underwriting – The life insurance company or prospective buyer reviews the policy terms and medical records to assess eligibility and obtain an estimate of life expectancy.

- Offer Issued – If eligible and there is interest, a viatical settlement purchaser makes a cash offer based on the policy value, premiums, and expected life span.

- Sale Finalized – If the offer is accepted, contracts are signed and the policy ownership is transferred. Payment is typically issued within days.

This process can often be completed in as little as 2–4 weeks, depending on how quickly medical records and insurance verification are provided.

Common Uses for the Funds

Viatical settlements can provide financial relief at a time when it’s most needed. Patients with stomach cancer often use the funds for:

- Experimental or integrative treatments not covered by insurance

- Travel expenses for specialized care or time with family

- Hiring private caregivers or hospice support

- Paying off debts to relieve family members of future burdens

- Creating lasting memories through family trips or meaningful experiences

There are no restrictions on how you use the money.

Will It Affect Medicaid or SSI?

If you are receiving needs-based government benefits such as Medicaid or Supplemental Security Income (SSI), it’s important to understand that the proceeds from a viatical settlement could count as income or assets. In some cases, this may affect eligibility. However, there are ways to protect the funds through spend-down strategies. A Medicaid Life Settlement may be an option available to you.

Are Viatical Settlements Taxable?

In most cases, viatical settlements are not taxable when the seller is terminally ill (with a life expectancy of 24 months or less) and the transaction meets IRS guidelines. However, tax laws can vary, so consulting a tax professional is always recommended.

Choosing the Right Buyer

Not all life settlement companies offer the same level of transparency or value. When exploring viatical settlements for patients with stomach cancer, make sure to:

- Verify that your case will be closed by a provider licensed in your state

- Review all fees and terms Many times, broker fees can be 30% of more of your offer. These fees should be disclosed to you.

You do not need to work with a broker, although some people choose to. Just be aware that brokers may take a commission out of your proceeds. When working with Viatical.org, you will never need to subtract a broker fee from your offer.

If you or a loved one is facing a difficult prognosis with stomach cancer, selling a life insurance policy may provide a source of financial relief when it’s most needed. Viatical settlements for patients with stomach cancer can offer peace of mind, giving you more control over your care, your comfort, and your remaining time.

For those navigating the realities of advanced cancer, knowing all your options—including the ability to access value from your life insurance—can be empowering. If you think you may qualify, start by getting a confidential evaluation to find out how much your policy may be worth. 800-973-8258