If you’re looking to get enhanced cash value from your universal life insurance, you may be able to unlock significantly more than your policy’s surrender value—especially if you qualify to sell all or even a portion of your life insurance policy for cash, now while you are still alive. This financial option allows you to sell your policy to a third party for a cash payout that may far exceed what you’d get by simply canceling your policy.

What Exactly Is Enhanced Cash Value from Universal Life Insurance?

Enhanced cash value refers to the higher amount you may receive for your life insurance policy through a life settlement, compared to the cash surrender value on your universal life insurance annual statement. This is made possible because institutional buyers are willing to purchase qualifying policies based on your age, health status, and the policy’s terms. In essence, it allows you to unlock hidden value from a policy you no longer need or can’t afford to keep.

Why Insurance Companies Offer Enhanced Surrender Value

In some cases, insurance companies offer what’s known as an enhanced surrender value in an attempt to buy back policies before they are sold on the secondary market. These offers are typically positioned as a generous option, but in reality, they are often lower than what you could receive from a life settlement. Life insurance companies have a vested interest in minimizing payouts, while third-party buyers competing in the life settlement market may offer substantially more—especially for policies that meet investor criteria.

Guaranteed Universal Life and Enhanced Settlement Value

One often-overlooked opportunity lies with guaranteed universal life (GUL) insurance. While these policies are designed to offer long-term coverage at a lower cost, they are particularly attractive in the life settlement market due to their guaranteed death benefit and relatively low premiums. If you hold a GUL policy, it may command more value than a traditional universal life policy—especially you are older or have experienced health changes. These policy types often yield some of the highest offers in life settlements, making them strong candidates for enhanced cash value.

Who Can Qualify?

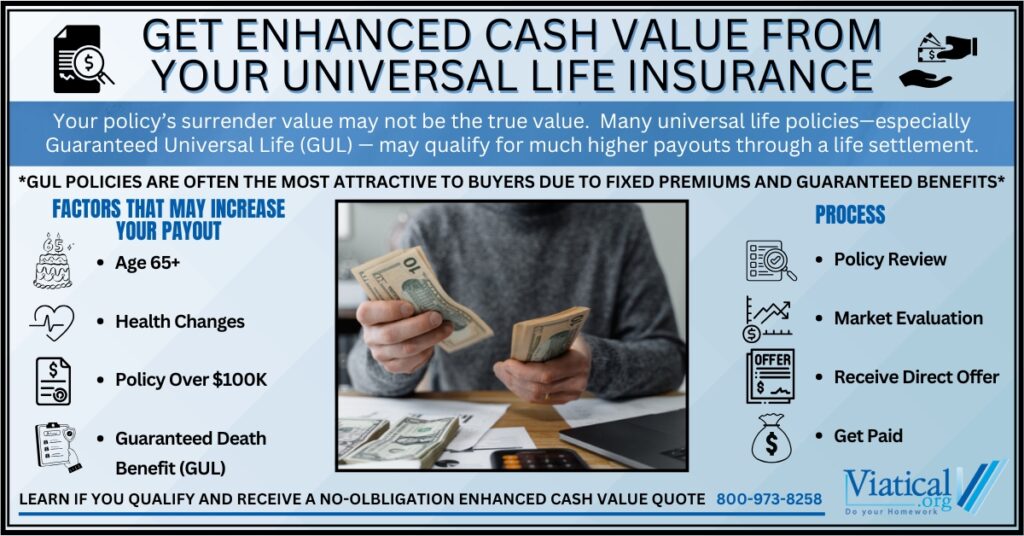

To get enhanced cash value from life insurance, certain conditions generally need to be met:

- Age: You typically need to be 65 or older, though younger individuals with serious health conditions may also qualify.

- Policy Type: Universal Life policies are most commonly eligible, but even convertible term policies can qualify if convertible to the right type of policy.

- Policy Size: Usually $100,000 or more in death benefit, but some smaller policies may qualify. As every case is different, it is always best to call to verify eligibility.

- Health Changes: Declines in health since the policy was issued can actually increase the value of your policy in the secondary market.

Why Not Just Surrender the Policy?

When you surrender a policy, the insurance company pays you the accumulated cash value—minus any fees. But if your policy qualifies for a life settlement, buyers may offer two to four times that amount, depending on the details. This can make a huge difference if you’re looking to supplement retirement income, cover long-term care costs, or simply eliminate premium payments.

How the Process Works

- Policy Review: A life settlement company or direct buyer evaluates your policy and health information.

- Offer Stage: If your policy qualifies and there is interest, you’ll receive a cash offer—typically much higher than the surrender value.

- Transfer & Payment: Once you accept an offer, the buyer becomes the new policy owner and beneficiary. You receive a lump sum payment, and you’re no longer responsible for future premiums.

Key Considerations

- Tax Implications: Typically, anything you receive beyond the total amount of premiums you’ve paid into your policy is taxable, but it is always best to check with your trusted tax advisor.

- Beneficiaries: Selling your policy means your beneficiaries will no longer receive the death benefit.

- Alternatives: If you still need some coverage, a partial life settlement (also known as a retained death benefit) may be an option.

Knowing how to get enhanced cash value from your universal life insurance can open up significant financial opportunities. If your policy is no longer serving its original purpose—or if you’re struggling with premium payments—life settlements may allow you to cash out for much more than the insurance company is offering. Always compare options carefully—especially if your policy is a guaranteed universal life policy, which often yields premium offers on the secondary market.

To learn if you are likely to qualify to sell your life insurance policy for cash in a short 5–10 minute phone call, please reach out to us at 800-973-8258. We can help you obtain a no-obligation enhanced cash value quote for all or a portion of your policy.