Facing a glioblastoma diagnosis is overwhelming. Between navigating treatment options, coping with physical changes, and preparing emotionally, financial concerns can add an extra layer of stress for patients and their families. Fortunately, a glioblastoma life insurance payout through a viatical settlement can offer critical financial support when it’s needed most, providing cash that can ease the burden and bring comfort during a difficult time.

A viatical settlement allows someone with a terminal illness, such as glioblastoma, to sell their life insurance policy to a licensed buyer for a lump-sum cash payment. While even healthy individuals can sometimes qualify to sell their life insurance policy, having glioblastoma often opens up additional options you may not be aware of — including the possibility of selling just a portion of your policy. This can help eliminate financial stress and give families the flexibility they need during a difficult time.

How a Viatical Settlement Works

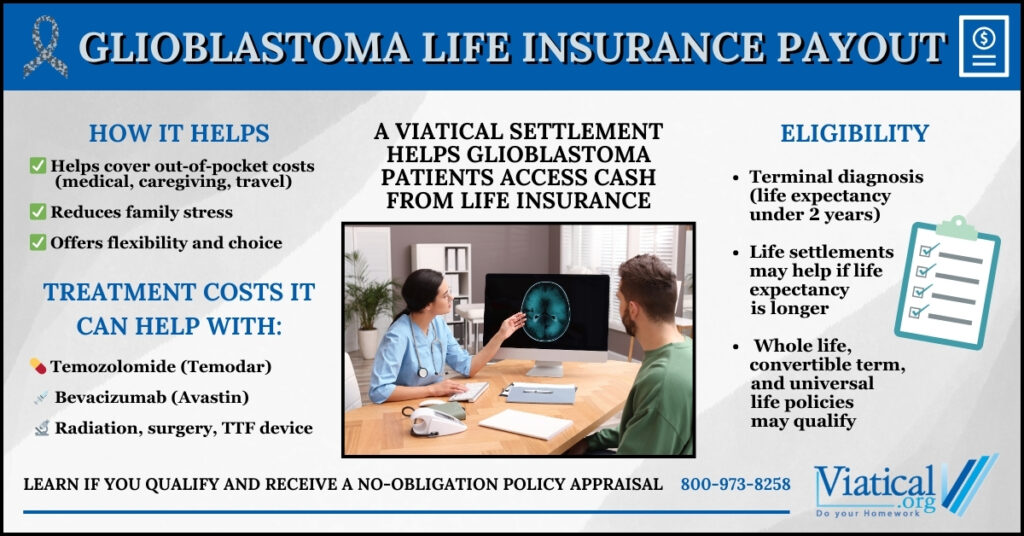

A viatical settlement involves selling a life insurance policy to a third party. The buyer becomes the policy’s owner, takes over premium payments, and receives the death benefit when the insured passes away. In return, the insured gets a cash payout right away, which can be used for:

- Medical expenses — such as treatments, medications like bevacizumab (Avastin), and other targeted therapies

- In-home care or hospice — hospice and palliative care ensure comfort and dignity at home

- Travel for specialized care — when the best options are far from home

- Daily living costs — like mortgage, utilities, or groceries

- Bucket list goals — creating meaningful memories with loved ones

For glioblastoma patients, this payout can provide peace of mind, allowing them to focus on care and quality of life without constant financial worries. Even if you are looking to get enhanced cash value from your universal life insurance, a viatical settlement can often deliver a larger payout than the surrender value — making it a valuable option to explore.

Common Glioblastoma Treatments

Treating glioblastoma typically involves a combination of therapies aimed at slowing tumor growth and managing symptoms. Some of the most common treatments include:

- Surgery — to remove as much of the glioblastoma tumor as safely possible

- Radiation therapy — to target and destroy cancer cells

- Chemotherapy — often with the drug temozolomide (Temodar)

- Tumor treating fields (TTF) — tumor treating fields is accomplished by a wearable device that delivers electric fields to slow cancer cell division

- Clinical trials — clinical trials can offer access to experimental treatments or novel therapies

While insurance may cover part of these treatments, many families face significant out-of-pocket costs, including deductibles, copays, travel, and caregiving expenses. A viatical settlement can help cover these uncovered costs, giving patients more options and easing the financial burden.

Who Qualifies for a Glioblastoma Life Insurance Payout?

Most viatical settlement buyers will consider:

- Policy type — convertible term, whole life, or universal life policies

- Policy size — usually over $100,000 in face value

- Health status — typically a life expectancy of two years or less

Because glioblastoma is considered a terminal illness, many patients meet the eligibility requirements. However, if someone has a longer life expectancy (over two years), they may still qualify to access cash through life settlements — a similar option that helps policyholders unlock value from their life insurance even without a terminal diagnosis.

Steps to Access a Viatical Settlement

- Gather your policy details — Know your policy type, face value, and any cash value.

- Find a reputable company — Choose an experienced company with viatical settlement expertise.

- Submit health and policy information — Direct buyers use this to evaluate eligibility and potential payout.

- Receive and review the offer — If value is found and there is interest, a direct buyer will present an offer to you. If accepted, you will proceed with signing contract documents.

- Complete the sale and receive funds — Once finalized, you typically receive funds within weeks.

The best company to sell your life insurance to will walk you through each step, answer questions, and ensure you feel comfortable throughout the process.

Why Consider a Viatical Settlement?

A glioblastoma life insurance payout offers several key benefits:

- Relieves financial pressure on family

- Provides funds for better care or treatment options

- Allows patients to fulfill meaningful wishes

- Prevents policies from lapsing with no value

A viatical settlement is a valuable solution that helps families navigate one of life’s hardest journeys with less financial fear.

If you or a loved one is facing glioblastoma, exploring a glioblastoma life insurance payout through a viatical settlement may offer much-needed support. It’s a way to unlock the hidden value of your policy and bring comfort, choice, and peace of mind during this profoundly challenging time.

For a no-obligation policy appraisal, please give us a call at 800-973-8258