The best company to sell your life insurance policy to is the one that will net you the most money for your life insurance policy, provided they are licensed. Non-licensed entities and individuals are permitted to purchase 1 or 2 policies per year in most states, and there are groups that actively solicit to that end. It is always best to deal with a licensed buyer.

Who is licensed to buy life insurance policies?

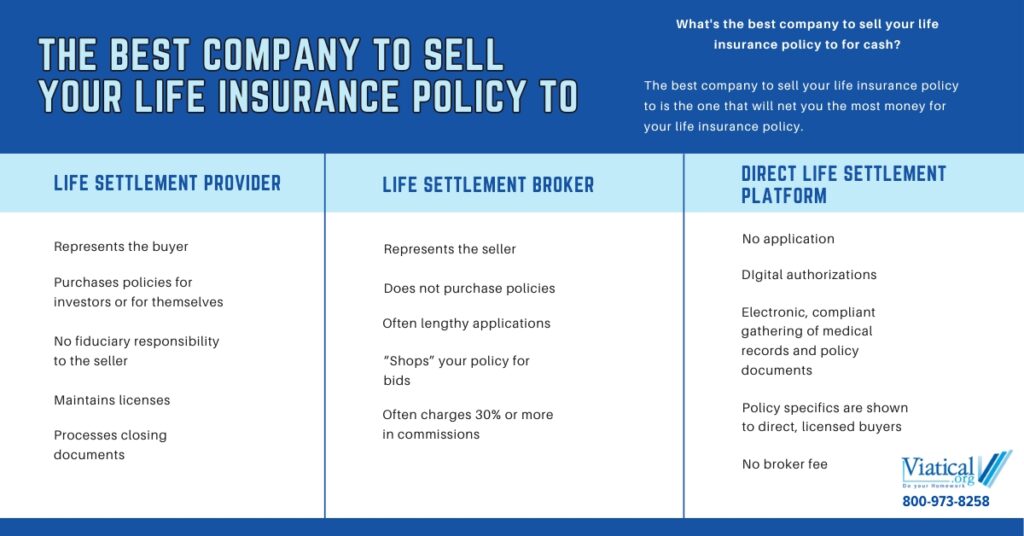

Life Settlement Providers are licensed to purchase life insurance policies, but most of them purchase policies to sell to institutional buyers or buy policies on various funds’ behalf. Though a Provider is the only entity licensed to purchase a life insurance policy, they ultimately hold no obligation with respect to a sales price to you, the seller of an insurance policy, beyond fair practice.

It is always best to get more than one bid for your life insurance policy and you should have your policy appraised before you do anything.

How are life settlement brokers paid?

Life settlement brokers do not purchase insurance policies. A life settlement broker maintains a license to represent the seller of a life insurance policy in the sales transaction and maintains a fiduciary capacity to the life insurance policy seller. Brokers are supposed to gather your medical information, muster your insurance documents, and get your policy to market as broadly as possible.

Unfortunately, some brokers do not do everything they are required to do. Many brokers we have spoken with worry that if they show your policy to the wrong buyer, that purchaser of life insurance policies will circumvent them and make an offer to you directly. Other brokers just hand off your policy to one or two life insurance policy buyers without shopping it widely.

Many brokers do a thorough job of shopping your policy, but the average commission for representing you in a transaction is around 30% of the sales proceeds. Most brokers require that you sign an agreement with them that you will only sell through them for a stipulated period of time.

If you choose to use a broker, please tell them that you are securing a direct offer on the viatical.org platform and that you need that excluded from the agreement. Some brokers refuse to work the case after you tell them you are getting a direct bid, but it is certainly your right, and it is not difficult.

What is a life settlement platform?

Most Life Settlement Providers resell your life insurance policy in the tertiary market after they purchase it and no Life Settlement Brokers are supposed to buy policies. The end buyer of life insurance policies maintains the policy with premiums with the intent of holding your policy until it matures.

Our platform will compliantly gather your medical information and secure your verification of coverage and all of the appropriate insurance illustrations that life settlement and viatical funds need in order to value your policy. All policies need to be closed by a licensed Provider, but by getting your policy in front of the actual end life insurance buyers with no broker fee, should yield you a higher offer.

Once digital authorizations are signed authorizing our platform to securely get your medical information and insurance documents, you are essentially done until valuations and bids are returned. You are never under any obligation to sell your policy and you pay no fee. Platform fees are paid by the direct licensed life insurance buyers in your state.

Who pays the most for your life insurance policy?

Who pays the most for your life insurance policy doesn’t necessarily mean you receive the most. The secondary market for life insurance is an evolving industry. Our founder was invited to introduce the direct-to-consumer approach to the Life Insurance Settlement Association (LISA) conference in 2016. We are proud that our consumer direct process has become even more efficient since that time.

We encourage you to call us. It only takes 5 or 10 minutes to learn if you’re likely to qualify. If you already have a bid for your insurance policy or just have a question, pick up the phone. That’s why we’re here. 800-973-8258