You may be able to cash out your term life insurance policy and actually sell your term life insurance policy for cash. This comes as a shock to many policy owners who mistakenly assume that when the term on your life insurance policy is up, your insurance and all the premiums you have paid over the years are simply gone.

If your health has slipped since you purchased your term life insurance policy, you may now have a hidden value in your term life insurance policy, value that you can access NOW as a cash payment for your policy.

Types of Insurance

Insurance companies sell different types of policies. Universal Life and Whole Life policies have a cash value element to them in addition to life insurance. The concept of permanent insurance is that you pay above and beyond what the actual cost of insurance and the excess cash receives interest and/or dividends that offset the amount of life insurance you are purchasing.

This accumulation of cash is meant to help keep the policy in force in later years when your actual cost of insurance per 1000 is often many times the cost of insurance on the day you bought your policy. Because of low interest rates, many interest sensitive products have underperformed the illustrations that were distributed 15 or 20 years ago.

Many people do not realize that the less cash value you have in a Universal Life policy, the more apt it is to qualify as a life settlement. By definition, a life settlement is selling your policy for a lump sum of cash that is greater than your current cash value. So, if you have a low or non-existent cash value, it would make sense that it is easier to surpass that offer. (That is what it is. Your cash surrender value is what your insurance company is going to give you, or offer you, to surrender your life insurance policy back to them.)

Term life insurance was never designed to develop a cash value and is often described as pure life insurance. Your life insurance company charges you a monthly rate per 1000 dollars of insurance. The amount is based upon your age and the status of your health at issue.

Some term life insurance policies will increase in price each year and others will be level for a certain term such as 5 years, 10 years, or 20 years. Some term policies are to a particular age, such as 65 or 70. There are a variety of policy provisions that matter in the valuation of your insurance policy, but the most critical variable when you are selling a term life insurance policy is whether it is convertible or not.

If your life insurance policy is convertible, you have the option to convert your term life insurance into a permanent life insurance policy. The type of policy to which you are able to convert is critical. Whole Life insurance usually does not have any value or very little value in the secondary market for life insurance unless your health has slipped.

Universal life insurance is far and away the type of policy that is purchased most often as a life settlement. This is because the policy owner (either you or the fund to which you sell your policy) has flexibility in premiums. Depending on policy specifics, you may be able to pay the very minimal cost of insurance to keep your policy in force. This is called premium optimization and it allows you minimize the amount of cash outlaid in premiums and maximize the return on capital used to purchase your policy.

Steps to Sell Your Policy for Cash

The steps in selling your term life insurance policy are pretty straight forward, but can be involved.

Qualify

It usually only takes a 5- or 10-minute phone call for us to determine if you and your policy is likely to qualify for a cash payment. There is no application.

Appraisal

If it looks like you qualify to sell your life insurance policy, your medical records and illustrations we obtain from your insurance company are underwritten to derive the market value of your policy.

You need only sign our digital authorization and our platform will muster your medical records inside of your HIPAA rights and securely gather verification of coverage and the proper illustrations from your insurance carrier. You are under no obligation and there is no charge to you.

Offers

Once you know approximately what your term life insurance policy is worth and you desire to sell it, your policy is taken to market and offers are secured and delivered to you by a licensed buyer in your state.

Offer Acceptance

You are under no obligation to accept any offer for your policy. When you accept your offer, the buyer will escrow the purchase funds. You will receive a packet of transfer documents to sign and the licensed Provider will initiate the transfer of ownership with your insurance company.

Transfer of Ownership

Once verification that ownership of your policy has changed is received from your insurance company, the proceeds from the sale of your life insurance policy are released to you. Most states give you 14 days to change your mind and undo the transaction. This is called the recission period and it exists to protect you and your rights.

After Transfer

Once you receive a cash payment for your life insurance policy, you are no longer the owner and are no longer responsible for any premium payments. The ownership and beneficiary of your policy will be the purchasing fund and the fund will receive the death benefit of your life insurance policy when you pass.

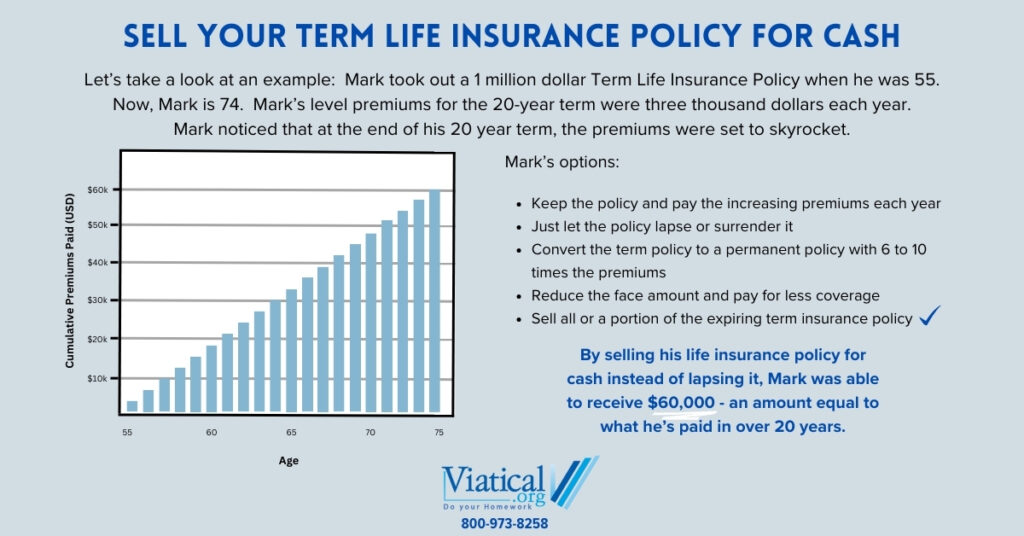

Not all life insurance qualifies to be sold and it truly is a case by case basis and dependent upon your health and your insurance policy specifics. Considering more than 90% of term life insurance policies never mature by paying a death benefit; and considering many insurance companies strongly discourage or even prevent their agents from the mere mention of the option to convert and sell your life insurance policy, you are absolutely your own best advocate.

It takes 5 or 10 minutes on the phone to learn if you are likely to qualify. Please do a little homework and learn if you qualify to sell your term life insurance policy for cash before you simply lapse and discard it like most people do. Please give us a call and we will answer your questions and help you get pre-qualified.