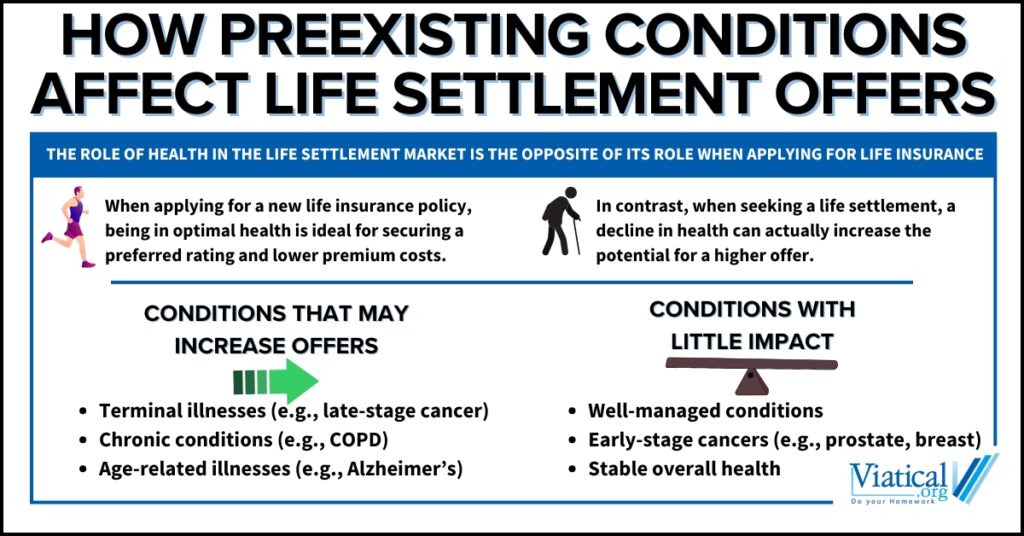

When considering selling your life insurance policy, it’s important to understand how preexisting conditions affect life settlement offers. These conditions can significantly influence the value of your policy and the offers you receive from potential buyers. Interestingly, the role of health in the life settlement market is the opposite of its role when applying for life insurance. When applying for a new life insurance policy, being in optimal health is ideal for securing a super-preferred rating and lower premium costs. In contrast, when seeking a life settlement, a decline in health can actually increase the potential for a higher offer.

Why Preexisting Conditions Matter

Life settlement providers assess the insured’s health as part of their valuation process. Preexisting conditions often shorten life expectancy, which in turn increases the potential return for the buyer. This makes policies whose insureds have certain preexisting conditions more attractive and valuable in the life settlement market.

Conditions That May Increase Policy Value

- Terminal Illnesses: Individuals diagnosed with terminal illnesses like late-stage cancer or advanced heart disease often receive higher offers due to the limited remaining premium payments required by the buyer. Insureds with a life expectancy of 2 years or less often qualify for a viatical settlement.

- Chronic Conditions: Chronic illnesses such as diabetes, COPD, or kidney disease can also enhance the value of a policy, although not to the same extent as terminal illnesses.

- Age-Related Health Issues: Conditions like Alzheimer’s or other forms of dementia in older individuals can influence settlement offers due to their impact on life expectancy.

Conditions That May Have Little Impact

Not all preexisting conditions significantly affect the value of a policy:

- Well-Managed Conditions: If a condition is well-controlled with treatment and has minimal impact on life expectancy, it may not significantly influence settlement offers. Longevity, rather than quality of life, is what impacts a policy’s hidden value.

- Stable Health Status: Individuals with preexisting conditions but a stable overall health status may not qualify for a life settlement or may receive a lower offer compared to someone with more pressing health concerns.

- Cancers Caught in Early Stages: Fortunately, cancers such as prostate and breast cancer caught in early stages are highly treatable and usually have little to no immediate impact on life expectancy.

Steps to Maximize Your Settlement Offer

- Provide Comprehensive Medical Records: Life settlement providers need a clear picture of your health history. Ensure all medical documentation is accurate and up-to-date.

- Have Your Policy Appraised: Understanding the appraisal value of your policy can help you set realistic expectations and navigate the life settlement process more effectively. We can assist you in obtaining a no obligation policy appraisal.

- Prepare Policy Information: Make sure your policy details, such as premiums, coverage amounts, and conversion options, are clear and available for potential buyers to review. It is always helpful to have a full copy of your policy on hand.

Preexisting conditions play a critical role in determining the value of life settlement offers. While some conditions can enhance the value of your policy, others may have little impact. Understanding the factors that influence settlement offers can help you make informed decisions and achieve the best possible outcome for your unique situation.

To find out if you’re likely to qualify for life settlements or a viatical settlement, please give us a call at 800-973-8258.