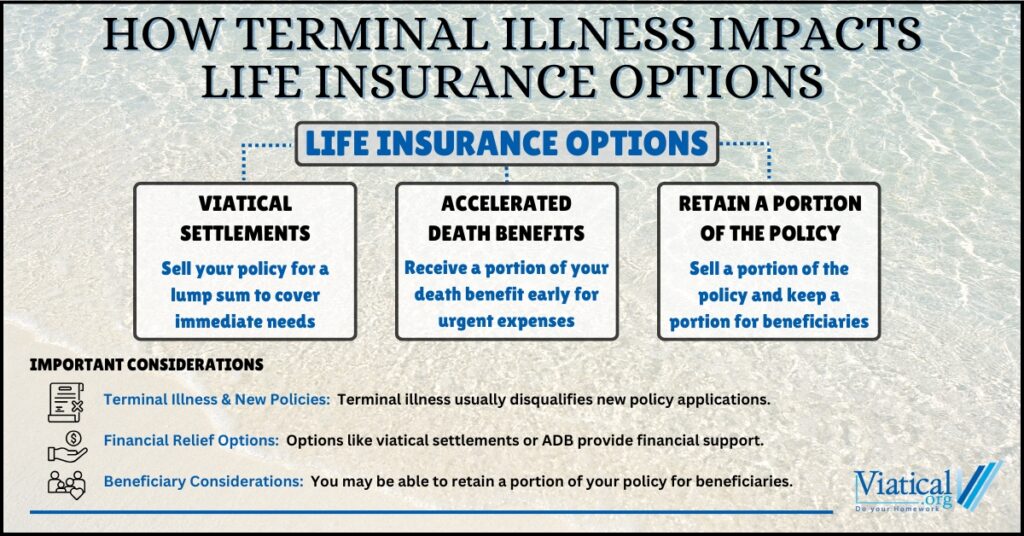

Facing a terminal illness is an incredibly challenging time, and understanding how terminal illness impacts life insurance options can provide valuable financial relief and peace of mind. If you or a loved one has a life insurance policy, it’s important to know that certain options, like viatical settlements or an accelerated death benefit, may be available to help cover expenses during this difficult period.

Exploring Viatical Settlements

One option for those with a terminal illness is a viatical settlement. This allows policyholders to sell their life insurance policy to a third party for a lump sum payment, which is higher than the policy’s cash surrender value but less than the death benefit. The buyer assumes responsibility for premium payments and receives the full death benefit upon the insured’s passing.

Viatical settlements can provide immediate funds to cover medical bills, living expenses, or other urgent financial needs. Policies eligible for a viatical settlement typically include term life insurance, whole life insurance, or universal life insurance, as long as the insured meets specific criteria, such as a life expectancy of two years or less. Those with a longer life expectancy may still qualify for life settlements.

Accelerated Death Benefits

Another option offered by many insurance companies is accelerated death benefits (ADB). With ADB, a portion of the policy’s death benefit is paid out early if the insured is diagnosed with a qualifying terminal illness. Unlike a viatical settlement, the remaining death benefit is still available to beneficiaries after the insured’s passing.

ADB payouts are generally tax-free but are limited to the terms set by the insurance provider, often a percentage of the total death benefit. Policyholders should carefully review their contract to understand the eligibility requirements and payout limits. Not everyone will qualify for this option. Contact your insurance company to learn the parameters you must meet in order to qualify.

Challenges in Obtaining New Insurance

It’s important to note that individuals with a terminal illness typically do not qualify for new life insurance policies due to their diagnosis. For this reason, maintaining and exploring options with an existing policy is critical. Those considering a viatical settlement should evaluate whether they may want to keep a portion of their policy to leave something for their beneficiaries. Some settlements allow for a partial sale of the policy, providing a balance between immediate financial needs and long-term legacy planning.

Comparing the Options

Both viatical settlements and accelerated death benefits can help ease financial burdens during a terminal illness. However, there are key differences:

- Control of Policy: A viatical settlement transfers ownership, while ADB allows the policyholder to retain their policy.

- Payout Amounts: Viatical settlements may provide larger lump sums compared to Accelerated Death Benefits.

- Tax Implications: Both funds from ADB and viatical settlements are typically tax free. Always consult with your trusted tax professional regarding your unique situation.

Key Considerations

Before deciding how to proceed, policyholders should research their options. Understanding policy terms, eligibility requirements, and the potential impact on beneficiaries can help you make an informed decision.

By learning how terminal illness impacts life insurance options, you can take steps to secure financial resources and focus on what matters most—spending time with loved ones. For more information, call us at 800-973-8258 to explore your options and find out if you are likely to qualify for a viatical settlement.