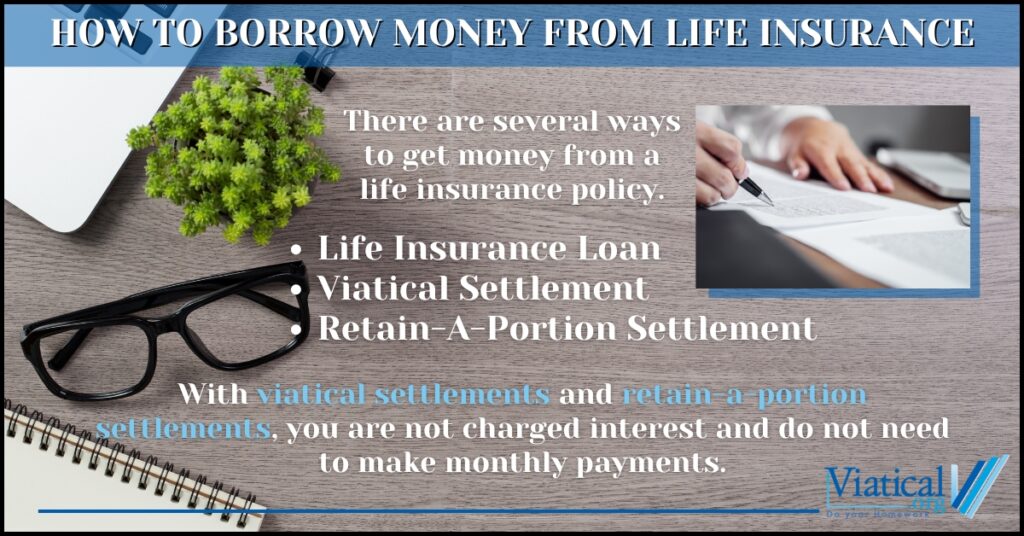

When unexpected financial challenges arise, knowing how to borrow money from life insurance can provide crucial financial relief. This process involves taking a loan against the cash value of your life insurance policy, allowing you to access funds without needing a credit check or income verification. This option is particularly useful for those with permanent life insurance policies, such as whole or universal life, which accumulate cash value over time.

Life Insurance Loans

To borrow money from your life insurance, you must have a permanent policy that has built up sufficient cash value. This cash value serves as collateral for the loan. Key benefits include flexible repayment terms and the loan not being dependent on your credit score.

However, there are important considerations:

Accruing Interest

The interest on the loan will accumulate, potentially reducing the policy’s cash value and death benefit if not repaid.

Impact on Death Benefit

Any unpaid loan balance, including interest, will be deducted from the death benefit, potentially affecting the amount left to beneficiaries.

Viatical Settlements: A Flexible Alternative

For policyholders with terminal illnesses, viatical settlements offer another option. This involves selling the life insurance policy to a third-party investor in exchange for a lump sum payment, typically higher than the cash surrender value of the policy.

Advantages:

Immediate Cash

Viatical settlements provide a substantial lump sum that can be used to cover medical expenses or other immediate needs.

No Repayment Obligations

Unlike loans, the money received from a viatical settlement does not need to be repaid.

Possible Disadvantages:

Tax Implications

The proceeds from a viatical settlement may be taxable, depending on individual circumstances. In many cases, viatical settlements are not taxable though. Consult with your trusted tax advisor.

Loss of Coverage

Once the policy is sold, the seller no longer has control over it, and the death benefit will go to the buyer.

Retain a Portion of Your Policy in a Viatical Settlement

An additional option within viatical settlements is the ability to retain a portion of your life insurance policy. This allows you to sell a part of your policy while keeping some coverage intact, providing a balance between accessing immediate funds and maintaining a death benefit for your beneficiaries. This option can be particularly beneficial if you want to ensure some financial protection remains for your loved ones.

Current Interest Rates in 2024

As of 2024, the financial environment features federal funds rates at 5.25%-5.50% and prime rates around 8.5%. These rates influence the cost of borrowing, including loans against life insurance policies. Understanding these rates is crucial when deciding whether to take a loan or opt for a viatical settlement.

Making the Right Choice

The decision between borrowing from your life insurance policy and choosing a viatical settlement depends on your immediate financial needs and long-term goals. If maintaining the policy’s death benefit is important, a life insurance loan may be more suitable. Alternatively, a viatical settlement, especially one where you retain a portion of the policy, can provide significant funds without the need for repayment, ideal for those with substantial expenses due to terminal illnesses.

To find out more about policy loan options and specifics, contact your insurance carrier. To learn if you’re likely to qualify for a viatical settlement or a retain a portion settlement, please call us at 800-973-8258.