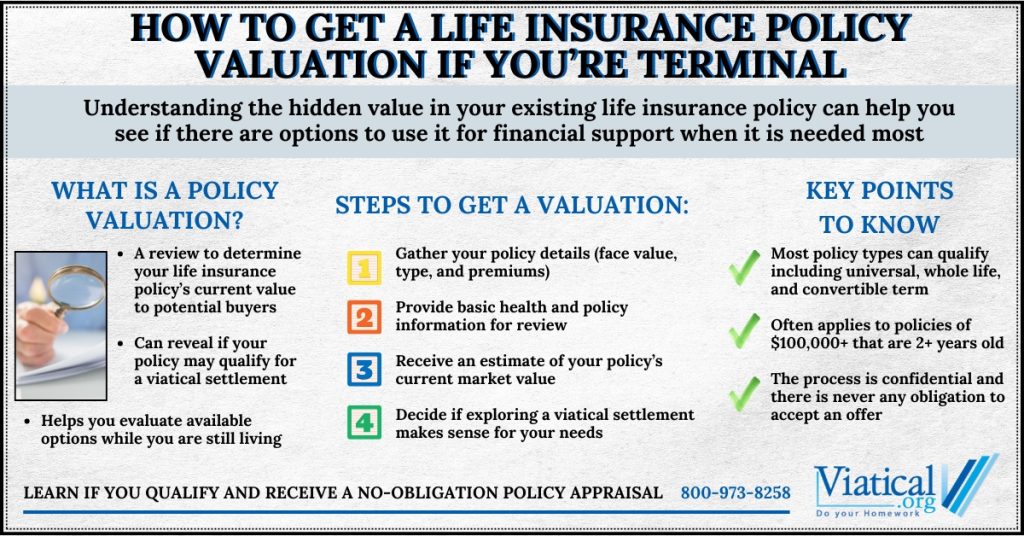

If you or a loved one has been diagnosed with a terminal illness, it is important to understand every financial option available. One of the most overlooked resources is your life insurance policy. You may be wondering how to get a life insurance policy valuation if you’re terminal. This process can help you discover whether your policy has immediate value that you can access now, when it is most needed.

What Is a Life Insurance Policy Valuation?

A life insurance policy valuation determines how much your policy is worth on the secondary market. This is not the same as your death benefit. Instead, it refers to what a third-party buyer may be willing to pay for the policy while you are still living. In cases of terminal illness, this is typically referred to as a viatical settlement. Understanding how terminal illness impacts life insurance options can help you to access value from your policy, now while you’re alive.

Why Terminal Illness Can Increase Policy Value

When someone is living with a terminal condition, their life expectancy is shorter than average. This changes the policy’s risk profile and may significantly increase its market value to buyers. As a result, a terminally ill policyholder may be able to sell their policy for a much higher amount than someone in good health. The amount offered depends on factors such as your age, diagnosis, policy type and specifics, and face value. In many cases, payouts can range from tens of thousands to several hundred thousand dollars, often up to 50% or more of your policy’s face value.

Who Can Qualify for a Policy Valuation?

While each viatical settlement purchaser has their own criteria, you may be eligible for a viatical settlement if:

- You have been diagnosed with a terminal illness and your life expectancy is generally 24 months or less (longer life expectancies can qualify for life settlements)

- Your policy is active and has a face value of $100,000 or more

- The policy is at least two years old (five in some states)

- The policy is either a permanent policy or a term policy that may be convertible

Even if you are not sure whether your policy qualifies, it is worth requesting a no-obligation life insurance policy valuation. There is no cost, and your coverage remains unchanged until you decide whether to sell.

How the Process Works

- Initial Inquiry – Start by calling a life settlement company that works with terminally ill policyholders. A short phone call, usually 5 to 10 minutes, can determine if it makes sense to move forward.

- Submit Your Policy and Health Information – You will likely be asked for a copy of your policy and permission to access relevant medical records.

- Receive an Offer – Once the review is complete, you may receive a cash offer for your policy if value is found and a direct buyer is interested. If you accept, the buyer will take over premium payments, and you will receive a lump sum.

How You Can Use the Funds

The money you receive from viatical settlements is yours to use as you see fit. Many people use the funds for medical care, living expenses, paying off debt, or helping their families. Others use the money to travel, improve quality of life, or leave something meaningful behind.

Start With a Policy Valuation

If you want to know how to get a life insurance policy valuation if you’re terminal, the best place to start is by giving us a call. In a brief 5-10 minute phone call, we can help you learn if you qualify for a viatical settlement and assist you in obtaining a no-obligation policy appraisal. 800-973-8258