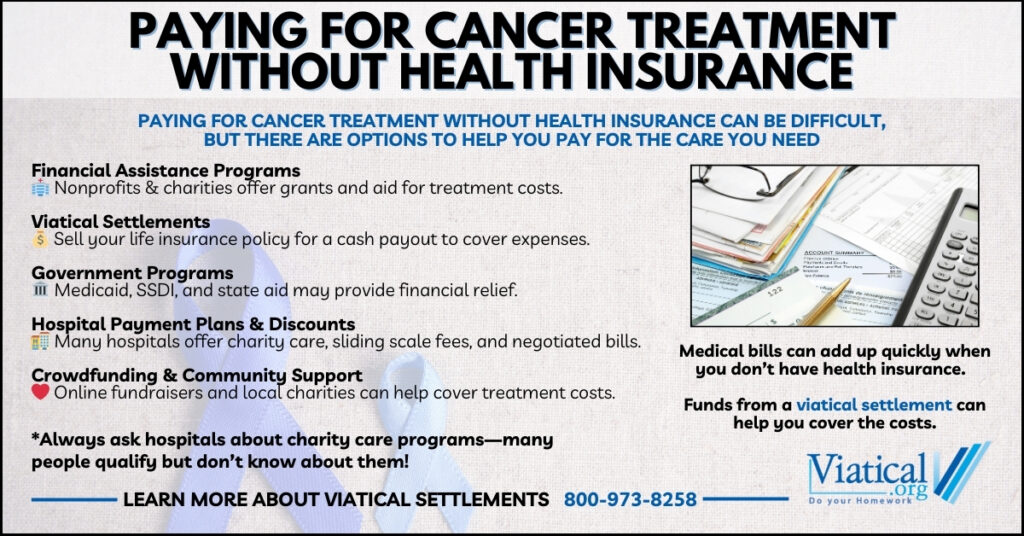

Facing a cancer diagnosis is challenging enough on its own, but navigating the costs of treatment without insurance can feel overwhelming. However, there are numerous avenues for financial assistance, creative payment solutions, and support resources available to help you get the care you need. Here’s how to go about paying for cancer treatment without health insurance:

1. Financial Assistance Programs and Charitable Organizations

Several nonprofit organizations and charitable foundations provide financial assistance specifically for cancer patients without insurance. These organizations can help cover the costs of medical bills, prescription medications, travel expenses, and other related costs.

Key Resources:

- CancerCare – Provides financial assistance for treatment-related expenses, including transportation and childcare.

- The Leukemia & Lymphoma Society – Offers co-pay assistance programs and financial support for blood cancer patients.

- Patient Advocate Foundation – Assists with negotiating medical bills and connecting patients to resources.

- HealthWell Foundation – Offers financial aid for medication and health insurance premiums for certain cancer diagnoses.

- The Assistance Fund – Helps cover out-of-pocket medical expenses.

To maximize assistance, reach out to multiple organizations and provide the necessary documentation, such as proof of diagnosis and financial need.

2. Viatical Settlements: Turning Life Insurance into Cash

If you own a life insurance policy, one effective way to pay for cancer treatment without health insurance is through a viatical settlement. This option allows you to sell your life insurance policy to a third party for a lump sum of cash, which can be used to help cover medical expenses, daily living costs, and other needs.

How It Works:

- You sell your life insurance policy to a viatical settlement buyer at a discounted rate, an amount more than the cash surrender value of the policy, but less than the policy’s death benefit.

- The buyer becomes the new beneficiary and takes over the premium payments.

- You receive a lump sum cash payment.

- This option is available to those with a terminal or chronic illness.

Advantages:

- Immediate access to funds without any restrictions on how you use the money. Viatical settlements for cancer treatment and alternative care allow you to pay for the treatment of your choice.

- No repayment obligations, unlike a loan.

- Can help relieve the financial burden of medical bills and living expenses.

Considerations:

- The payout is generally tax-free if you are terminally ill.

- It may impact eligibility for Medicaid and other need-based programs.

- You will no longer have life insurance coverage for your beneficiaries.

3. Government Assistance Programs

There are several government programs that provide health coverage and financial assistance to individuals without health insurance:

Medicaid

- A federal and state program that offers free or low-cost health coverage to low-income individuals.

- Eligibility varies by state, but cancer patients may qualify based on income and health status.

- Some states offer Medicaid “spend down” programs that allow you to qualify by subtracting medical expenses from your income.

Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI)

- If your cancer diagnosis prevents you from working, you may qualify for SSDI or SSI.

- SSDI is for those with sufficient work history, while SSI is for low-income individuals regardless of work history.

- After approval, SSDI recipients qualify for Medicare after a 24-month waiting period, and SSI recipients automatically qualify for Medicaid.

Hill-Burton Program

- Provides free or reduced-cost care at participating hospitals and clinics.

- Eligibility is based on income level, and services are available nationwide.

Local and State Assistance Programs

- Some states offer cancer treatment assistance programs for uninsured individuals.

- Check with your state’s health department for available resources.

4. Hospital Financial Aid and Payment Plans

Many hospitals and cancer treatment centers offer financial assistance programs or sliding scale fees for uninsured patients.

Options to Consider:

- Charity Care Programs: Nonprofit hospitals are required to provide a certain amount of free or reduced-cost care. Inquire about charity care programs and eligibility requirements.

- Negotiated Discounts: Speak with the hospital’s billing department to negotiate discounts or reduced fees for paying out of pocket.

- Payment Plans: Many hospitals offer payment plans that allow you to pay medical bills over time.

Tips for Negotiation:

- Request an itemized bill to ensure all charges are accurate.

- Research the average cost of procedures in your area to strengthen your negotiation.

- Be honest about your financial situation and ask for the lowest possible rate.

5. Pharmaceutical Assistance Programs

Many pharmaceutical companies provide patient assistance programs to help uninsured patients afford prescription medications.

How to Access These Programs:

- Visit the drug manufacturer’s website or contact their patient assistance program directly.

- Ask your healthcare provider or pharmacist for information about available programs.

- Organizations like NeedyMeds and RxAssist provide comprehensive databases of patient assistance programs.

Examples of Assistance Programs:

- Pfizer RxPathways – Offers financial assistance and free medication to eligible patients.

- Merck Patient Assistance Program – Provides free medications to uninsured patients who meet income guidelines.

- Lilly Cares Foundation – Helps eligible patients receive Lilly medications at no cost.

6. Crowdfunding and Community Support

Online fundraising platforms allow you to share your story and raise money for cancer treatment costs.

Popular Crowdfunding Platforms:

- GoFundMe – A widely used platform for medical fundraising.

- GiveForward – Specializes in medical expense fundraising.

- YouCaring – Charges no platform fees, allowing you to keep more of the donations.

Tips for Successful Crowdfunding:

- Share your story authentically and include photos or videos.

- Update donors on your progress and express gratitude.

- Promote your campaign on social media and through community networks.

Local Community Support:

- Organize local fundraising events, such as bake sales, car washes, or charity walks.

- Reach out to community organizations, religious institutions, or local businesses for sponsorships or donations.

7. Clinical Trials and Experimental Treatments

Participating in clinical trials can provide access to cutting-edge cancer treatments at no cost.

How to Find Clinical Trials:

- ClinicalTrials.gov – A database of publicly and privately funded clinical studies worldwide.

- National Cancer Institute (NCI) – Offers a list of cancer clinical trials and resources to help you find the right one.

- EmergingMed – A free service that matches patients with clinical trials.

Considerations:

- Clinical trials may cover the cost of experimental treatments, but not always routine care expenses.

- Carefully review the informed consent document to understand the risks and benefits.

- Not everyone will qualify for a clinical trial.

8. Additional Tips and Resources

- Medical Billing Advocates: Consider hiring a medical billing advocate to help negotiate medical bills and identify billing errors.

- Grants and Scholarships: Some foundations provide grants and scholarships to cancer patients for non-medical expenses, such as housing, transportation, and childcare.

- Tax Deductions: Medical expenses may be tax-deductible if they exceed a certain percentage of your income. Keep detailed records of all expenses.

Navigating cancer treatment without health insurance is undoubtedly challenging, but there are numerous resources and financial strategies to help manage costs. By exploring a combination of assistance programs, viatical settlements, government aid, and community support, you can alleviate some of the financial burden and focus on recovery.

If you or a loved one is considering a viatical settlement as a way to pay for cancer treatment, please give us a call at 800-973-8258. We can help you learn if you may qualify and assist with a no obligation policy appraisal.