When facing a cancer diagnosis, the journey ahead can feel overwhelming, both emotionally and financially. From understanding treatment options to managing everyday expenses, individuals and families impacted by cancer often find themselves in need of additional support. In such challenging times, exploring financial options becomes crucial. Among the array of resources available, viatical settlements for cancer treatment and alternative care stand out as a potential lifeline, offering immediate financial relief to those in need.

Understanding Viatical Settlements

A viatical settlement is a financial transaction in which a person with a life-threatening illness, such as cancer, sells their life insurance policy to a third party for a lump sum payment. This option is typically considered by individuals with a life expectancy of two years or less. The viatical settlement provider becomes the new beneficiary of the policy and assumes responsibility for future premiums, receiving the death benefit upon the insured’s passing.

Funds for Cancer Treatment

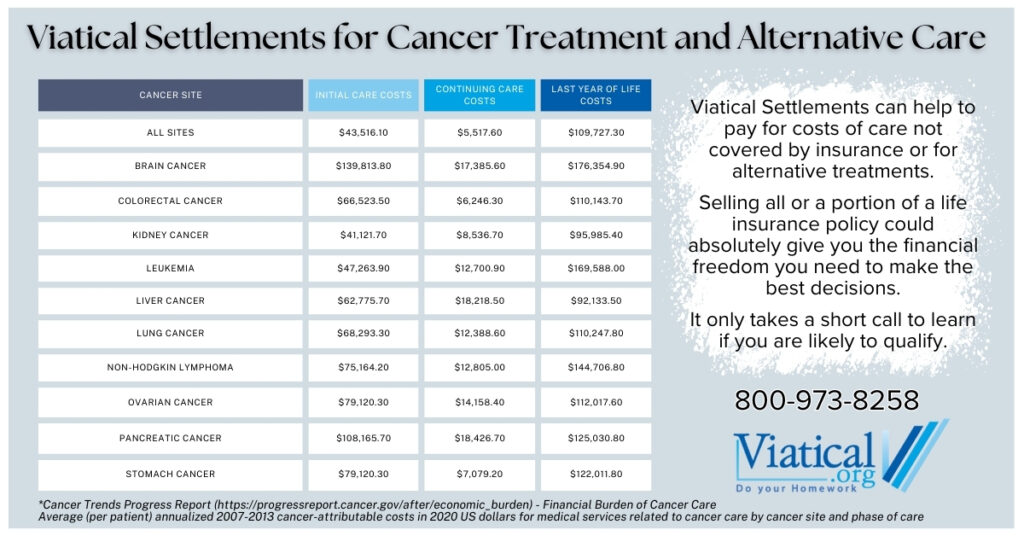

Cancer treatment can be both physically and financially draining, especially when considering the cost of chemotherapy, surgeries, and other medical interventions. Additionally, many individuals seek out alternative therapies such as integrative cancer care, holistic treatments, and nutritional support to complement traditional treatments and improve overall well-being.

You do not have to have a life expectancy of under 2 years to qualify to sell your life insurance policy. People with chronic illness and persistent health conditions may qualify to sell their life insurance policy as a life settlement which mainly differs from the viatical with respect to taxation. In most cases, a viatical settlement is considered an advance of your policy’s death benefit and is not subject to taxation.

Viatical settlements offer a practical solution for covering these expenses. The lump sum received from selling the life insurance policy can be used to pay for various cancer treatments available, including:

- Chemotherapy sessions

- Immunotherapy cancer treatment

- Surgical procedures

- Medications and prescription drugs

- Integrative cancer care therapies

- Holistic treatments and wellness programs

- Nutritional supplements and dietary support

Whether it’s seeking treatment at renowned cancer treatment centers like Cancer Treatment Centers of America or exploring alternative therapies at holistic cancer treatment centers, viatical settlements can provide the necessary financial support. The funds received from a viatical settlement have no use restrictions.

Navigating the Viatical Settlement Process

Cancer treatment is a journey that often comes with significant financial challenges, but viatical settlements for cancer treatment and alternative care offer a viable solution for those in need of immediate financial assistance. By unlocking the value of a life insurance policy, individuals can access funds to cover medical expenses, alternative therapies, and everyday costs associated with cancer care. With careful planning and consideration, viatical settlements can provide peace of mind and support during the fight against cancer, allowing individuals to focus on what matters most: their health and well-being.

If you are trying to take control of your care and have financial limitations, please do not overlook your life insurance policy as a potential resource. Selling all or a portion of a life insurance policy could absolutely give you the financial freedom you need to make the best decisions. You are always your own best advocate. Please give us a call and we’ll let you know if you’re likely to qualify.

A 5- or 10-minute phone call could be lifesaving and give you the peace of mind you deserve. There are no fees or obligations to see if you qualify to sell a portion of your life insurance policy to cover the cost and maintenance of your health.

800-973-8258