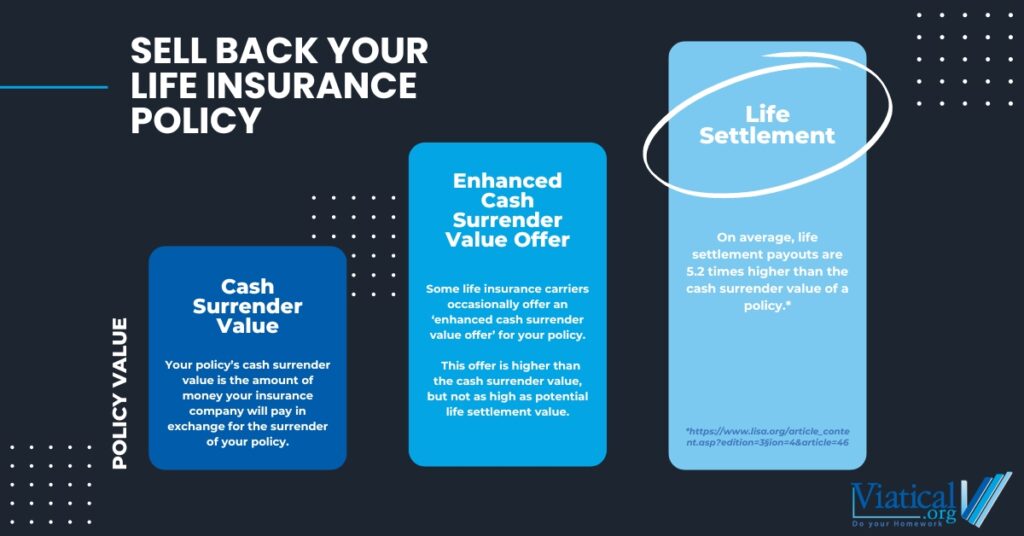

If you are trying to sell back your life insurance policy, you will find that your insurance company may not make the highest offer to you. Insurance companies are limited to the amount of cash that they can offer you for your insurance policy.

What is the Cash Value of an Insurance Policy?

If you have a permanent insurance policy, your policy is designed to build a cash value into the future to offset the increasing cost of insurance or the likelihood of dying as you age. When you accept delivery of your insurance policy, you’ll get an illustration showing what you are likely to have with respect to insurance and cash value in the future. Some of the numbers are guaranteed and some of the projections are just that, a projection based upon current or hypothetical interest rate that is non-guaranteed.

The cash value of your insurance policy may still have surrender charges, meaning that you will not get your entire cash value should you cancel, but rather the cash surrender value or CSV. Regardless of what your insurance company illustrates or tells you, you may have a hidden value in your policy that exceeds the money your insurance carrier is willing to pay you for your life insurance policy.

Can I Sell Back My Life Insurance Policy?

Essentially, your cash surrender value is an offer from your insurance company to give you that much money to surrender or cancel your policy. Because Life Insurance is private property, you have the right to check the market for life settlements and secure an offer to purchase your life insurance policy that surpasses that of your insurance company.

If you choose to sell your life insurance policy to a third-party fund that purchases insurance policies, the purchaser is responsible for the premiums and will collect the death benefit of your policy when it matures, meaning when you die.

Though some insurance companies have sent letters to certain policy owners offering to pay more money in the form of an enhanced death benefit as an encouragement to surrender their life insurance policies back to the insurance company, most companies have not. What you see on your statement is all you are going to get.

Depending upon interest rates, the cost of insurance (COI) inside of your policy and other policy provisions, you may see a decline in cash value at some future point or even a policy lapse, even if you are paying the premiums on your policy. This mainly happens with flexible premium policies or universal life, but there are so many different types of policies and provisions.

What Qualifies You to Sell Your Life Insurance Policy?

No two peoples’ health is the same, so every life settlement or viatical settlement case is approached individually.

It only takes a 5- or 10-minute phone call to learn if you are likely to qualify to sell your life insurance policy for cash. There should never be a fee nor an obligation to have your policy reviewed. So please give us a call at 800-973-8258 if you are trying to sell back your life insurance policy.

If it looks like you are likely to qualify, your policy can be appraised and platformed so that direct buyers can make you up-front cash offers for all of a portion of your life insurance policy.