The Financial Challenge of Cancer Care

A comprehensive study led by researchers at the American Cancer Society (ACS) and The University of Texas MD Anderson Cancer Center reveals rising cancer costs. The study, published in the Journal of the National Cancer Institute (JNCI), highlights the increasing financial burden on privately insured patients under 65. Out-of-pocket costs for breast, colorectal, and lung cancer patients rose by more than 15% to over $6,000, and to $4,500 for prostate cancer patients in 2016.

Study Findings

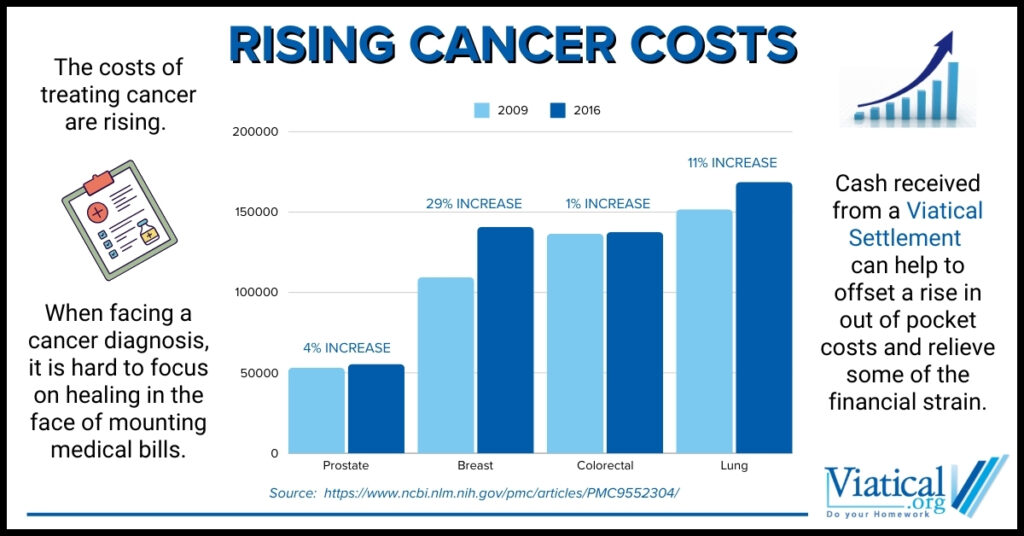

The study examined trends in total and out-of-pocket costs for breast, colorectal, lung, and prostate cancer patients diagnosed between 2009 and 2016. The researchers found significant increases in treatment costs:

- Breast Cancer: Total mean costs increased from $109,544 to $140,732 (29% increase).

- Lung Cancer: Costs rose from $151,751 to $168,730 (11% increase).

- Prostate Cancer: Costs increased from $53,300 to $55,497 (4% increase).

- Colorectal Cancer: Costs slightly rose from $136,652 to $137,663 (1% increase, not statistically significant).

The study noted increased use of intravenous (IV) systemic therapy, radiation, and cancer-related surgeries, contributing to the overall cost rise. High-deductible insurance plans exacerbate the financial burden, leading to significant out-of-pocket expenses for patients.

The Role of Viatical Settlements

A viatical settlement can provide crucial financial support for cancer patients facing these rising costs. Here’s how they help:

Immediate Cash Access

By selling their life insurance policies, those with medical conditions qualifying for viatical settlements receive a lump sum of cash that can be used to cover medical bills, treatment costs, and other essential expenses.

No Repayment Obligation

Unlike loans, the funds from a viatical settlement do not need to be repaid, offering relief without additional financial strain.

Financial Flexibility

Patients can use the cash for a variety of needs, including everyday living expenses, allowing them to focus on their health and recovery.

Patients often ask, “should I sell my life insurance policy?” or “is it legal to sell a life insurance policy?” Yes, viatical settlements are legal and can be an effective way to manage the financial strain of cancer treatment. It’s important to explore life policy settlement options and understand how life insurance money can be used to improve your financial situation.

Viatical settlements can play a key role in providing immediate financial relief, helping patients manage their out-of-pocket costs more effectively.

Real-World Impact

High treatment costs can lead to significant financial challenges for cancer patients, often resulting in debt, reduced quality of life, and even treatment abandonment. By providing a source of immediate funds, viatical settlements can help alleviate these financial pressures, ensuring that patients can afford the care they need without the added stress of financial toxicity.

Practical Considerations

For patients considering this option, common questions include “where can I sell my life insurance policy?” and “who can I sell my life insurance policy to?” There are various life settlement companies specializing in viatical settlements who can guide you through the process. Before proceeding, it’s crucial to weigh the benefits and potential drawbacks to ensure it’s the right decision for your circumstances.

As the costs of cancer care continue to rise, viatical settlements offer a valuable financial lifeline for patients. They provide immediate access to funds, helping to pay for out-of-pocket expenses and improve the overall quality of life for those undergoing cancer treatment. This financial strategy can be essential for patients navigating the challenging journey of cancer care, offering relief and support when it is most needed.

To learn more about the process and find out if you are likely to qualify, please give us a call at 800-973-8258.