You can’t just say “Sell my life insurance policy” to someone and expect to get the most cash for your insurance policy. If someone tells you it is fast and easy to sell your life insurance policy, there is a good chance you are not going to get the most money for the sale of your insurance.

Look at it as if you are selling a home. Life insurance is also property. There are some Real Estate investors that will offer to buy your home in a day, but they rarely pay anywhere near the true market price. It’s often the same with Life Settlement companies if you are trying to sell your policy yourself.

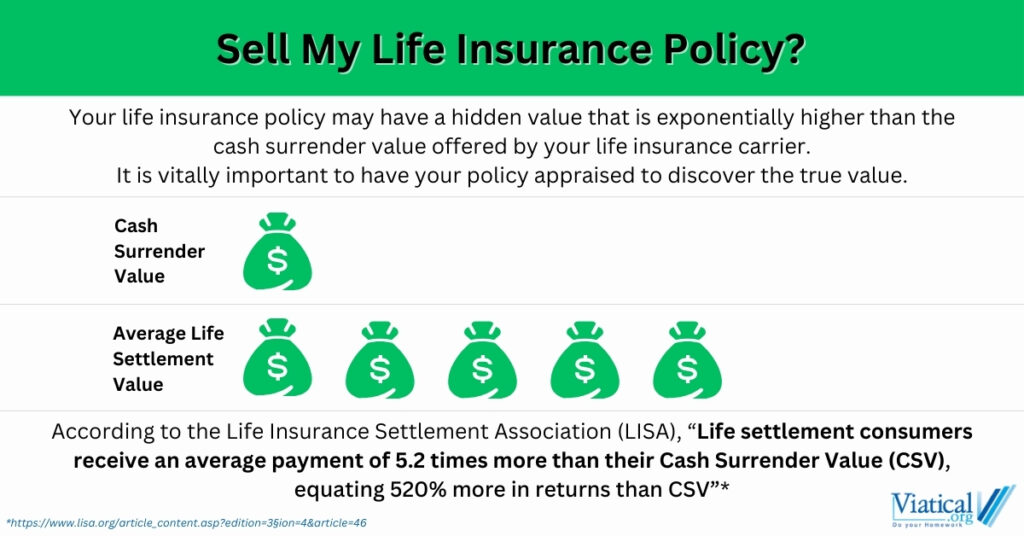

You should always have a piece of property valued before you attempt to sell it and if you qualify, the first step in selling your life insurance policy is also the valuation of your policy. If you qualify to sell your life insurance policy for cash and your life insurance appraisal indicates the range of value that your policy could be worth in the secondary market, you are less apt to sell your policy for less than the market will yield.

The Best Company to Sell Your Life Insurance to

The best company to sell your life insurance to is the company that pays you the most cash for your life insurance policy. You should only sell to a licensed buyer in your state and licensed buyers do not have a fiduciary responsibility to you beyond fair practice, which is sometimes ignored.

You can hire a life settlement broker. Brokers are supposed to shop your policy widely in the market, but many do not. Most brokers charge 30% of your settlement for their service.

You can sell your policy directly to a licensed Provider, but if you are selling your policy yourself you must get more than one bid and it’s best to get buyers bidding against one another. Providers usually purchase on behalf of life settlement institutional investors.

You can utilize a life settlement platform to electronically muster your insurance and medical reports so as to show them directly to buyers of life insurance policies. Funds that purchase life insurance policies still have to utilize a licensed provider in your state to complete the transaction, but this approach often yields the highest net offers for your policy.

Do not do business with someone that does not allow you to get a bid on your own. If you have a bid on your policy, you should absolutely get a second opinion if you are not on a platform that exposes your policy to many buyers of life insurance policies.

What are the Steps to Sell My Life Policy?

Find out if you qualify for a life settlement.

Your policy must be the right type of life insurance and you must be either old enough or sick enough that the projected premiums over your life expectancy will carry your insurance for your lifetime.

The initial preliminary qualification can be done over the phone with a short conversation.

Document Gathering and Policy Review

Complete a digital authorization so that your medical records and insurance documents may be obtained.

Once your medical file is reviewed by a Life Expectancy company that assigns a life expectancy to your particular case, pricing is completed with the modeling of your policy performance over that period of time.

Bids

Bids are secured for the purchase of your policy and an offer is extended.

You are under no obligation to accept a bid or sell your policy and the expense of underwriting is paid by potential buyers.

Offer Acceptance and Closing

Once you have accepted your offer, you will receive a closing packet from a licensed provider in your state. The purchase price is escrowed and released to you upon the transfer of ownership at your insurance carrier.

Most states give you 14 days to change your mind and undo the transaction and a few states give you as long as 30 days. You should never feel pressured to sell your life insurance policy in any way.